Form ST 9, Virginia Retail Sales and Use Tax Form ST 9, Virginia Retail Sales and Use Tax 2020

What is the Form ST 9?

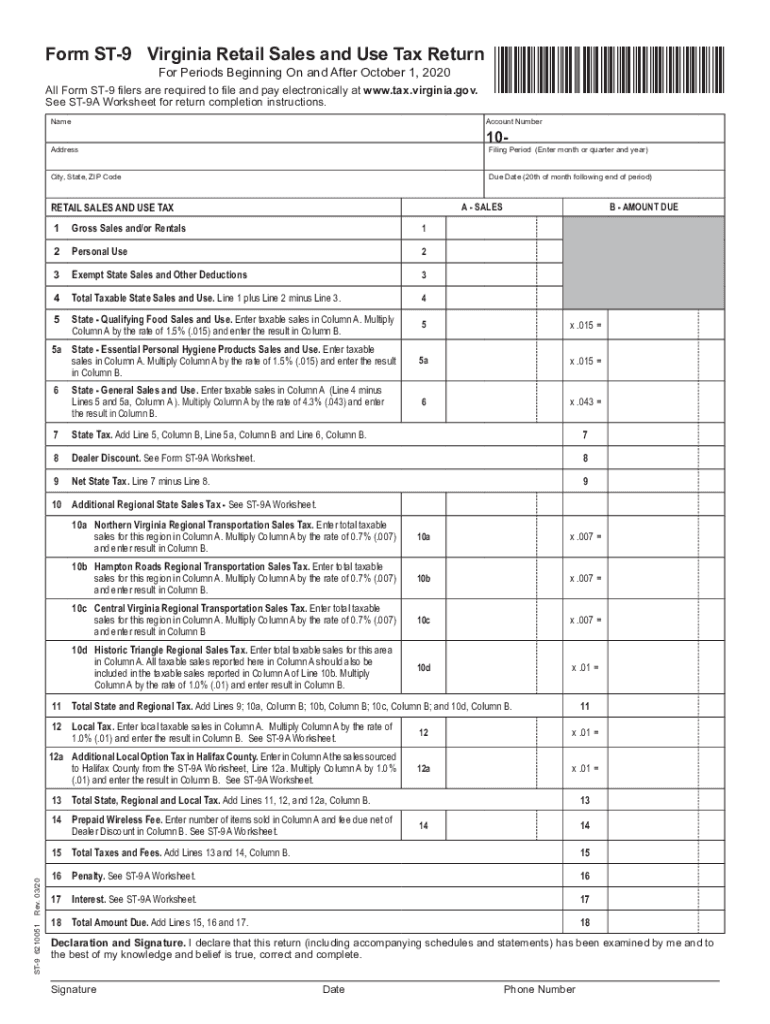

The Form ST 9, also known as the Virginia Retail Sales and Use Tax Form, is a document used by businesses in Virginia to report and remit sales and use tax. This form is essential for ensuring compliance with state tax laws and is typically required for retailers who sell tangible personal property or provide taxable services. The ST 9 form allows businesses to calculate the amount of tax owed based on their sales and purchases during a specific reporting period.

How to Use the Form ST 9

To use the Form ST 9 effectively, businesses must first gather all relevant sales and purchase data for the reporting period. This includes total sales, exempt sales, and any purchases subject to use tax. Once the data is compiled, it can be entered into the appropriate sections of the form. The form requires businesses to report gross sales, deductions for exempt sales, and the taxable amount to calculate the total tax owed. After completing the form, it must be submitted to the Virginia Department of Taxation along with any payment due.

Steps to Complete the Form ST 9

Completing the Form ST 9 involves several key steps:

- Gather all sales and purchase records for the reporting period.

- Calculate total gross sales and identify any exempt sales.

- Fill in the required fields on the form, including gross sales, deductions, and taxable amount.

- Calculate the total sales tax due based on the taxable amount.

- Review the form for accuracy before submission.

Once completed, the form can be submitted online, by mail, or in person, depending on the preferred method of the business.

Legal Use of the Form ST 9

The legal use of the Form ST 9 is governed by Virginia tax law. Businesses must ensure that they are using the most current version of the form and that it is filled out accurately to avoid penalties. The form serves as a declaration of sales and use tax liability and must be filed in accordance with the state's deadlines. Failure to file or inaccuracies in the form can lead to fines or additional tax liabilities.

Key Elements of the Form ST 9

Key elements of the Form ST 9 include:

- Business information: Name, address, and tax identification number.

- Sales data: Total gross sales, exempt sales, and taxable sales.

- Tax calculation: Total sales tax due based on the taxable amount.

- Signature: The form must be signed by an authorized representative of the business.

These elements ensure that the form is complete and compliant with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 9 vary based on the reporting period. Typically, businesses are required to file the form on a monthly, quarterly, or annual basis, depending on their sales volume. It is crucial for businesses to be aware of these deadlines to avoid late fees or penalties. The Virginia Department of Taxation provides a schedule of due dates that businesses should consult to ensure timely filing.

Quick guide on how to complete form st 9 virginia retail sales and use tax form st 9 virginia retail sales and use tax

Complete Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents promptly without delays. Manage Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to alter and electronically sign Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax with ease

- Obtain Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax and click on Get Form to initiate.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 9 virginia retail sales and use tax form st 9 virginia retail sales and use tax

Create this form in 5 minutes!

How to create an eSignature for the form st 9 virginia retail sales and use tax form st 9 virginia retail sales and use tax

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an st9 form and why is it important?

An st9 form is a document often required for tax exemption purposes when purchasing certain items or services. Understanding the st9 form is essential for businesses looking to manage their sales tax obligations efficiently and legally.

-

How can airSlate SignNow help with the st9 form?

airSlate SignNow simplifies the process of filling out and signing the st9 form. Our platform allows you to create, send, and eSign this document seamlessly, ensuring compliance and saving valuable time in managing your paperwork.

-

Is there a cost associated with using airSlate SignNow for the st9 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide access to features that streamline the preparation and signing of the st9 form, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for handling the st9 form?

airSlate SignNow provides features such as customizable templates, an intuitive drag-and-drop interface, and secure eSignature capabilities for the st9 form. These features enhance efficiency and ensure all documents are signed promptly and securely.

-

Can I integrate airSlate SignNow with other software to manage the st9 form?

Yes, airSlate SignNow offers integrations with a variety of software platforms, enabling you to manage the st9 form alongside your other business tools. This connectivity ensures a smoother workflow and helps you keep track of all necessary documents in one place.

-

How secure is the eSignature process for the st9 form with airSlate SignNow?

The eSignature process for the st9 form with airSlate SignNow is highly secure, employing advanced encryption standards to protect your documents. We prioritize your data privacy and compliance with regulations, giving you confidence when signing sensitive documents.

-

Is it easy to collaborate with others on the st9 form in airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration on the st9 form by enabling multiple users to review, comment, and sign the document. This collaborative feature streamlines the approval process, making it simple for everyone involved.

Get more for Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax

- Company employment policies and procedures package vermont form

- Vt child form

- Newly divorced individuals package vermont form

- Contractors forms package vermont

- Power of attorney for sale of motor vehicle vermont form

- Wedding planning or consultant package vermont form

- Hunting forms package vermont

- Identity theft recovery package vermont form

Find out other Form ST 9, Virginia Retail Sales And Use Tax Form ST 9, Virginia Retail Sales And Use Tax

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will