Form ST 9 Single Location, Virginia Retail Sales and Use Tax Return Virginia Retail Sales and Use Tax Return, Form ST 9 Single L 2021-2026

Understanding the ST-9 Form: Virginia Retail Sales and Use Tax Return

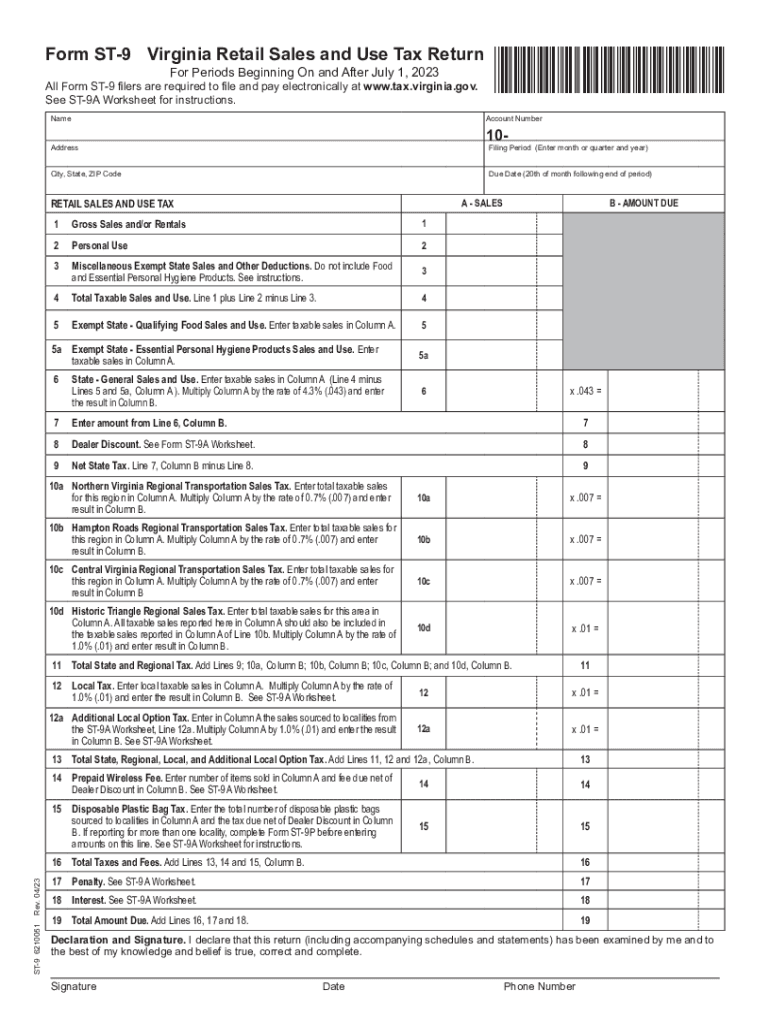

The ST-9 form is a crucial document for businesses operating in Virginia, specifically designed for reporting retail sales and use tax. This form is utilized by single-location businesses to report their sales tax obligations to the Virginia Department of Taxation. It is essential for ensuring compliance with state tax laws and for maintaining accurate financial records. By using the ST-9 form, businesses can accurately calculate the amount of sales tax they owe based on their taxable sales for the reporting period.

Steps to Complete the ST-9 Form

Completing the ST-9 form involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including total sales and any exempt sales. Next, fill out the form by entering your business information, including your name, address, and sales tax account number. Then, calculate the total taxable sales and the corresponding sales tax due. Be sure to review the form for any errors before submission. Finally, submit the form by the designated deadline to avoid penalties.

Obtaining the ST-9 Form

The ST-9 form can be easily obtained through the Virginia Department of Taxation's website. It is available in a printable format, allowing businesses to fill it out manually. Additionally, businesses can access the form through various tax preparation software that supports Virginia tax forms. Ensure you have the most current version of the ST-9 form to comply with any updates in tax law or filing procedures.

Legal Use of the ST-9 Form

The ST-9 form serves a legal purpose in the state of Virginia, as it is required for businesses to report their sales tax liabilities. Accurate completion and timely submission of this form are essential to avoid legal repercussions, including fines and penalties. Businesses must adhere to the guidelines set forth by the Virginia Department of Taxation to ensure they are in compliance with state tax regulations.

Key Elements of the ST-9 Form

Understanding the key elements of the ST-9 form is vital for accurate completion. The form includes sections for reporting total sales, exempt sales, and the total sales tax due. Additionally, it requires the business's identification information, such as the sales tax account number and contact details. Familiarity with these elements will aid businesses in accurately reporting their sales tax obligations.

Filing Deadlines for the ST-9 Form

Filing deadlines for the ST-9 form are crucial for businesses to avoid penalties. The form is typically due on a monthly basis, with specific deadlines outlined by the Virginia Department of Taxation. It is important for businesses to mark these deadlines on their calendars and prepare their sales tax reports in advance to ensure timely filing.

Quick guide on how to complete form st 9 single location virginia retail sales and use tax return virginia retail sales and use tax return form st 9 single

Complete Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L effortlessly on any device

Web-based document management has become increasingly popular with businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L without hassle

- Find Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight relevant sections of your documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 9 single location virginia retail sales and use tax return virginia retail sales and use tax return form st 9 single

Create this form in 5 minutes!

How to create an eSignature for the form st 9 single location virginia retail sales and use tax return virginia retail sales and use tax return form st 9 single

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ST9 form and why is it important?

An ST9 form is a crucial document used for various financial and legal transactions. It serves to validate and provide information necessary for processing state taxes and other obligations. Understanding the ST9 form is essential for businesses to maintain compliance and ensure smooth operations.

-

How can airSlate SignNow help me with ST9 forms?

With airSlate SignNow, you can easily send, receive, and eSign ST9 forms electronically. Our platform streamlines the submission process, reducing paperwork and saving time. Plus, our user-friendly interface makes managing ST9 forms simple and efficient.

-

Are there any fees associated with using airSlate SignNow for ST9 forms?

Yes, while airSlate SignNow offers a cost-effective solution for managing ST9 forms, there are subscription plans available based on your needs. Each plan includes various features to optimize your workflow with ST9 forms, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other applications for ST9 forms?

Absolutely! airSlate SignNow provides easy integrations with numerous applications, enhancing the efficiency of handling ST9 forms. This allows you to connect with your existing tools and streamline your document management processes seamlessly.

-

What features does airSlate SignNow offer for ST9 form management?

airSlate SignNow offers features such as customizable templates, advanced signing options, and secure document storage specifically for ST9 forms. These tools ensure that you can manage your forms effectively while maintaining security and compliance.

-

Is airSlate SignNow suitable for small businesses handling ST9 forms?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses dealing with ST9 forms. Our platform provides an affordable and user-friendly solution to help manage essential documents without breaking the bank.

-

How secure is the process of eSigning ST9 forms with airSlate SignNow?

The security of your ST9 forms is a top priority at airSlate SignNow. We utilize encrypted technology to ensure your documents are protected throughout the eSigning process. Additionally, our platform complies with industry standards for data protection.

Get more for Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L

Find out other Form ST 9 Single Location, Virginia Retail Sales And Use Tax Return Virginia Retail Sales And Use Tax Return, Form ST 9 Single L

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form