Tax Alaska 2020

What is the Tax Alaska

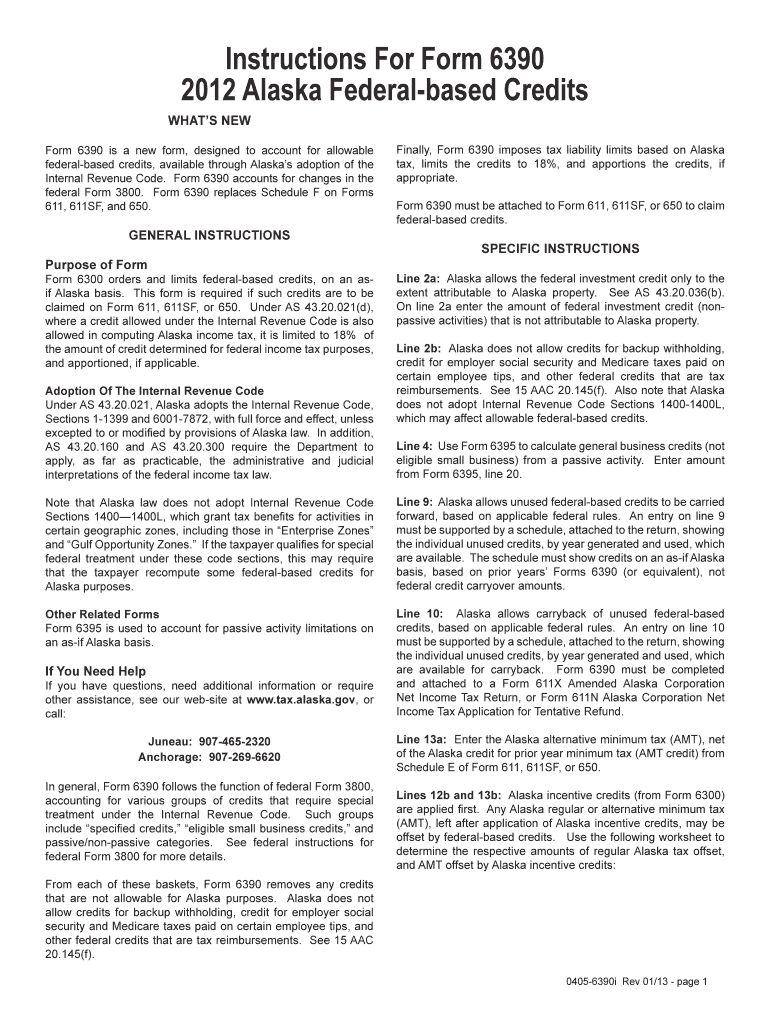

The Tax Alaska form is a specific document used for reporting and managing tax obligations within the state of Alaska. This form is essential for individuals and businesses to ensure compliance with state tax laws. It encompasses various tax-related information, including income, deductions, and credits applicable to Alaskan taxpayers. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as W-2s, 1099s, and any other income statements. Next, carefully fill out the form, ensuring that each section is completed with the correct figures. It is important to double-check calculations and ensure all required signatures are present. Finally, submit the completed form by the designated deadline to avoid any late fees or penalties.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Review the form instructions to understand each section's requirements.

- Fill out personal information, including name, address, and Social Security number.

- Report income from all sources, ensuring to include any applicable deductions and credits.

- Review the completed form for accuracy, checking calculations and required signatures.

- Submit the form electronically or via mail, as per the guidelines provided.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws, which dictate how and when the form must be filed. It is essential to comply with all relevant regulations to ensure that the form is considered valid. This includes adhering to submission deadlines, accurately reporting income, and maintaining proper documentation to support claims made on the form. Failure to comply with these legal requirements can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical for compliance. Typically, the deadline for submitting the form aligns with federal tax deadlines, which is usually April fifteenth. However, specific dates may vary based on individual circumstances, such as extensions or changes in state law. It is advisable to stay informed about any updates to deadlines to avoid late submissions and potential penalties.

Required Documents

To successfully complete the Tax Alaska form, several documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income.

- Documentation for deductions, such as receipts for business expenses or charitable contributions.

- Previous year’s tax return for reference.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for managing tax collection and ensuring compliance with state tax laws. They provide resources and guidance on how to properly complete and submit the form, as well as information on any changes to tax regulations that may affect taxpayers in Alaska.

Quick guide on how to complete tax alaska 6967234

Complete Tax Alaska effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, since you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Tax Alaska on any device with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to edit and eSign Tax Alaska with ease

- Obtain Tax Alaska and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Tax Alaska and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967234

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967234

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska?

airSlate SignNow is a powerful eSignature platform that allows businesses to streamline the signing process of documents, including those related to Tax Alaska. By using airSlate SignNow, businesses can ensure compliance and enhance efficiency when dealing with tax forms and submissions.

-

How does airSlate SignNow handle taxation documents specific to Tax Alaska?

airSlate SignNow is designed to handle a variety of documents, including tax-related forms specific to Tax Alaska. Our platform provides customizable templates and secure signing options, ensuring that all documents meet the regulatory requirements for taxation in Alaska.

-

What are the pricing options for using airSlate SignNow for Tax Alaska needs?

airSlate SignNow offers flexible pricing plans that cater to varying business needs for handling Tax Alaska documents. Whether you are a small startup or a large enterprise, you can find a plan that fits your budget while providing access to all essential features for tax document management.

-

Can I integrate airSlate SignNow with my existing accounting software for Tax Alaska?

Yes, airSlate SignNow easily integrates with numerous accounting and finance software, making it an excellent fit for managing Tax Alaska documentation. This integration allows for seamless data exchange, helping to automate and simplify your tax preparation and filing processes.

-

What benefits does airSlate SignNow offer for businesses dealing with Tax Alaska?

airSlate SignNow provides signNow advantages for businesses managing Tax Alaska, including faster document turnaround, secure eSigning, and a user-friendly interface. These benefits help reduce paperwork-related errors and improve compliance, ultimately saving businesses time and resources.

-

Is airSlate SignNow suitable for individual taxpayers in Alaska?

Absolutely! While airSlate SignNow is ideal for businesses, individual taxpayers in Alaska can also benefit from our eSignature solutions. The platform simplifies the signing process for tax documents, making it more convenient for individuals as they navigate their Tax Alaska obligations.

-

How secure is airSlate SignNow for handling sensitive Tax Alaska documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and compliance measures to protect sensitive Tax Alaska documents. Users can confidently send and sign documents knowing that their information is safeguarded against bsignNowes and unauthorized access.

Get more for Tax Alaska

- 25 literary terms crossword puzzle answer key form

- Supervised driving log form

- Planet earth caves 47 minutes answer key form

- Abb vfd warranty form

- Igneous rocks worksheet answer key form

- Mass effect d20 character sheet form

- Function report adult form ssa 3373 bk

- Authorization release information albany medical center

Find out other Tax Alaska

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF