Tax Alaska 2019

What is the Tax Alaska

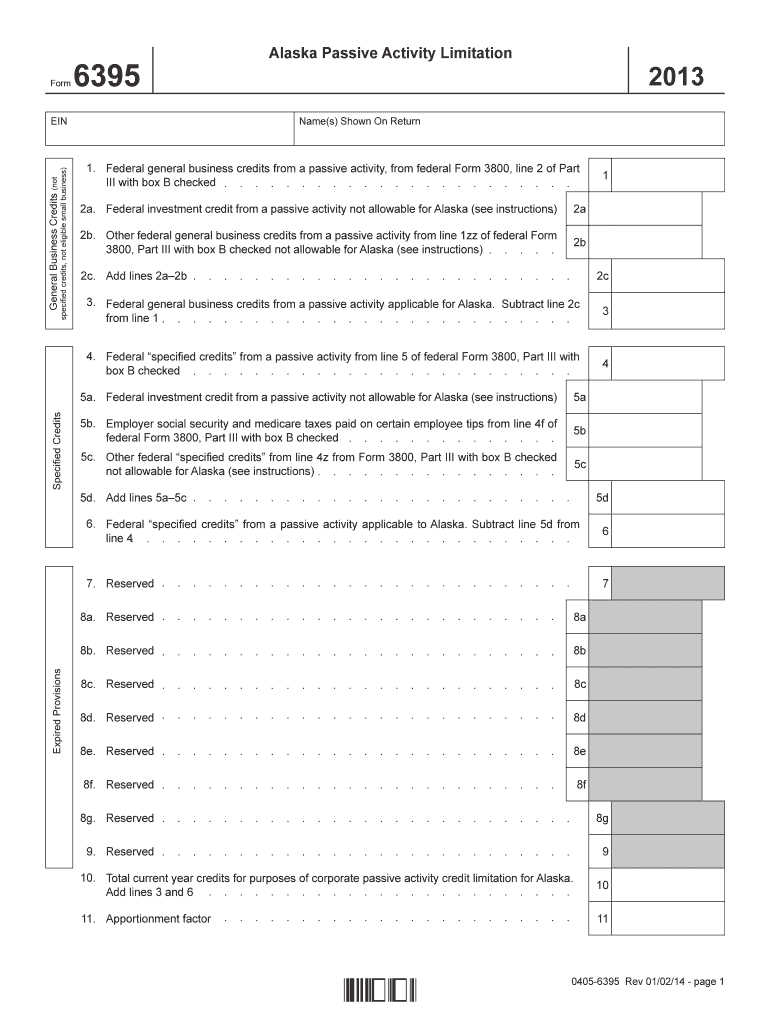

The Tax Alaska form is a specific document used for tax reporting and compliance within the state of Alaska. It is designed to assist individuals and businesses in accurately reporting their income, deductions, and other relevant financial information to state tax authorities. Understanding the purpose and requirements of this form is essential for maintaining compliance with state tax laws.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather necessary financial documents, including income statements and receipts for deductions.

- Obtain the latest version of the Tax Alaska form from the appropriate state tax authority.

- Fill out the form by entering personal and financial information as required.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form, confirming that the information provided is truthful.

- Submit the form through the preferred method: online, by mail, or in person.

Legal use of the Tax Alaska

The Tax Alaska form must be used in accordance with state tax laws to be considered legally binding. It is crucial to ensure that all information provided is accurate and complete. Failure to comply with legal requirements can result in penalties or audits. Utilizing electronic signature solutions can enhance the legal standing of the document, as they often provide necessary compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, it is essential to verify specific dates each tax year, as they may vary. Keeping track of these deadlines helps ensure timely compliance with state tax obligations.

Required Documents

When completing the Tax Alaska form, several documents are typically required to support the information provided. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission through the state tax authority's website

- Mailing a physical copy to the designated tax office

- In-person submission at local tax offices

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Quick guide on how to complete tax alaska 6967232

Handle Tax Alaska seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Steps to adjust and eSign Tax Alaska effortlessly

- Find Tax Alaska and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Produce your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Alaska and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967232

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967232

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska?

airSlate SignNow is an eSignature solution designed to streamline the document signing process, especially useful for handling Tax Alaska related documents. With its user-friendly interface, you can easily send, sign, and store tax forms electronically, ensuring you save time and reduce paperwork. Businesses can benefit from fast processing and enhanced security, making tax-related operations much smoother.

-

How much does airSlate SignNow cost for Tax Alaska purposes?

Pricing for airSlate SignNow varies based on the plan you choose, but it typically offers cost-effective solutions tailored for businesses managing Tax Alaska documents. The subscription plans include various features that cater to different business sizes and needs. You can take advantage of a free trial to determine which plan meets your requirements for handling tax documents.

-

What features does airSlate SignNow offer for Tax Alaska documentation?

airSlate SignNow includes features like eSigning, document templates, and secure storage, all of which are beneficial for managing Tax Alaska. You can create templates for recurring tax forms, reducing the time spent on repetitive tasks. Additionally, the platform allows you to track the status of documents in real time, enhancing organization and efficiency.

-

Is airSlate SignNow secure for processing Tax Alaska documents?

Yes, airSlate SignNow employs robust security measures to ensure that all Tax Alaska documents are protected. The platform utilizes encryption methods and complies with industry standards to safeguard sensitive information from unauthorized access. This built-in security gives users peace of mind when handling important tax documents.

-

Can I integrate airSlate SignNow with other tools for Tax Alaska management?

airSlate SignNow easily integrates with a variety of tools and applications commonly used in tax management, making it ideal for Tax Alaska processes. You can connect it with CRM systems, cloud storage services, and other productivity tools to streamline your workflow. These integrations help create a seamless experience while dealing with tax documents and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Tax Alaska?

The primary benefits of using airSlate SignNow for Tax Alaska include increased efficiency, cost savings, and enhanced compliance. By digitizing the signing process, businesses can reduce turnaround times and eliminate printing costs associated with traditional signatures. Additionally, the platform ensures that your processes comply with local tax regulations, making it easier to manage tax obligations.

-

How user-friendly is airSlate SignNow for new users handling Tax Alaska?

airSlate SignNow is designed with user-friendliness in mind, making it accessible for new users managing Tax Alaska. The intuitive interface guides you through the signing and sending process, minimizing the learning curve. With helpful resources and customer support, even those unfamiliar with eSignature solutions will find it easy to get started.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online