26 U S Code469 Passive Activity Losses and Credits Limited 2024-2026

Understanding the 26 U S Code 469 Passive Activity Losses and Credits Limited

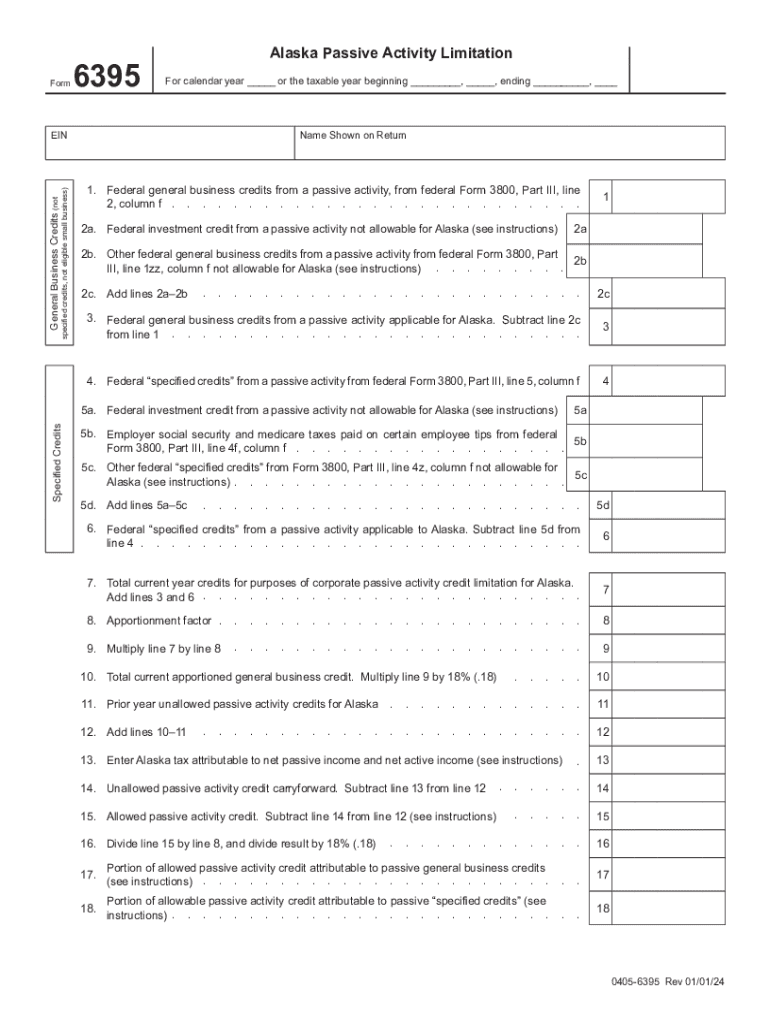

The 26 U S Code 469 addresses the limitations on passive activity losses and credits for taxpayers in the United States. This section of the tax code is designed to prevent individuals from using losses from passive activities to offset non-passive income, such as wages or salaries. Passive activities typically include rental real estate and businesses in which the taxpayer does not materially participate. The code outlines specific rules on how losses and credits are calculated and applied, ensuring that only those who actively engage in their investments can benefit from these tax advantages.

How to Utilize the 26 U S Code 469

To effectively use the provisions of the 26 U S Code 469, taxpayers should first identify their passive activities and determine if they qualify for any losses or credits. It is essential to maintain accurate records of income and expenses related to these activities. Taxpayers can then complete the appropriate forms, such as Schedule E, to report income or losses from rental properties and other passive ventures. Understanding the limitations imposed by this code is crucial, as it dictates how much of the passive losses can be deducted against other income types.

Key Elements of the 26 U S Code 469

Several key elements define the structure of the 26 U S Code 469. These include:

- Passive Activity Losses: Losses that can only offset passive income.

- Material Participation: A requirement for taxpayers to be involved in their business activities to deduct losses.

- Rental Real Estate Exception: Specific rules apply to rental activities, allowing for certain deductions even if the taxpayer does not materially participate.

- Carryover of Losses: Unused passive losses can be carried forward to future tax years.

Eligibility Criteria for the 26 U S Code 469

Eligibility for the benefits outlined in the 26 U S Code 469 depends on several factors. Taxpayers must determine if their activities qualify as passive and whether they meet the material participation requirements. Additionally, individuals who are real estate professionals may have different eligibility rules that allow them to deduct losses against non-passive income. Understanding these criteria helps ensure compliance and maximizes potential tax benefits.

Examples of Applying the 26 U S Code 469

Consider a taxpayer who owns a rental property that generates a loss of $10,000. If this individual has no other passive income, the loss cannot offset their salary. However, if they have passive income from another investment of $5,000, they can use $5,000 of the rental loss to offset this income. The remaining $5,000 can be carried forward to future tax years. Another example involves a taxpayer who actively participates in a partnership. If their share of the partnership loss is $15,000, they may be able to use this loss against other income if they meet the material participation criteria.

Required Documents for the 26 U S Code 469

When preparing to file taxes under the provisions of the 26 U S Code 469, taxpayers should gather several key documents:

- Income Statements: Documentation of all income generated from passive activities.

- Expense Records: Receipts and invoices related to the operation of passive activities.

- Tax Forms: Completed forms such as Schedule E and any relevant supporting documentation.

Having these documents organized and accessible can streamline the filing process and ensure accurate reporting of passive activities.

Quick guide on how to complete 26 u s code469 passive activity losses and credits limited

Complete 26 U S Code469 Passive Activity Losses And Credits Limited effortlessly on any device

Online document administration has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage 26 U S Code469 Passive Activity Losses And Credits Limited on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign 26 U S Code469 Passive Activity Losses And Credits Limited with ease

- Find 26 U S Code469 Passive Activity Losses And Credits Limited and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 26 U S Code469 Passive Activity Losses And Credits Limited and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 26 u s code469 passive activity losses and credits limited

Create this form in 5 minutes!

How to create an eSignature for the 26 u s code469 passive activity losses and credits limited

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 26 U S Code469 Passive Activity Losses And Credits Limited?

The 26 U S Code469 Passive Activity Losses And Credits Limited is crucial for understanding how passive activity losses can affect your tax liabilities. It outlines the limitations on deducting these losses, which can impact your overall financial strategy. Familiarizing yourself with this code can help you make informed decisions regarding your investments.

-

How can airSlate SignNow assist with documents related to 26 U S Code469 Passive Activity Losses And Credits Limited?

airSlate SignNow provides a streamlined platform for sending and eSigning documents that pertain to 26 U S Code469 Passive Activity Losses And Credits Limited. Our solution ensures that your documents are securely signed and stored, making it easier to manage your tax-related paperwork. This efficiency can save you time and reduce the stress associated with compliance.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for your documents. These tools are particularly beneficial for managing documents related to 26 U S Code469 Passive Activity Losses And Credits Limited. By utilizing these features, you can ensure that your tax documents are organized and easily accessible.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, especially those managing tax documents related to 26 U S Code469 Passive Activity Losses And Credits Limited. Our pricing plans are flexible and cater to various business needs, ensuring that you can find a plan that fits your budget while still accessing essential features.

-

Can airSlate SignNow integrate with accounting software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage documents related to 26 U S Code469 Passive Activity Losses And Credits Limited efficiently. This integration helps streamline your workflow, ensuring that all your financial documents are in one place and easily accessible for tax preparation.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents offers numerous benefits, including enhanced security, faster turnaround times, and improved compliance with regulations like 26 U S Code469 Passive Activity Losses And Credits Limited. Our platform ensures that your signatures are legally binding and that your documents are stored securely, giving you peace of mind.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive tax documents related to 26 U S Code469 Passive Activity Losses And Credits Limited. We prioritize the confidentiality of your information, ensuring that only authorized users have access to your documents. This commitment to security helps safeguard your business's financial data.

Get more for 26 U S Code469 Passive Activity Losses And Credits Limited

Find out other 26 U S Code469 Passive Activity Losses And Credits Limited

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document