Form 568 2019

What is the Form 568

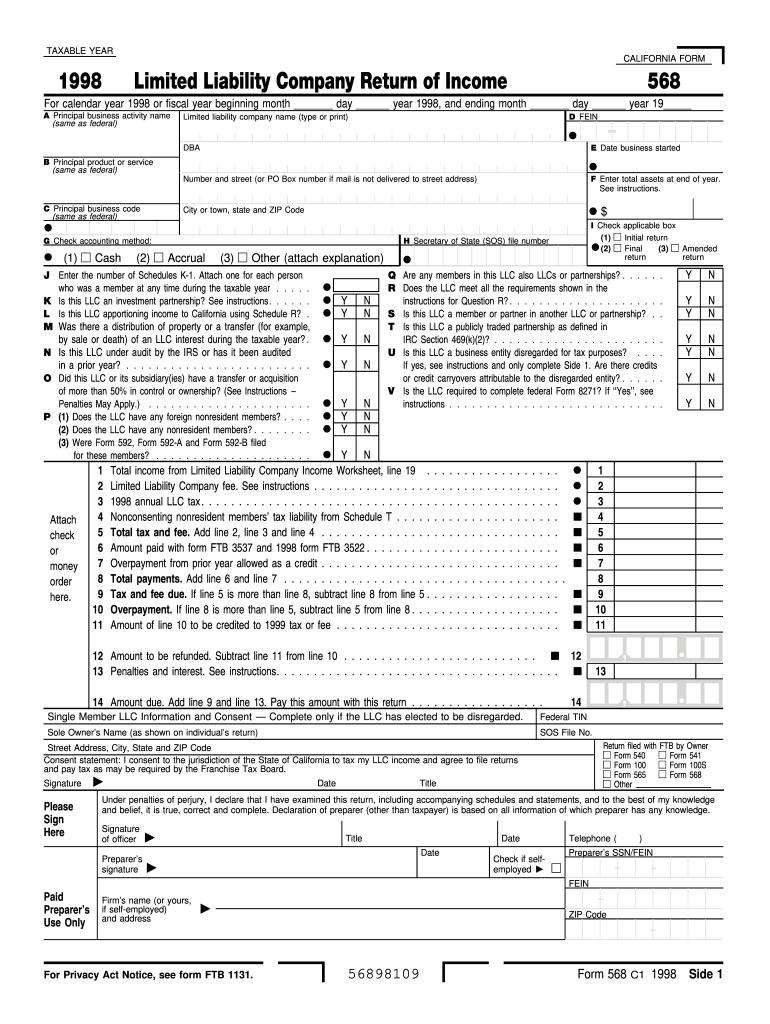

The Form 568 is a tax document used primarily by limited liability companies (LLCs) in California to report income, deductions, and other financial information to the state. This form is essential for ensuring compliance with California tax laws and is typically filed annually. It provides the state with necessary details about the LLC's operations, including its income, expenses, and any applicable taxes owed. Understanding the purpose of Form 568 is crucial for LLC owners to maintain good standing with the California Franchise Tax Board.

How to use the Form 568

Using Form 568 involves several steps to ensure accurate reporting of your LLC's financial activities. First, gather all relevant financial documents, including income statements, expense receipts, and any previous tax filings. Next, fill out the form by providing information about your LLC, such as its name, address, and federal employer identification number (EIN). Additionally, report your total income and allowable deductions. Finally, review the completed form for accuracy before submitting it to the California Franchise Tax Board.

Steps to complete the Form 568

Completing Form 568 requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including income and expense records.

- Fill in the LLC's name, address, and federal EIN at the top of the form.

- Report total income and deductions in the appropriate sections.

- Calculate the total tax owed based on the reported figures.

- Sign and date the form, certifying that the information is accurate.

Ensure you keep a copy of the completed form for your records.

Legal use of the Form 568

Form 568 must be completed and submitted in accordance with California tax laws to be considered legally valid. This includes adhering to deadlines for filing and ensuring that all reported information is accurate and truthful. Failure to comply with these legal requirements may result in penalties or fines from the California Franchise Tax Board. It is advisable to consult with a tax professional to ensure compliance and to address any specific legal questions regarding the use of Form 568.

Filing Deadlines / Important Dates

Timely filing of Form 568 is essential to avoid penalties. The typical deadline for submitting the form is March 15 for calendar year filers. If you require additional time, you may file for an extension, which allows for an extended deadline of up to six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. It is important to stay informed about any changes to deadlines that may occur due to state regulations.

Required Documents

To complete Form 568, you will need several key documents:

- Financial statements, including income and expense reports.

- Previous tax returns for the LLC, if applicable.

- Records of any payments made to the California Franchise Tax Board.

- Any additional documentation required for deductions claimed.

Having these documents ready will streamline the process of completing the form and ensure accurate reporting.

Who Issues the Form

The Form 568 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring compliance among businesses operating within the state. The FTB provides guidelines and resources for completing Form 568, making it easier for LLC owners to navigate their tax obligations.

Quick guide on how to complete 1998 form 568

Complete Form 568 effortlessly on any gadget

Online document administration has gained signNow traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without any delays. Manage Form 568 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign Form 568 without any hassle

- Locate Form 568 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 568 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1998 form 568

Create this form in 5 minutes!

How to create an eSignature for the 1998 form 568

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Form 568 and how does it relate to airSlate SignNow?

Form 568 is a California tax form required for LLCs to report income, deductions, and other tax information. With airSlate SignNow, you can easily prepare and eSign Form 568, streamlining the compliance process for your business and ensuring you meet state regulations.

-

How much does airSlate SignNow cost for managing Form 568?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans are cost-effective, allowing you to manage the preparation and eSigning of Form 568 without breaking your budget, with added features that enhance document management.

-

What features does airSlate SignNow provide for Form 568?

airSlate SignNow includes a variety of features such as customizable templates, automated workflows, and secure cloud storage specifically designed for managing Form 568. These tools help simplify the document preparation process and ensure accuracy and compliance.

-

Is airSlate SignNow suitable for small businesses filing Form 568?

Yes, airSlate SignNow is particularly beneficial for small businesses filing Form 568 because it offers an intuitive interface and cost-effective solutions tailored to their needs. Small business owners can easily eSign and send documents, making tax compliance hassle-free.

-

Can I integrate airSlate SignNow with other software when filing Form 568?

Absolutely! airSlate SignNow supports integrations with various software platforms, including accounting and tax preparation tools, making it easier to manage Form 568. This integration ensures that your financial data is seamlessly connected, improving efficiency.

-

How does airSlate SignNow ensure the security of my Form 568?

airSlate SignNow prioritizes the security of your documents, including Form 568, by employing advanced encryption and compliance protocols. All documents are stored securely, ensuring your sensitive information remains protected while eSigning and sharing.

-

Can I track the status of my Form 568 documents with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking of your Form 568 documents. You can monitor when your documents are opened, signed, and completed, providing you with peace of mind and ensuring you stay informed throughout the process.

Get more for Form 568

Find out other Form 568

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe