NOTICE and APPLICATION for ALTERNATIVE PAYMENT of PROPERTY TAXES 2011

What is the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES

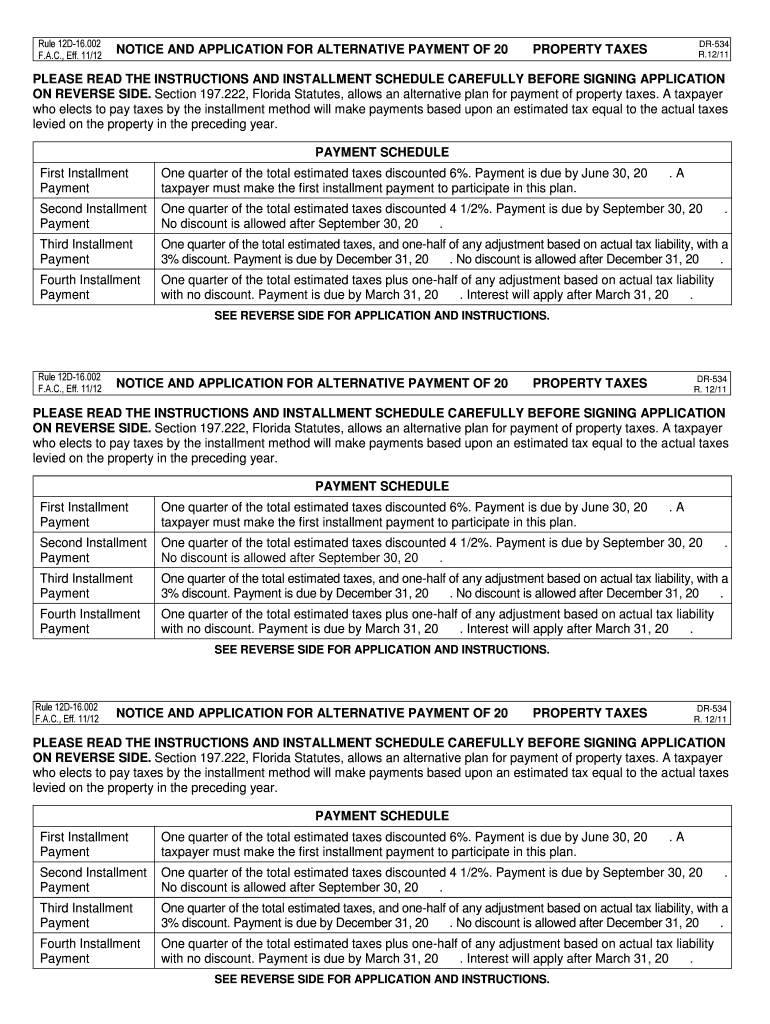

The NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES is a formal document that allows property owners to request alternative payment arrangements for their property taxes. This form is particularly useful for individuals facing financial difficulties or those seeking to manage their tax obligations more effectively. By submitting this application, taxpayers can propose alternative payment plans, which may include installment payments or other flexible arrangements, depending on state regulations and individual circumstances.

Steps to complete the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES

Completing the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, such as property details, tax identification numbers, and personal identification. Next, fill out the form clearly, providing all required information, including the proposed payment plan. After completing the form, review it for accuracy and sign it. Finally, submit the application according to your local jurisdiction's guidelines, ensuring you meet any specified deadlines.

Key elements of the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES

Understanding the key elements of the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES is essential for successful submission. Important components typically include:

- Property Information: Details about the property, including address and tax identification number.

- Taxpayer Information: Personal details of the taxpayer, including name, address, and contact information.

- Proposed Payment Plan: Specifics of the alternative payment arrangement being requested.

- Signature: A signature is required to validate the application.

Eligibility Criteria

Eligibility for submitting the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES varies by state and local jurisdiction. Generally, property owners facing financial hardship or those who cannot pay their property taxes on time may qualify. It is important to check local regulations to understand specific eligibility requirements, which may include income thresholds or other financial criteria. Additionally, some jurisdictions may require proof of financial hardship, such as income statements or tax returns.

Form Submission Methods

Submitting the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES can typically be done through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow electronic submission through official government websites.

- Mail: The form can often be printed and mailed to the appropriate tax authority.

- In-Person: Some taxpayers may prefer to submit the form in person at their local tax office.

Legal use of the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES

The legal use of the NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES is governed by state laws and regulations. When properly completed and submitted, this form serves as a formal request for alternative payment arrangements, which tax authorities are obligated to review. It is important for taxpayers to ensure that all information is accurate and that they comply with any legal requirements to avoid complications or delays in processing their application.

Quick guide on how to complete notice and application for alternative payment of 2011 property taxes

Finalize NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly without interruptions. Manage NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES with ease

- Obtain NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with features specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES to guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct notice and application for alternative payment of 2011 property taxes

Create this form in 5 minutes!

How to create an eSignature for the notice and application for alternative payment of 2011 property taxes

The best way to make an electronic signature for a PDF in the online mode

The best way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'?

The 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES' is a formal document that allows property owners to apply for alternative payment options for their property taxes. By using this application, homeowners can reduce their financial burden and manage their tax payments more effectively.

-

How can airSlate SignNow help with the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'?

airSlate SignNow simplifies the process of sending and eSigning the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES' by providing a user-friendly platform. With just a few clicks, you can upload your document, add signers, and secure your signature electronically, streamlining the entire application process.

-

Is there a cost associated with using airSlate SignNow for the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning documents, specific pricing plans may apply depending on your usage needs. Different tiers allow you to choose the plan that best fits your requirements when processing the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'.

-

What features does airSlate SignNow offer for processing the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'?

airSlate SignNow includes several features that enhance the processing of the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES', such as customizable templates, real-time tracking, and secure storage. These features make it easier to manage your documents and keep everything in order.

-

Does airSlate SignNow integrate with other software for managing property tax applications?

Yes, airSlate SignNow offers integration with various software applications, enabling users to streamline their workflow around the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'. This compatibility ensures that you can work seamlessly with other tools in your business operations.

-

What are the benefits of using airSlate SignNow for the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'?

Using airSlate SignNow for your 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES' offers numerous benefits, including improved efficiency, reduced paperwork, and faster processing times. By eSigning documents electronically, you can expedite your application and save time.

-

Is airSlate SignNow secure for handling personal information in the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES'?

Absolutely, airSlate SignNow prioritizes the security of your personal information. With advanced encryption standards and compliance with industry regulations, you can trust that your data, especially in the 'NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES', is kept safe and confidential.

Get more for NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES

Find out other NOTICE AND APPLICATION FOR ALTERNATIVE PAYMENT OF PROPERTY TAXES

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement