Application Installment Property 2016

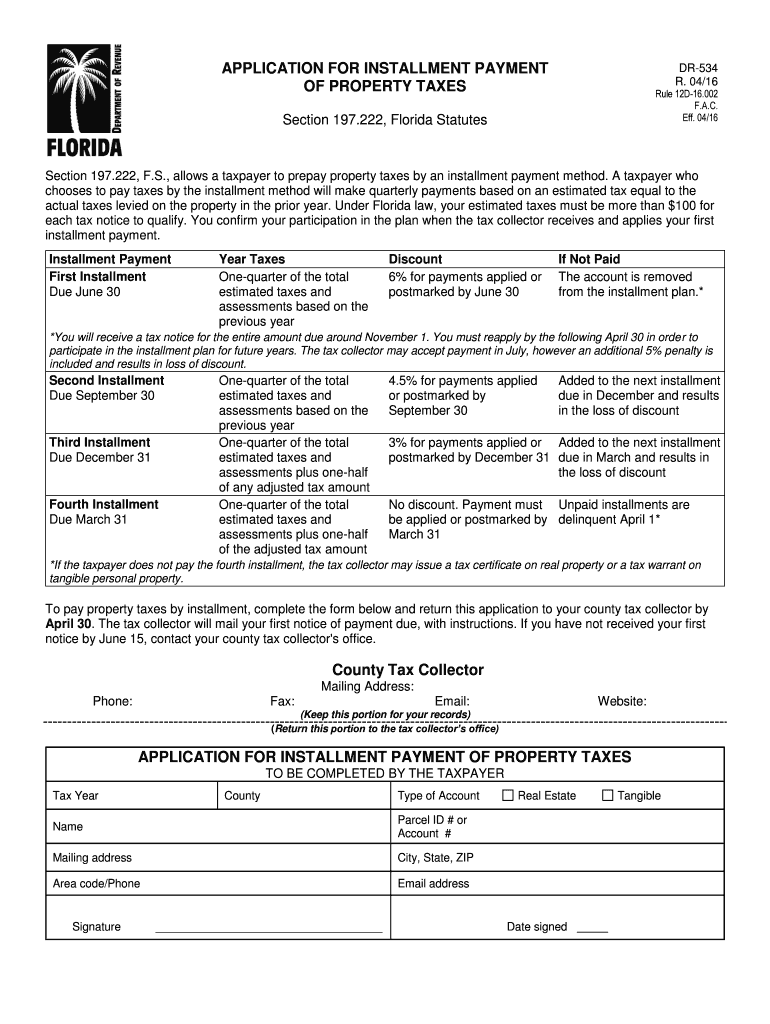

What is the application installment payment?

The application installment payment is a financial arrangement that allows property owners to pay their property taxes in smaller, more manageable amounts over a specified period. This method is particularly beneficial for those who may struggle to pay their taxes in a lump sum. By opting for this payment structure, individuals can alleviate the financial burden associated with annual property tax payments.

Key elements of the application installment payment

Understanding the key elements of the application installment payment is essential for successful navigation. These elements typically include:

- Eligibility criteria: Not all property owners qualify for installment payments. Eligibility often depends on factors such as property type and tax amount.

- Payment schedule: The installment plan outlines specific dates when payments are due, often spread throughout the year.

- Interest and fees: Some jurisdictions may impose interest or fees on installment payments, which can affect the total amount paid over time.

- Documentation: Proper documentation is required to apply for installment payments, ensuring that all parties are aware of their obligations.

Steps to complete the application installment payment

Completing the application for installment payment involves several key steps:

- Determine eligibility: Check if your property qualifies for the installment payment option based on local regulations.

- Gather necessary documents: Collect required documentation, which may include proof of income, property tax statements, and identification.

- Fill out the application: Complete the application form accurately, ensuring all information is correct and up to date.

- Submit the application: Send the completed application to the appropriate local authority, either online, by mail, or in person.

- Await approval: After submission, wait for confirmation of approval or any further instructions from the local tax office.

Legal use of the application installment payment

The legal framework surrounding the application installment payment is crucial for ensuring compliance. In the United States, laws such as the ESIGN Act and UETA provide guidelines for electronic signatures and documents, making them legally binding when executed correctly. It is important to follow local regulations regarding installment payments to avoid penalties or legal issues.

Required documents for the application installment payment

When applying for the application installment payment, certain documents are typically required. These may include:

- Completed application form

- Recent property tax statement

- Proof of income or financial hardship, if applicable

- Identification documents, such as a driver's license or social security card

Filing deadlines / important dates

Filing deadlines for the application installment payment can vary by state and local jurisdiction. It is crucial to be aware of these dates to ensure timely submission. Common deadlines may include:

- Initial application submission date

- Payment due dates for each installment

- Final deadline for any appeals or adjustments

Quick guide on how to complete application installment property

Complete Application Installment Property effortlessly on any device

Digital document management has gained widespread acceptance among enterprises and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Application Installment Property on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Application Installment Property seamlessly

- Locate Application Installment Property and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, lengthy form navigation, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Application Installment Property and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application installment property

Create this form in 5 minutes!

How to create an eSignature for the application installment property

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the application installment payment option offered by airSlate SignNow?

The application installment payment option by airSlate SignNow allows customers to spread the cost of their subscription over multiple payments. This feature makes it easier for businesses to manage cash flow while gaining access to our powerful eSigning and document management tools. By choosing installment payments, users can invest in their operations without financial strain.

-

How does the pricing structure work for application installment payments?

With airSlate SignNow, the pricing structure for application installment payments is simple and transparent. Customers can choose a payment plan that meets their budget, enabling them to pay for their subscription in manageable monthly installments. This approach ensures businesses can leverage our platform without upfront financial commitments.

-

What features are included with airSlate SignNow's application installment payment plan?

The application installment payment plan with airSlate SignNow includes access to all essential features like unlimited eSigning, document templates, and API integrations. Users benefit from our user-friendly interface that simplifies document workflows. Additionally, customers can utilize advanced features designed to enhance efficiency and streamline operations.

-

Are there any benefits to using the application installment payment plan?

Using the application installment payment plan provides signNow benefits, such as improved budget management and reduced immediate financial impact. Companies can allocate their resources effectively while still accessing high-quality eSignature services. This flexibility allows businesses of all sizes to adopt digital solutions without the burden of a large initial payment.

-

Can I cancel my application installment payment plan at any time?

Yes, you can cancel your application installment payment plan at any time, but terms and conditions apply. It's important to review our cancellation policy to understand any implications on your ongoing subscription. Users should feel confident in their business decisions, knowing that airSlate SignNow provides flexible options tailored to their needs.

-

What integrations are compatible with airSlate SignNow's application installment payment option?

airSlate SignNow supports numerous integrations with popular business tools and platforms. Whether you're using CRM systems, document management solutions, or cloud storage providers, our application installment payment plan remains compatible. This ensures a seamless user experience, allowing you to efficiently manage documents with integrated eSigning capabilities.

-

How can businesses benefit from implementing airSlate SignNow with application installment payment?

Businesses can greatly benefit from implementing airSlate SignNow with application installment payment by streamlining their document workflows while preserving cash flow. This empowers teams to focus on core activities without the distraction of payment concerns. Ultimately, it enhances operational efficiency and accelerates contract signing, improving overall business productivity.

Get more for Application Installment Property

Find out other Application Installment Property

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract