Application Installment Payment 2021

What is the Application Installment Payment

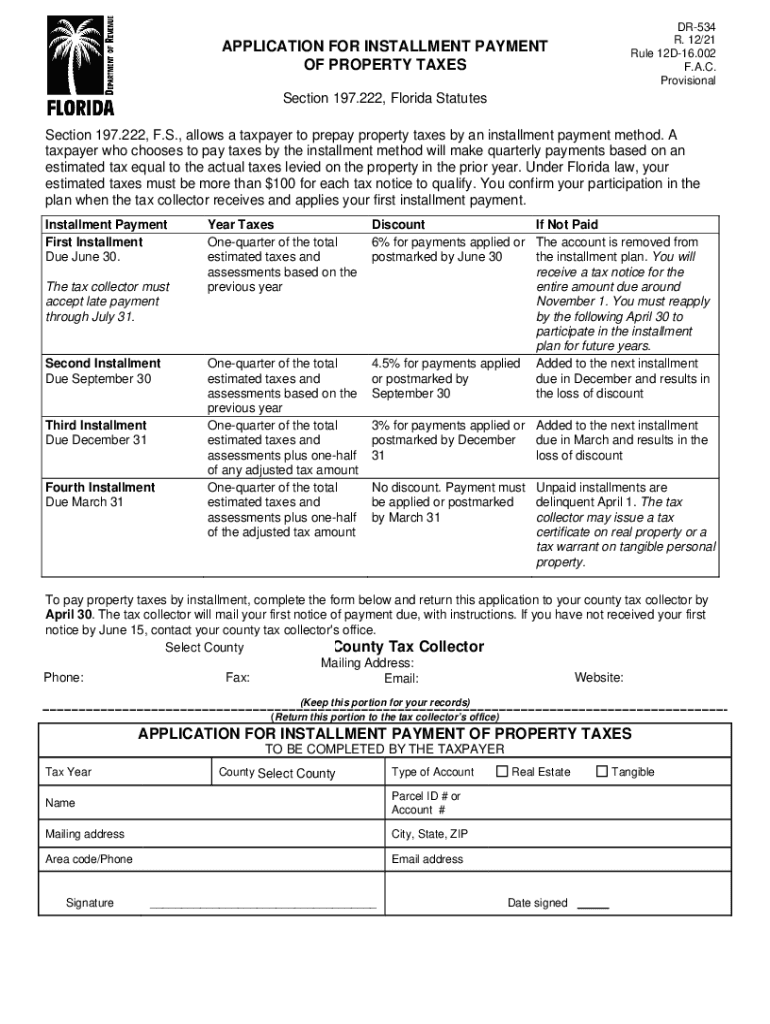

The application installment payment refers to a structured payment method that allows individuals or businesses in Florida to pay property taxes or other fees over a specified period. This approach is beneficial for those who may not be able to pay the full amount upfront. By breaking down the total into manageable installments, taxpayers can meet their obligations without financial strain. This method is particularly relevant for property owners looking to manage their finances effectively while ensuring compliance with state regulations.

Steps to Complete the Application Installment Payment

Completing the application installment payment involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including property details and identification. Next, fill out the application installment form, ensuring all information is accurate and complete. Once the form is filled out, submit it through the designated method, which may include online submission, mailing, or in-person delivery to the appropriate office. After submission, monitor the status of your application and be prepared to make the scheduled payments as outlined in your agreement.

Legal Use of the Application Installment Payment

The legal use of the application installment payment is governed by state laws and regulations. In Florida, this payment method is recognized as a valid approach to fulfilling property tax obligations. To ensure that your application is legally binding, it is essential to adhere to the guidelines set forth by local authorities. This includes using approved forms, meeting deadlines, and providing accurate information. Compliance with these legal requirements helps protect your rights as a taxpayer and ensures that your payments are properly credited.

Eligibility Criteria

Eligibility for the application installment payment may vary based on specific criteria set by Florida state regulations. Generally, property owners must demonstrate a valid reason for opting for installment payments, such as financial hardship or the inability to pay the full amount due. Additionally, applicants may need to meet certain income thresholds or provide documentation of their financial situation. Understanding these criteria is crucial for ensuring that your application is accepted and processed without complications.

Required Documents

When applying for the application installment payment, several documents are typically required to support your application. These may include proof of identity, such as a driver's license or state ID, documentation of property ownership, and financial statements that demonstrate your ability to make installment payments. It is important to review the specific requirements for your locality, as additional documentation may be necessary to complete the application process successfully.

Form Submission Methods

The application installment form can be submitted through various methods, providing flexibility for applicants. Common submission methods include online submission through the official state portal, mailing the completed form to the designated office, or delivering it in person to a local tax office. Each method has its own set of guidelines and deadlines, so it is advisable to choose the one that best fits your circumstances while ensuring timely submission.

Key Elements of the Application Installment Payment

Understanding the key elements of the application installment payment is essential for successful navigation of the process. These elements typically include the total amount due, the number of installments, payment due dates, and any applicable interest or fees. Additionally, it is important to be aware of the consequences of missed payments, which may include penalties or loss of eligibility for future installment agreements. Being informed about these elements helps ensure that you remain compliant and avoid potential issues.

Quick guide on how to complete application installment payment

Complete Application Installment Payment effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Application Installment Payment on any device with airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Application Installment Payment without hassle

- Obtain Application Installment Payment and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark essential sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign Application Installment Payment and guarantee effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application installment payment

Create this form in 5 minutes!

How to create an eSignature for the application installment payment

The way to create an e-signature for a PDF file in the online mode

The way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the florida application installment process?

The florida application installment process allows you to break down your payments into manageable portions. This enables businesses to apply for services such as eSigning documents without facing financial strain. With airSlate SignNow, you can use an easy-to-navigate platform to manage your applications and installments efficiently.

-

How does airSlate SignNow facilitate the florida application installment?

airSlate SignNow simplifies the florida application installment by offering a user-friendly interface that guides you through each step. This streamlined process helps to ensure that all required documents are completed accurately and promptly. By leveraging this service, businesses can focus on their core operations without being bogged down by paperwork.

-

What are the pricing options for the florida application installment?

The pricing options for the florida application installment with airSlate SignNow are competitive and designed to fit various budgets. You can choose from different plans based on the number of users and features you need. Our goal is to provide you with a cost-effective solution that meets your signing needs while supporting your application installments.

-

What features does airSlate SignNow offer for florida application installment users?

For florida application installment users, airSlate SignNow provides essential features like eSignature, document templates, and customizable workflows. These tools help streamline the application process and ensure a seamless experience. Additionally, you can track the status of your documents and manage your installments through our secure platform.

-

How can airSlate SignNow benefit my business during the florida application installment?

Using airSlate SignNow for the florida application installment can signNowly enhance your business efficiency. The platform's automation features reduce document processing times and minimize human error. By changing how you manage your applications and installments, you can improve productivity and satisfy customer demands more effectively.

-

Can I integrate airSlate SignNow with other software for the florida application installment?

Yes, airSlate SignNow offers seamless integrations with various software, making it easy to manage your florida application installment alongside other tools. Whether it's CRM systems, cloud storage, or project management software, our platform ensures that data flows smoothly. This flexibility helps you maintain a cohesive workflow across your business.

-

Is airSlate SignNow secure for managing florida application installment documents?

Absolutely! airSlate SignNow prioritizes security for all users, especially when dealing with sensitive florida application installment documents. We utilize industry-standard encryption protocols and comply with regulations to protect your data. You can rest assured knowing that your documents are safe while being processed and stored on our platform.

Get more for Application Installment Payment

- Discovery interrogatories post dissolution ex spouse not remarried minnesota form

- Discovery interrogatories post dissolution ex spouse remarried minnesota form

- Suggested signature page for judgment and decree recommended by referee minnesota form

- Minnesota parentage 497312392 form

- Motion change venue 497312393 form

- Oral testimony form

- Motion compel discovery form

- Tenants maintenance repair request form minnesota

Find out other Application Installment Payment

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy