ST 556 Sales Tax Transaction Return Instructions 1 for Sales from 2020

What is the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

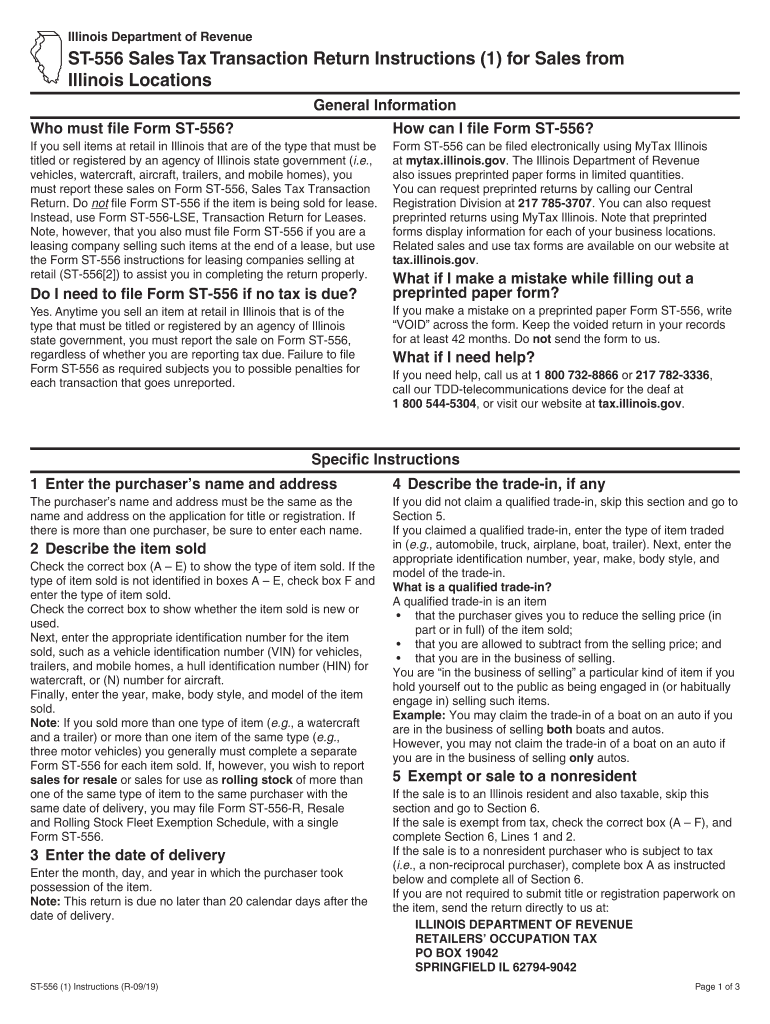

The ST 556 Sales Tax Transaction Return Instructions 1 For Sales From is a form used by businesses in the United States to report sales tax transactions. This form is essential for documenting taxable sales and ensuring compliance with state sales tax regulations. It provides a structured way for businesses to report the details of their sales, including the amount of sales tax collected and the total sales amount. Proper completion of this form helps businesses maintain accurate records and fulfill their tax obligations.

Steps to complete the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

Completing the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From involves several key steps:

- Gather all necessary sales data, including total sales amounts and sales tax collected.

- Fill in the business information, such as name, address, and tax identification number.

- Detail each transaction, ensuring that the sales tax is calculated correctly based on applicable rates.

- Review the completed form for accuracy, ensuring all figures are correct and all required fields are filled.

- Submit the form according to the specified submission methods, whether online or by mail.

Legal use of the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

The ST 556 Sales Tax Transaction Return Instructions 1 For Sales From is legally binding when completed accurately and submitted on time. This form must comply with state regulations regarding sales tax reporting. Failure to adhere to these regulations can result in penalties or audits. It is crucial for businesses to understand the legal implications of their submissions and ensure that they are following all guidelines to avoid potential legal issues.

Key elements of the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

Key elements of the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From include:

- Business Information: Name, address, and tax identification number of the business.

- Transaction Details: A breakdown of each sale, including dates, amounts, and sales tax collected.

- Total Sales Amount: The total amount of sales made during the reporting period.

- Sales Tax Collected: The total amount of sales tax that has been collected from customers.

Form Submission Methods (Online / Mail / In-Person)

The ST 556 Sales Tax Transaction Return Instructions 1 For Sales From can be submitted through various methods, ensuring flexibility for businesses:

- Online Submission: Many states offer online portals for submitting sales tax returns, allowing for quicker processing.

- Mail Submission: Businesses can print the completed form and send it via postal service to the appropriate tax authority.

- In-Person Submission: Some businesses may choose to submit the form in person at local tax offices.

Filing Deadlines / Important Dates

Filing deadlines for the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From vary by state and are typically based on the reporting period. Businesses should be aware of the following important dates:

- Monthly Filers: Generally due on the last day of the month following the reporting period.

- Quarterly Filers: Typically due on the last day of the month following the end of the quarter.

- Annual Filers: Due on a specific date set by the state, often at the end of the calendar year.

Quick guide on how to complete st 556 sales tax transaction return instructions 1 for sales from

Effortlessly Prepare ST 556 Sales Tax Transaction Return Instructions 1 For Sales From on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage ST 556 Sales Tax Transaction Return Instructions 1 For Sales From on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

Effortlessly Edit and eSign ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

- Locate ST 556 Sales Tax Transaction Return Instructions 1 For Sales From and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight essential sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method of sending your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign ST 556 Sales Tax Transaction Return Instructions 1 For Sales From to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 556 sales tax transaction return instructions 1 for sales from

Create this form in 5 minutes!

How to create an eSignature for the st 556 sales tax transaction return instructions 1 for sales from

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What are the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From?

The ST 556 Sales Tax Transaction Return Instructions 1 For Sales From provide detailed guidelines on how to properly complete the form for reporting sales tax transactions. These instructions are essential for ensuring compliance with state tax regulations and accurate reporting of sales. Understanding these instructions can help businesses avoid penalties and streamline their tax filing process.

-

How can airSlate SignNow help in processing ST 556 Sales Tax Transaction Return Instructions 1 For Sales From?

airSlate SignNow simplifies the process of managing and signing documents related to ST 556 Sales Tax Transaction Return Instructions 1 For Sales From by offering a user-friendly platform for electronic signatures. This allows businesses to securely send, receive, and store important documents, ensuring quick compliance with state tax requirements. Plus, it enhances collaboration among team members involved in the tax filing process.

-

What features does airSlate SignNow offer for handling sales tax documents?

airSlate SignNow offers features like customizable templates, in-app signing, and secure document storage to facilitate the processing of sales tax documents like the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From. These features ensure that users can create, manage, and track their tax documents efficiently. Moreover, the platform provides audit trails for additional security and compliance.

-

Is airSlate SignNow cost-effective for small businesses needing ST 556 Sales Tax Transaction Return Instructions 1 For Sales From?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses that require ST 556 Sales Tax Transaction Return Instructions 1 For Sales From. With competitive pricing plans and a pay-as-you-go option, businesses can benefit from robust features without breaking the bank. This affordability allows small businesses to manage their sales tax documents efficiently while staying compliant.

-

How does airSlate SignNow ensure the security of documents related to ST 556 Sales Tax Transaction Return Instructions 1 For Sales From?

Security is a top priority for airSlate SignNow. The platform employs bank-level encryption and robust security protocols to protect documents, including those containing the ST 556 Sales Tax Transaction Return Instructions 1 For Sales From. This ensures that sensitive information remains confidential and is only accessible to authorized individuals.

-

Can airSlate SignNow integrate with accounting software for ST 556 Sales Tax Transaction Return Instructions 1 For Sales From?

Yes, airSlate SignNow seamlessly integrates with various accounting software, simplifying the management of ST 556 Sales Tax Transaction Return Instructions 1 For Sales From. This integration allows for easy syncing of sales data and streamlining of the tax return process. By connecting your accounting software with SignNow, you can ensure accurate record-keeping and efficient tax filing.

-

What are the benefits of using airSlate SignNow for ST 556 Sales Tax Transaction Return Instructions 1 For Sales From?

Using airSlate SignNow for ST 556 Sales Tax Transaction Return Instructions 1 For Sales From offers numerous benefits, including enhanced efficiency, reduced turnaround times, and improved compliance. The platform allows teams to collaborate in real-time, track document statuses, and maintain an organized filing system. This ultimately leads to fewer errors and better management of sales tax obligations.

Get more for ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

Find out other ST 556 Sales Tax Transaction Return Instructions 1 For Sales From

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement