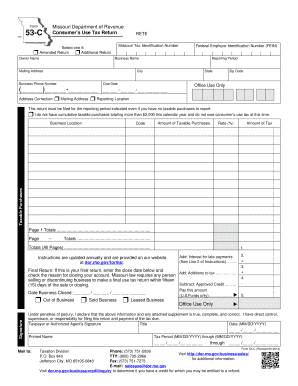

BForm 53b C Consumer39s Use Tax Return 2020

What is the BForm 53b C Consumer's Use Tax Return

The BForm 53b C Consumer's Use Tax Return is a tax document used in the United States for reporting and paying use tax on items purchased for use in the state where the tax is being filed. This form is essential for individuals and businesses that have acquired goods from out-of-state vendors and have not paid sales tax at the time of purchase. Use tax is designed to ensure that local businesses are not disadvantaged by out-of-state purchases.

How to use the BForm 53b C Consumer's Use Tax Return

Using the BForm 53b C Consumer's Use Tax Return involves several key steps. First, gather all necessary information regarding your purchases, including dates, descriptions, and amounts. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled, you can submit it through the designated channels, which may include online submission or mailing it to the appropriate tax authority.

Steps to complete the BForm 53b C Consumer's Use Tax Return

Completing the BForm 53b C Consumer's Use Tax Return involves a systematic approach:

- Collect purchase records: Gather receipts and invoices for items bought out of state.

- Fill out personal information: Provide your name, address, and any relevant identification numbers.

- Detail your purchases: List each item, including the purchase date, description, and cost.

- Calculate the use tax owed: Determine the applicable tax rate and calculate the total tax due based on your purchases.

- Review the form: Double-check all entries for accuracy before submission.

- Submit the form: Follow the instructions for submitting the form, whether online or by mail.

Legal use of the BForm 53b C Consumer's Use Tax Return

The legal use of the BForm 53b C Consumer's Use Tax Return is governed by state tax laws. It is important to ensure that the form is used correctly to avoid penalties. Filing this form is a legal obligation for individuals and businesses that meet the criteria for use tax. Compliance with the regulations ensures that taxpayers fulfill their responsibilities while contributing to state revenue.

Filing Deadlines / Important Dates

Filing deadlines for the BForm 53b C Consumer's Use Tax Return vary by state. Typically, the form must be submitted annually, with specific due dates often aligned with the state's income tax filing deadline. It is crucial to check with your state’s tax authority for the exact dates to avoid late fees or penalties.

Required Documents

To complete the BForm 53b C Consumer's Use Tax Return, you will need several documents:

- Receipts or invoices for out-of-state purchases.

- Personal identification information, such as a Social Security number or taxpayer ID.

- Any previous tax returns that may provide context for your current filing.

Form Submission Methods (Online / Mail / In-Person)

The BForm 53b C Consumer's Use Tax Return can typically be submitted through various methods. Many states offer online filing options, which provide a quick and efficient way to submit your return. Alternatively, you may choose to mail the completed form to the appropriate tax office or, in some cases, deliver it in person. Always verify the submission methods accepted by your state to ensure compliance.

Quick guide on how to complete bform 53b c consumer39s use tax return

Effortlessly Prepare BForm 53b C Consumer39s Use Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage BForm 53b C Consumer39s Use Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and eSign BForm 53b C Consumer39s Use Tax Return Effortlessly

- Locate BForm 53b C Consumer39s Use Tax Return and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as an old-fashioned ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign BForm 53b C Consumer39s Use Tax Return while ensuring excellent communication throughout the document preparation stages with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bform 53b c consumer39s use tax return

Create this form in 5 minutes!

How to create an eSignature for the bform 53b c consumer39s use tax return

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the BForm 53b C Consumer39s Use Tax Return?

The BForm 53b C Consumer39s Use Tax Return is a tax document that residents must file to report and pay use tax on items purchased for personal use. This return helps ensure compliance with state tax laws. airSlate SignNow simplifies the process, allowing you to easily create, sign, and submit your BForm 53b C Consumer39s Use Tax Return online.

-

How can airSlate SignNow help with filing the BForm 53b C Consumer39s Use Tax Return?

airSlate SignNow provides an intuitive platform that enables users to draft and electronically sign the BForm 53b C Consumer39s Use Tax Return efficiently. Our solution ensures that your documents are legally binding and securely stored. By streamlining the workflow, we help reduce the hassle of filing tax returns.

-

What are the features of airSlate SignNow for processing the BForm 53b C Consumer39s Use Tax Return?

Key features of airSlate SignNow include customizable templates, electronic signature capabilities, and seamless document management. You can create the BForm 53b C Consumer39s Use Tax Return from scratch or use pre-existing templates. Additionally, our platform allows you to track the status of your filings for efficient management.

-

Is there a cost to use airSlate SignNow for the BForm 53b C Consumer39s Use Tax Return?

airSlate SignNow offers competitive pricing tailored to meet various business needs. You can select from different plans that provide access to features suitable for managing the BForm 53b C Consumer39s Use Tax Return efficiently. We also offer a free trial to explore our services before committing.

-

What benefits do businesses gain by using airSlate SignNow for their BForm 53b C Consumer39s Use Tax Return?

Using airSlate SignNow for your BForm 53b C Consumer39s Use Tax Return simplifies document management and enhances productivity. Businesses can reduce the time spent on paperwork, minimize errors through electronic forms, and ensure compliance effortlessly. The ease of electronic signatures also accelerates the approval process.

-

Can airSlate SignNow integrate with other software for the BForm 53b C Consumer39s Use Tax Return?

Yes, airSlate SignNow seamlessly integrates with various software applications and tools to streamline your workflow for filing the BForm 53b C Consumer39s Use Tax Return. These integrations allow users to import data from accounting software and export finalized documents easily. This ensures a cohesive experience across platforms.

-

Is it secure to use airSlate SignNow for my BForm 53b C Consumer39s Use Tax Return documents?

Absolutely! AirSlate SignNow prioritizes security and employs advanced encryption methods to protect your BForm 53b C Consumer39s Use Tax Return documents. Your data is stored securely, ensuring only authorized users can access sensitive information. We comply with industry standards to provide a safe platform for all users.

Get more for BForm 53b C Consumer39s Use Tax Return

Find out other BForm 53b C Consumer39s Use Tax Return

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now