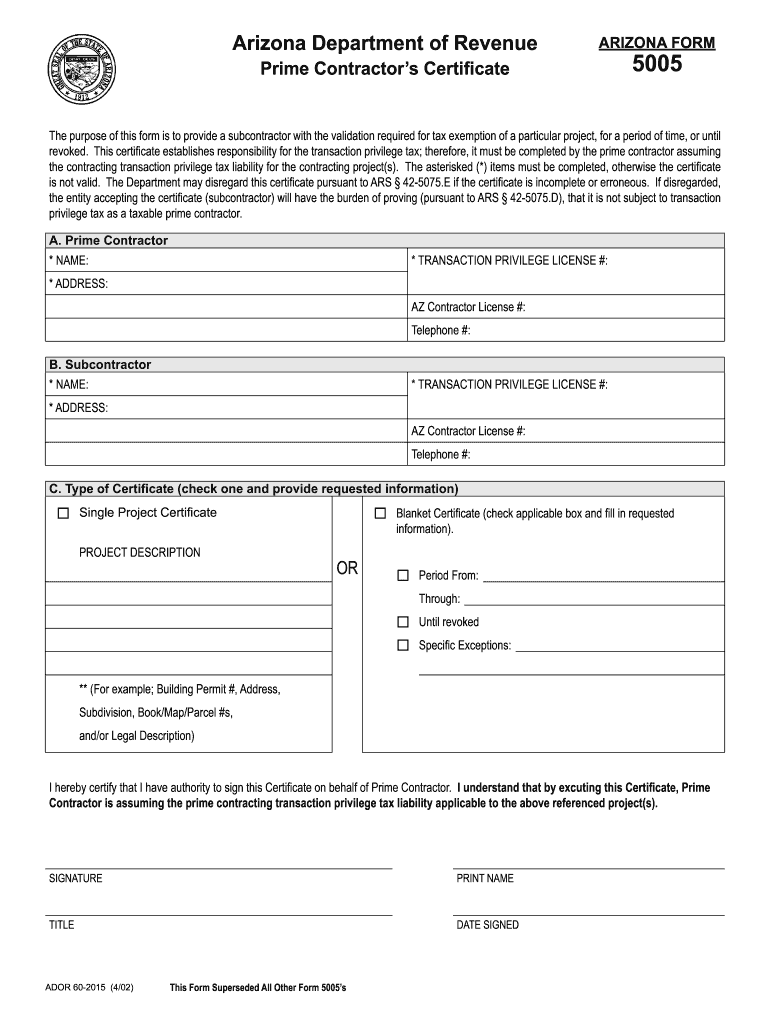

5005 Arizona Department of Revenue 2020

What is the 5005 Arizona Department Of Revenue

The 5005 Arizona Department of Revenue form is a crucial document used for various tax-related purposes within the state of Arizona. It is primarily utilized to report income, deductions, and credits for individuals and businesses. Understanding the purpose of this form is essential for accurate tax reporting and compliance with state regulations. The form ensures that taxpayers fulfill their obligations while taking advantage of any applicable tax benefits.

How to use the 5005 Arizona Department Of Revenue

Using the 5005 Arizona Department of Revenue form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records, as this can be useful for future reference or in case of audits.

Steps to complete the 5005 Arizona Department Of Revenue

Completing the 5005 Arizona Department of Revenue form requires a systematic approach:

- Gather all necessary documentation, including W-2s, 1099s, and receipts.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and dividends.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either online or via mail.

Legal use of the 5005 Arizona Department Of Revenue

The 5005 Arizona Department of Revenue form holds legal significance as it is used to report tax information to the state. To be considered legally binding, the form must be completed accurately and submitted on time. Compliance with state tax laws is essential to avoid penalties or legal issues. Additionally, electronic signatures on the form are recognized as valid under U.S. law, provided that they meet specific legal requirements.

Form Submission Methods

The 5005 Arizona Department of Revenue form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers prefer to submit the form electronically through the Arizona Department of Revenue's website.

- Mail: The form can also be printed and mailed to the appropriate address provided by the Arizona Department of Revenue.

- In-Person: Taxpayers may choose to submit the form in person at designated state offices, ensuring immediate confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the 5005 Arizona Department of Revenue form are critical to ensure compliance and avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. It is essential to stay informed about any updates regarding filing dates to ensure timely submission.

Quick guide on how to complete 5005 arizona department of revenue

Effortlessly Prepare 5005 Arizona Department Of Revenue on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and without hassle. Manage 5005 Arizona Department Of Revenue on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-focused procedure today.

The Easiest Way to Edit and Electronically Sign 5005 Arizona Department Of Revenue with Ease

- Obtain 5005 Arizona Department Of Revenue and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign 5005 Arizona Department Of Revenue while ensuring clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5005 arizona department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 5005 arizona department of revenue

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the 5005 Arizona Department Of Revenue form?

The 5005 Arizona Department Of Revenue form is a document that business professionals use for tax reporting purposes. It includes essential information for compliance with state taxation requirements. Using airSlate SignNow simplifies the process of sending and signing this form, ensuring timely submissions.

-

How can airSlate SignNow assist with the 5005 Arizona Department Of Revenue form?

airSlate SignNow provides a platform for securely sending, signing, and managing the 5005 Arizona Department Of Revenue form efficiently. Our easy-to-use features allow you to streamline the signing process, making it simple to obtain necessary signatures and store completed forms in the cloud.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs, including features tailored for handling documents like the 5005 Arizona Department Of Revenue form. We have a range of options, from basic to premium, ensuring you find the right fit for your budget and requirements.

-

What key features help with the 5005 Arizona Department Of Revenue form management?

Key features of airSlate SignNow include document templates, customizable workflows, and real-time tracking. These tools help you manage the 5005 Arizona Department Of Revenue form efficiently, reducing the time spent on administrative tasks while enhancing accuracy and compliance.

-

Are there integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, allowing for effortless management of the 5005 Arizona Department Of Revenue form alongside other tools you use daily. Integration options include popular software like Google Drive, Dropbox, and CRM systems, ensuring a cohesive workflow.

-

What benefits does using airSlate SignNow provide for tax-related documents?

Using airSlate SignNow for tax-related documents like the 5005 Arizona Department Of Revenue form provides numerous benefits, including enhanced security, reduced turnaround time, and improved compliance. Our eSignature solution ensures that your documents are signed quickly and securely, leading to increased efficiency in your tax preparation.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises. Regardless of your company's scale, you can effectively manage the 5005 Arizona Department Of Revenue form and other documents with our flexible solutions.

Get more for 5005 Arizona Department Of Revenue

Find out other 5005 Arizona Department Of Revenue

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online