Arizona 140nr Form 2019

What is the Arizona 140nr Form

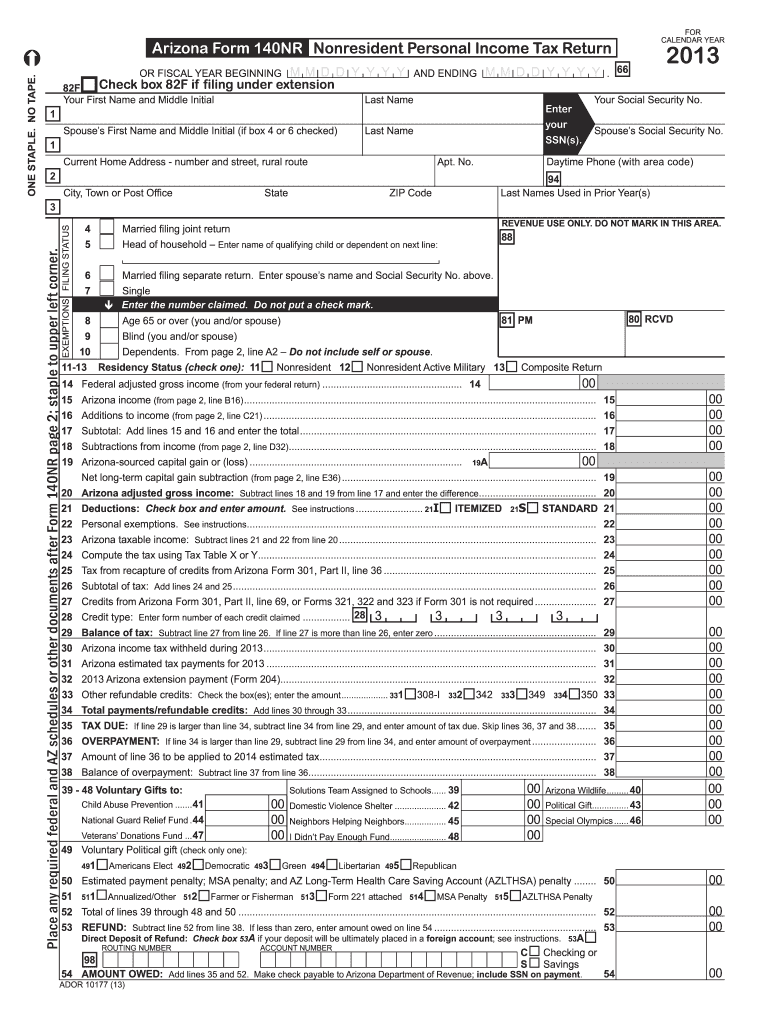

The Arizona 140nr Form is a state tax form specifically designed for non-residents who earn income in Arizona. It is used to report income earned from various sources within the state, such as wages, rental income, or business profits. This form helps ensure that non-residents pay the appropriate amount of state income tax based on their earnings in Arizona. Understanding the purpose of this form is crucial for compliance with Arizona tax regulations.

How to obtain the Arizona 140nr Form

The Arizona 140nr Form can be obtained through several methods. It is available for download on the Arizona Department of Revenue's official website. Additionally, taxpayers can request a physical copy by contacting the department directly. Many tax preparation software programs also include the Arizona 140nr Form, making it accessible for those who prefer to file electronically.

Steps to complete the Arizona 140nr Form

Completing the Arizona 140nr Form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and records of any other income earned in Arizona.

- Fill out personal information such as your name, address, and Social Security number at the top of the form.

- Report your income in the designated sections, ensuring you include all sources of income earned while in Arizona.

- Calculate your taxable income and the corresponding tax owed using the tax tables provided by the Arizona Department of Revenue.

- Review the completed form for accuracy before signing and dating it.

Legal use of the Arizona 140nr Form

The Arizona 140nr Form is legally binding when completed accurately and submitted on time. It must comply with state tax laws, and failure to file can result in penalties. The form must be signed by the taxpayer, and if filed electronically, it should adhere to the eSignature requirements set forth by the Arizona Department of Revenue.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Arizona 140nr Form. Typically, the form must be filed by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any changes in deadlines that may arise due to state regulations or special circumstances.

Required Documents

To complete the Arizona 140nr Form, several documents are required. These include:

- W-2 forms from employers showing income earned in Arizona.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any rental income or business profits derived from Arizona sources.

- Documentation of any deductions or credits that may apply to your situation.

Form Submission Methods (Online / Mail / In-Person)

The Arizona 140nr Form can be submitted through various methods. Taxpayers may choose to file online using approved e-filing services, which often provide immediate confirmation of receipt. Alternatively, the form can be mailed to the Arizona Department of Revenue at the designated address. In-person submissions are also accepted at local tax offices, providing an option for those who prefer face-to-face assistance.

Quick guide on how to complete 2013 arizona 140nr form

Effortlessly Complete Arizona 140nr Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Arizona 140nr Form on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Simplest Way to Modify and Electronically Sign Arizona 140nr Form with Ease

- Obtain Arizona 140nr Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Arizona 140nr Form to ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 arizona 140nr form

Create this form in 5 minutes!

How to create an eSignature for the 2013 arizona 140nr form

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Arizona 140nr Form?

The Arizona 140nr Form is a non-resident income tax return that must be filed by individuals who earn income in Arizona but do not reside in the state. This form helps ensure compliance with Arizona tax laws for non-residents. Using airSlate SignNow simplifies the eSigning process for this form, making it quick and efficient.

-

How do I fill out the Arizona 140nr Form?

Filling out the Arizona 140nr Form requires you to provide information about your income, deductions, and tax credits applicable to non-residents. To streamline this process, airSlate SignNow offers templates and autofill features to assist you in completing the form correctly. Additionally, you can easily eSign the form once completed.

-

What is the cost of using airSlate SignNow for the Arizona 140nr Form?

AirSlate SignNow offers a variety of pricing plans that cater to both individuals and businesses. The cost will depend on the features you need for managing your documents, including the Arizona 140nr Form. We recommend checking our pricing page for the best plan that suits your needs.

-

Can airSlate SignNow integrate with other accounting software for the Arizona 140nr Form?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your Arizona 140nr Form alongside your financial documents. This integration helps streamline your workflow, allowing you to access and eSign documents without leaving your preferred software.

-

What are the benefits of using airSlate SignNow for the Arizona 140nr Form?

Using airSlate SignNow for the Arizona 140nr Form offers numerous benefits, including enhanced efficiency, reduced paper usage, and increased security through electronic signatures. Furthermore, our platform ensures that your documents are legally binding and easily accessible from anywhere, simplifying your filing process.

-

Is airSlate SignNow suitable for small businesses dealing with the Arizona 140nr Form?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, including small businesses that need to manage the Arizona 140nr Form. Our user-friendly interface and cost-effective plans make it a perfect solution for small businesses looking to streamline document management and eSigning.

-

How secure is airSlate SignNow for signing the Arizona 140nr Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies to protect your documents, including the Arizona 140nr Form, ensuring your data is safe and secure during transmission and storage. Additionally, our platform complies with industry-leading security standards, giving you peace of mind.

Get more for Arizona 140nr Form

- Summary process eviction complaint termination of lease by lapse of time form

- A guide to understanding the americans with disabilities act form

- Www courts state hi us form

- Summons miami dade form

- Florida supreme court approved family law form 12 970c waiver of service of process and consent for temporary custody by

- Form 17a case conference briefgeneral ontario

- Journal of trauma ampamp orthopaedics vol 4 iss 1 by british form

- Ontariocourtforms on cafamily17cat settlement conference brief general ontario court forms

Find out other Arizona 140nr Form

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document