540 Es Form 2020

What is the 540 Es Form

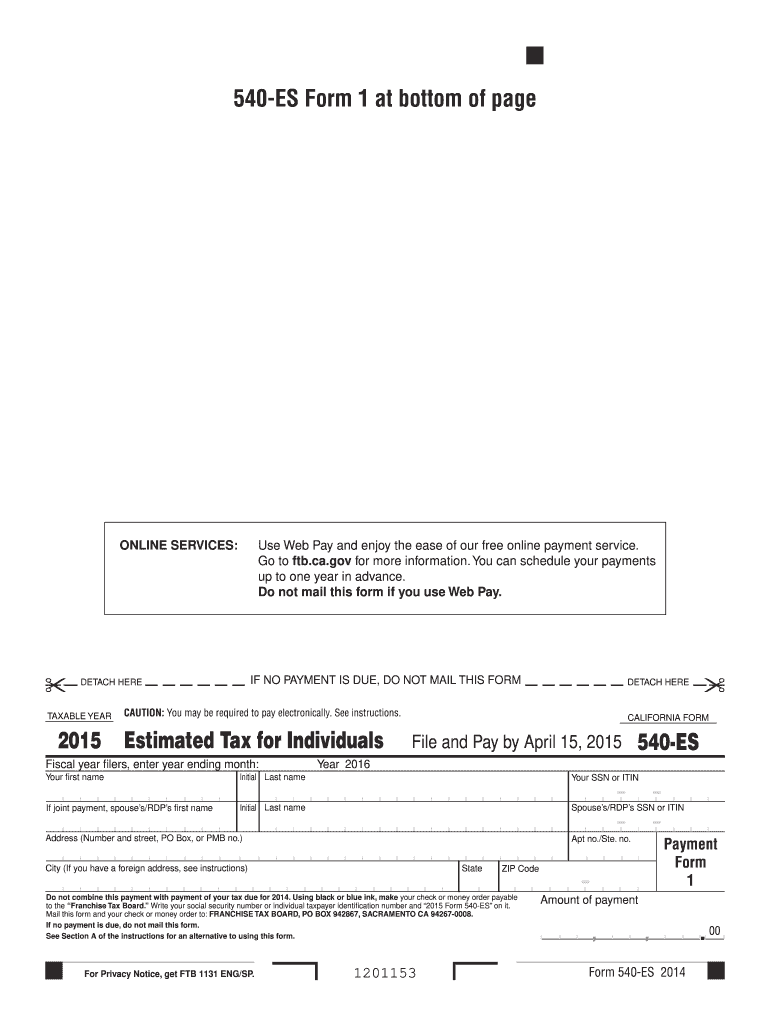

The 540 Es Form is a California state tax document used to report estimated tax payments for individuals. It is specifically designed for taxpayers who expect to owe tax of five hundred dollars or more when they file their annual return. The form allows individuals to make quarterly estimated tax payments, helping to ensure that they meet their tax obligations throughout the year. This proactive approach can prevent underpayment penalties and interest charges that may arise from insufficient tax payments.

How to use the 540 Es Form

Using the 540 Es Form involves several straightforward steps. First, taxpayers need to determine their expected taxable income for the year, which will help calculate the estimated tax liability. Next, individuals should complete the form by entering their personal information and the calculated estimated tax amounts. Finally, the completed form can be submitted either electronically or via mail, depending on the taxpayer's preference. It's essential to adhere to the quarterly deadlines to avoid penalties.

Steps to complete the 540 Es Form

Completing the 540 Es Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your expected annual income and applicable deductions.

- Determine your estimated tax liability using the California tax rate schedule.

- Fill out the form with your personal information and estimated tax amounts for each quarter.

- Review the form for accuracy before submission.

Legal use of the 540 Es Form

The 540 Es Form is legally recognized by the California Franchise Tax Board (FTB) as a valid method for reporting estimated tax payments. To ensure compliance, taxpayers must follow the guidelines set forth by the FTB. This includes submitting the form on time and making payments as required. Failure to comply with these regulations may result in penalties or interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the 540 Es Form is crucial to avoid penalties. The estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure they submit their payments on time. Additionally, it is advisable to check for any updates or changes to deadlines that may occur due to legislative changes or other factors.

Required Documents

To complete the 540 Es Form accurately, taxpayers should gather several essential documents:

- Previous year’s tax return for reference.

- W-2 forms or 1099 forms reflecting income.

- Documentation for any deductions or credits that may apply.

- Records of any other income sources, such as rental or investment income.

Form Submission Methods (Online / Mail / In-Person)

The 540 Es Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the California Franchise Tax Board's website, which offers a secure and efficient process. Alternatively, the form can be mailed to the appropriate address as indicated in the form instructions. For those who prefer in-person assistance, visiting a local FTB office may also be an option, although it is advisable to check for appointment requirements.

Quick guide on how to complete 540 es form 2015

Effortlessly prepare 540 Es Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 540 Es Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign 540 Es Form without hassle

- Locate 540 Es Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to finalize your modifications.

- Select your preferred method of sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign 540 Es Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 540 es form 2015

Create this form in 5 minutes!

How to create an eSignature for the 540 es form 2015

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 540 Es Form?

The 540 Es Form is a document used for California resident income tax returns. airSlate SignNow simplifies the process by allowing users to eSign and send the 540 Es Form easily, ensuring compliance and accuracy in tax filing.

-

How can airSlate SignNow help with the 540 Es Form?

airSlate SignNow streamlines the workflow for completing the 540 Es Form by enabling users to create, edit, and sign documents online. Its user-friendly interface ensures that you can manage your tax forms efficiently and securely.

-

What are the pricing options for airSlate SignNow for eSigning the 540 Es Form?

airSlate SignNow offers flexible pricing plans to suit various business needs. Users can choose from individual, business, or enterprise plans, each providing unlimited eSigning capabilities for documents like the 540 Es Form.

-

Are there any integrations available for airSlate SignNow when managing the 540 Es Form?

Yes, airSlate SignNow integrates seamlessly with various applications, such as Google Drive, Dropbox, and CRM systems. This ensures that you can manage all aspects of your 540 Es Form and related documents from one centralized platform.

-

Is the 540 Es Form secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect your sensitive data, including the 540 Es Form. This means your documents are safe and compliant with industry regulations.

-

Can multiple users collaborate on the 540 Es Form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 540 Es Form simultaneously. This feature is perfect for teams needing to review, edit, and eSign the form collectively, enhancing efficiency and accuracy.

-

What benefits does airSlate SignNow offer when filing the 540 Es Form?

By using airSlate SignNow for the 540 Es Form, businesses enjoy a simplified signing process, reduced paper usage, and faster turnaround times. These benefits not only enhance productivity but also support environmentally friendly practices.

Get more for 540 Es Form

Find out other 540 Es Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement