Dc Tax Forms 2018-2026

What are the DC Tax Forms?

The DC tax forms are official documents required for filing income taxes in Washington, D.C. These forms include various types, such as the 2017 D-40, which is the primary income tax return for residents. Each form serves a specific purpose, ensuring compliance with local tax laws. The forms are designed to capture essential information about an individual's income, deductions, and tax credits, which ultimately determine the amount of tax owed or refunded.

Steps to Complete the DC Tax Forms

Completing the 2017 DC tax forms involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Download the appropriate forms, such as the 2017 D-40 or D-40EZ, from the official tax website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Claim any deductions and credits you qualify for, which can reduce your taxable income.

- Review the completed form for accuracy before signing.

- Submit the form by the deadline, either electronically or by mail.

Legal Use of the DC Tax Forms

The 2017 DC tax forms are legally binding documents. To ensure their validity, they must be completed accurately and submitted on time. Failure to comply with tax regulations can lead to penalties or legal repercussions. The forms must be signed by the taxpayer, and electronic signatures are acceptable if they meet specific legal standards. Understanding the legal implications of these forms is crucial for all taxpayers.

Filing Deadlines / Important Dates

For the 2017 tax year, the filing deadline for DC tax forms was April 15, 2018. It's important to be aware of these deadlines to avoid late fees and penalties. Extensions may be available, but they require proper filing before the original deadline. Keeping track of important dates ensures timely compliance with tax obligations.

Form Submission Methods

There are several methods for submitting the 2017 DC tax forms:

- Online: Taxpayers can file electronically using approved e-filing software, which often simplifies the process.

- Mail: Completed forms can be printed and mailed to the appropriate tax office, with postage paid by the taxpayer.

- In-Person: Some taxpayers may choose to submit their forms in person at designated tax offices, ensuring immediate confirmation of receipt.

Required Documents

To complete the 2017 DC tax forms, several documents are typically required:

- W-2 forms from employers, detailing annual earnings and taxes withheld.

- 1099 forms for additional income, such as freelance work or interest earned.

- Documentation for any deductions claimed, such as receipts for charitable contributions.

- Social Security numbers for all dependents.

Form Variants

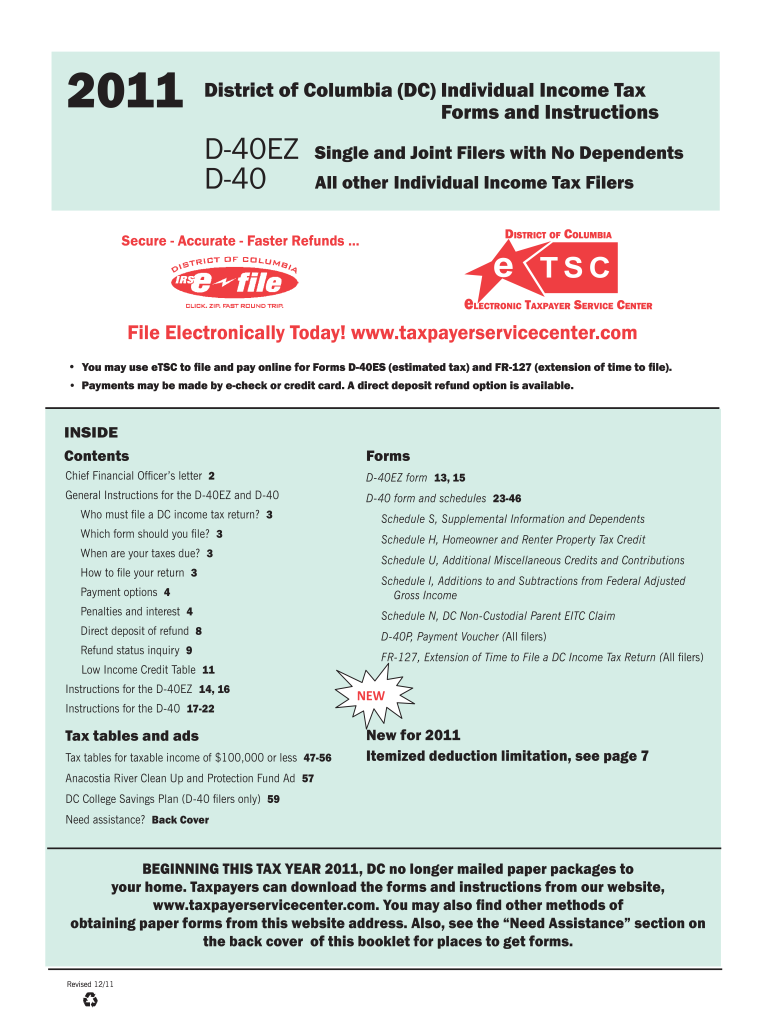

In addition to the 2017 D-40, there are other variants of DC tax forms. The D-40EZ is a simplified version for eligible taxpayers with straightforward tax situations. Understanding the differences between these forms helps taxpayers choose the correct one based on their financial circumstances. Other forms may cater to specific situations, such as non-residents or special deductions.

Quick guide on how to complete 2011 dc tax forms

Complete Dc Tax Forms effortlessly on any device

Online document management has gained traction among both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely archive it online. airSlate SignNow equips you with all the essential tools to craft, modify, and eSign your documents swiftly without delays. Manage Dc Tax Forms on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Dc Tax Forms with ease

- Find Dc Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Dc Tax Forms and ensure effective communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 dc tax forms

Create this form in 5 minutes!

How to create an eSignature for the 2011 dc tax forms

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What should I know about filing my 2017 DC income tax?

When filing your 2017 DC income tax, it's essential to gather all necessary documents, including W-2s and 1099s. Ensure you are aware of the deadlines to avoid penalties. Using an e-signature solution like airSlate SignNow can simplify the process of signing and submitting your tax documents securely.

-

How can airSlate SignNow help with 2017 DC income tax documents?

airSlate SignNow allows you to sign and send your 2017 DC income tax documents quickly and securely. Our platform offers a user-friendly interface that makes it easy to manage your paperwork digitally. This can save you time and reduce the hassle of manual signatures and paper forms.

-

What are the pricing options for airSlate SignNow for tax season?

Our pricing for airSlate SignNow is competitive, especially for users needing to manage their 2017 DC income tax documents. We offer various plans to fit your specific needs, whether you're an individual, a small business, or a large organization. Check our website for the most up-to-date pricing details and any promotional offerings.

-

Are there any features specifically beneficial for handling 2017 DC income tax?

Yes, airSlate SignNow includes features like customizable templates and multi-party signing that are particularly beneficial for handling your 2017 DC income tax documents. Our platform supports easy document tracking and secure sharing, ensuring that all parties can efficiently complete their tax forms. This streamlines the filing process and enhances compliance.

-

Can I integrate airSlate SignNow with accounting software for my 2017 DC income tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software to streamline the management of your 2017 DC income tax filings. This integration allows for easy access to necessary documents, which can expedite the signing process. Make sure to explore our integration options to enhance your filing experience.

-

What benefits does airSlate SignNow offer for small businesses dealing with 2017 DC income tax?

For small businesses, airSlate SignNow provides a cost-effective solution for managing 2017 DC income tax documentation. Our platform saves time and reduces errors with electronic signatures. Additionally, it facilitates compliance and ensures your documents are securely stored and easily accessible during tax season.

-

How secure is airSlate SignNow for filing 2017 DC income tax documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods to protect your sensitive 2017 DC income tax documents. We are committed to ensuring that your information remains private and secure throughout the e-signing process.

Get more for Dc Tax Forms

Find out other Dc Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors