D 40B Nonresident Request for Refund the District of Columbia Dc 2019

What is the D 40B Nonresident Request For Refund The District Of Columbia Dc

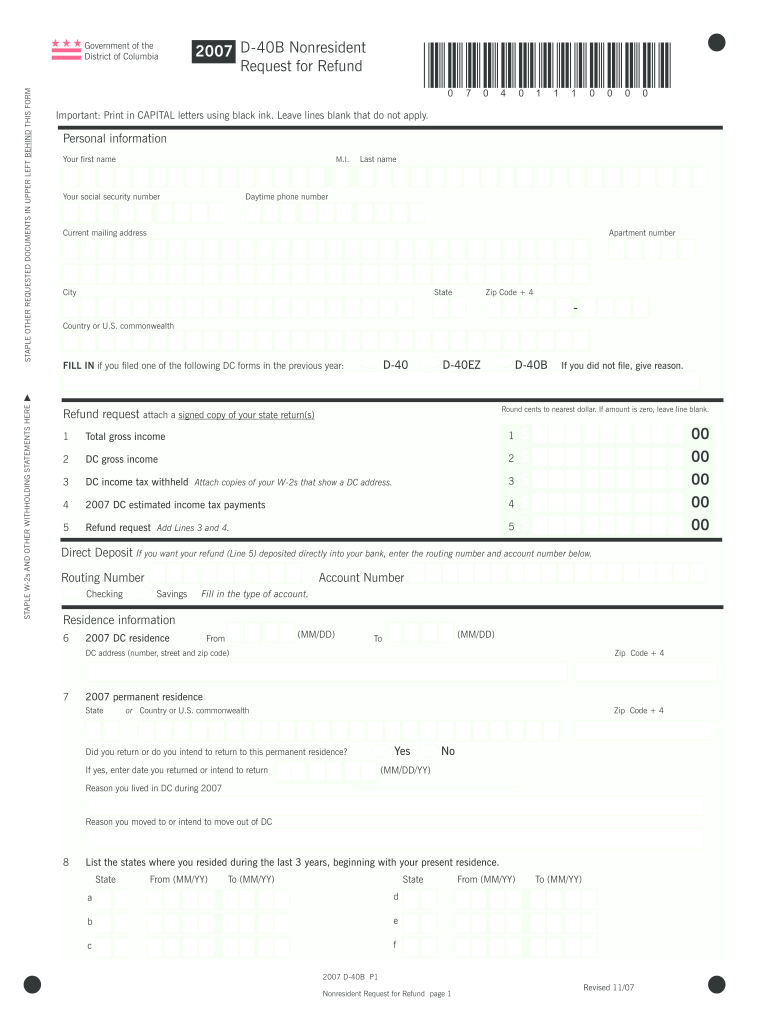

The D 40B Nonresident Request For Refund is a tax form used by nonresident individuals who have overpaid their income taxes in the District of Columbia. This form allows eligible taxpayers to request a refund for the excess amount paid. It is specifically designed for individuals who earned income in D.C. but do not reside there, ensuring they are not taxed more than necessary. Understanding this form is crucial for nonresidents seeking to reclaim their funds effectively.

Steps to complete the D 40B Nonresident Request For Refund The District Of Columbia Dc

Completing the D 40B Nonresident Request For Refund involves several key steps:

- Gather Required Information: Collect all necessary documents, including your W-2 forms and any other income statements relevant to your D.C. earnings.

- Fill Out the Form: Accurately complete all sections of the D 40B form, ensuring that personal information and income details are correct.

- Calculate Your Refund: Determine the amount of tax overpaid by reviewing your tax payments and any applicable deductions.

- Sign and Date: Ensure that you sign and date the form, as an unsigned form may be rejected.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and send the completed form to the appropriate D.C. tax authority.

Key elements of the D 40B Nonresident Request For Refund The District Of Columbia Dc

Several key elements must be included when filling out the D 40B Nonresident Request For Refund:

- Taxpayer Information: Full name, address, and Social Security number or taxpayer identification number.

- Income Details: A summary of income earned in D.C. during the tax year.

- Tax Payments: Documentation of all taxes paid to the District of Columbia.

- Refund Amount: The specific amount you are requesting to be refunded, calculated based on overpayments.

Legal use of the D 40B Nonresident Request For Refund The District Of Columbia Dc

The legal use of the D 40B Nonresident Request For Refund is governed by tax laws in the District of Columbia. This form must be completed accurately and submitted within the designated time frame to ensure compliance with D.C. tax regulations. Failure to adhere to these legal requirements may result in delays or denial of the refund request. It is essential for nonresidents to be aware of their rights and responsibilities when filing this form.

Eligibility Criteria

To be eligible to file the D 40B Nonresident Request For Refund, individuals must meet specific criteria:

- Must be a nonresident of the District of Columbia.

- Must have earned income in D.C. during the tax year in question.

- Must have overpaid D.C. income taxes based on their earnings.

- Must submit the form within the required timeframe set by D.C. tax authorities.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the D 40B Nonresident Request For Refund:

- Online Submission: Use the D.C. Office of Tax and Revenue's online portal for electronic filing.

- Mail: Send the completed form to the appropriate address provided by the D.C. tax authority.

- In-Person: Visit a local D.C. tax office to submit the form directly.

Quick guide on how to complete d 40b nonresident request for refund the district of columbia dc

Complete D 40B Nonresident Request For Refund The District Of Columbia Dc effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, as you can find the right template and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage D 40B Nonresident Request For Refund The District Of Columbia Dc on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign D 40B Nonresident Request For Refund The District Of Columbia Dc without stress

- Find D 40B Nonresident Request For Refund The District Of Columbia Dc and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign D 40B Nonresident Request For Refund The District Of Columbia Dc and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 40b nonresident request for refund the district of columbia dc

Create this form in 5 minutes!

How to create an eSignature for the d 40b nonresident request for refund the district of columbia dc

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the D 40B Nonresident Request For Refund The District Of Columbia Dc?

The D 40B Nonresident Request For Refund The District Of Columbia Dc is a form used by non-residents who wish to request a refund of their DC income tax withholding. This form is crucial for ensuring that non-residents receive any overpaid taxes. Filling out the D 40B accurately can simplify the refund process signNowly.

-

How much does it cost to submit the D 40B Nonresident Request For Refund The District Of Columbia Dc?

There is no filing fee associated with submitting the D 40B Nonresident Request For Refund The District Of Columbia Dc. However, costs may be incurred if you choose to use professional tax services. It's recommended to review any potential charges before submission.

-

What documents are needed to complete the D 40B Nonresident Request For Refund The District Of Columbia Dc?

To complete the D 40B Nonresident Request For Refund The District Of Columbia Dc, you will need your W-2 forms, tax return copies, and proof of your non-resident status. Ensure that all necessary documentation is accurate to avoid delays in processing your refund.

-

How long does it take to process the D 40B Nonresident Request For Refund The District Of Columbia Dc?

The processing time for the D 40B Nonresident Request For Refund The District Of Columbia Dc can vary, typically taking between 8 to 12 weeks. Factors like the volume of requests and the accuracy of your submission can influence the timeline. Tracking your submission through the DC tax website can provide updates on your refund status.

-

Can I file the D 40B Nonresident Request For Refund The District Of Columbia Dc online?

Yes, you can file the D 40B Nonresident Request For Refund The District Of Columbia Dc online through the DC Office of Tax and Revenue's website. They offer an easy-to-navigate platform that allows you to submit your request electronically, expediting the process. Ensure you have all required information ready for a smooth filing experience.

-

What are the benefits of using airSlate SignNow for the D 40B Nonresident Request For Refund The District Of Columbia Dc?

Using airSlate SignNow for the D 40B Nonresident Request For Refund The District Of Columbia Dc streamlines the eSigning process, making it easier to capture signatures quickly and securely. Additionally, it offers templates that reduce paperwork errors, ensuring your submission is accurate and timely. This efficient solution can save you valuable time and effort.

-

Does airSlate SignNow integrate with other tools for managing the D 40B Nonresident Request For Refund The District Of Columbia Dc?

Yes, airSlate SignNow offers integrations with various productivity tools and document management systems to facilitate the handling of the D 40B Nonresident Request For Refund The District Of Columbia Dc. This means you can synchronize your workflows, manage files efficiently, and enhance collaboration with team members while processing your refund request.

Get more for D 40B Nonresident Request For Refund The District Of Columbia Dc

Find out other D 40B Nonresident Request For Refund The District Of Columbia Dc

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself