Dr15 Forms 2020

What is the Dr15 Forms

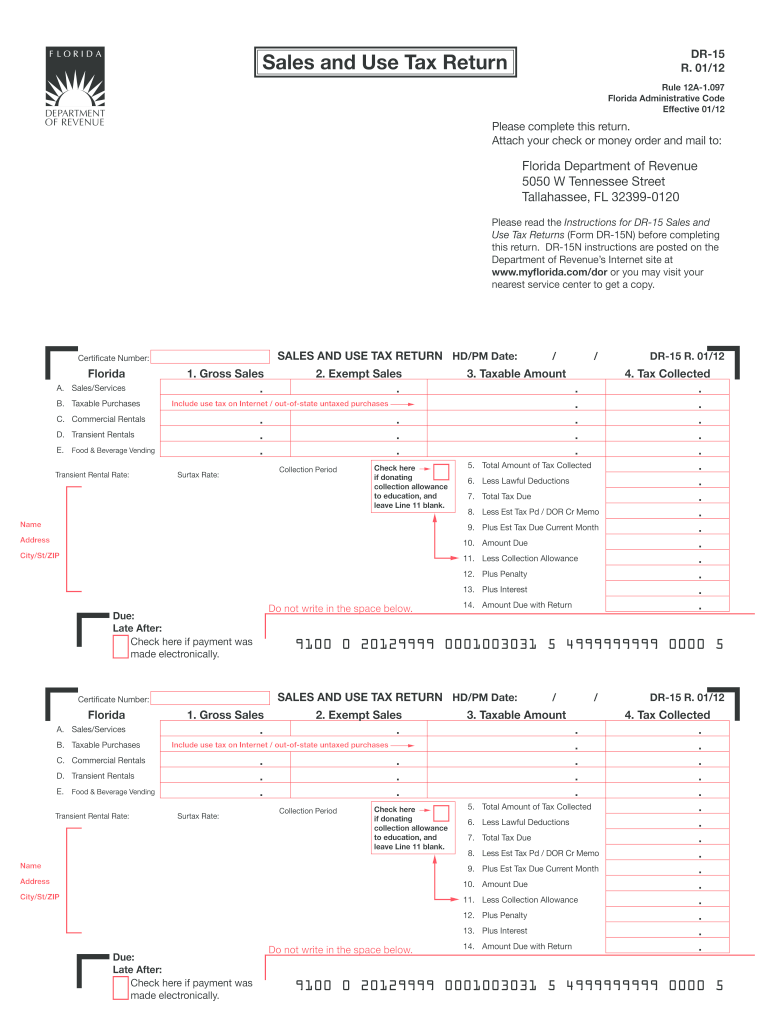

The Dr15 Forms are specific documents used primarily for tax purposes in the United States. These forms are essential for individuals and businesses to report income, claim deductions, and ensure compliance with federal and state tax regulations. The Dr15 Forms can vary based on the specific tax situation, such as individual income tax returns or business-related filings. Understanding the purpose and requirements of these forms is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Dr15 Forms

Using the Dr15 Forms involves several key steps. First, determine the specific type of Dr15 Form required for your situation. Next, gather all necessary documentation, such as income statements, receipts for deductions, and any other relevant financial records. Once you have the required information, complete the form accurately, ensuring all sections are filled out according to IRS guidelines. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the Dr15 Forms

Completing the Dr15 Forms can be streamlined by following these steps:

- Identify the correct form: Ensure you have the right version of the Dr15 Form for your tax situation.

- Gather documentation: Collect all necessary documents, including W-2s, 1099s, and any receipts for deductions.

- Fill out the form: Carefully enter your information, ensuring accuracy in all sections.

- Review: Double-check your entries for mistakes or omissions.

- Submit: File the completed form according to the instructions, either online, by mail, or in person.

Legal use of the Dr15 Forms

The legal use of the Dr15 Forms is governed by IRS regulations and state laws. These forms must be filled out accurately and submitted by the designated deadlines to ensure compliance. Failure to use the forms correctly can lead to penalties, including fines or audits. It is essential to keep copies of submitted forms and any supporting documentation for your records, as they may be required for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Dr15 Forms vary depending on the type of form and the taxpayer's situation. Typically, individual tax returns must be filed by April 15 each year, while extensions may be available. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late fees and ensure timely compliance with tax regulations.

Required Documents

When completing the Dr15 Forms, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements and investment income records

- Any prior year tax returns for reference

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Who Issues the Form

The Dr15 Forms are typically issued by the Internal Revenue Service (IRS) or state tax authorities, depending on the specific form type. These agencies provide the necessary guidelines and instructions for completing and submitting the forms. It is important to obtain the most current version of the form from the official sources to ensure compliance with any updates or changes in tax law.

Quick guide on how to complete dr15 2011 forms 2012

Complete Dr15 Forms effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Dr15 Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Dr15 Forms with ease

- Locate Dr15 Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to confirm your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Dr15 Forms while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr15 2011 forms 2012

Create this form in 5 minutes!

How to create an eSignature for the dr15 2011 forms 2012

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What are Dr15 Forms, and how can airSlate SignNow help with them?

Dr15 Forms are essential documents used for various administrative processes. airSlate SignNow simplifies the completion and signing of Dr15 Forms by providing a user-friendly interface that allows for quick eSignatures, ensuring your documents are processed efficiently.

-

Is there a cost associated with using airSlate SignNow for Dr15 Forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan is designed to provide access to features that streamline the handling of Dr15 Forms, allowing you to choose the most cost-effective option for your organization.

-

What are the key features of airSlate SignNow for managing Dr15 Forms?

Key features of airSlate SignNow for Dr15 Forms include customizable templates, document tracking, and secure eSignature options. These tools enable users to create, send, and manage Dr15 Forms efficiently while ensuring compliance and security throughout the process.

-

How can airSlate SignNow help improve the workflow for Dr15 Forms?

airSlate SignNow enhances workflow by automating the process of sending and signing Dr15 Forms. With instant notifications and reminders, teams can ensure timely responses, reducing bottlenecks and improving overall operational efficiency.

-

Can I integrate other software with airSlate SignNow for Dr15 Forms?

Absolutely! airSlate SignNow provides seamless integrations with various third-party applications, which allows you to streamline the handling of Dr15 Forms within your existing systems. This flexibility ensures you can maintain your workflow without disruption.

-

Is airSlate SignNow secure for handling sensitive Dr15 Forms?

Yes, airSlate SignNow prioritizes security by employing advanced encryption and authentication measures. These protocols ensure that all Dr15 Forms are handled securely, giving users peace of mind when dealing with sensitive information.

-

What benefits can businesses expect from using airSlate SignNow for Dr15 Forms?

Businesses can expect increased efficiency, reduced turnaround times, and improved accuracy when using airSlate SignNow for Dr15 Forms. The convenience of eSigning allows for faster processing, leading to enhanced productivity and customer satisfaction.

Get more for Dr15 Forms

- Imm 5269 form

- Ssi wage reporting worksheet form

- Form 27ba word format

- Yard sale permit 29417125 form

- Erailsafe test answers form

- Hardin county homestead exemption form

- Pauper39s affidavit eighth judicial district eighthdistrict form

- Subpoena duces tecum for deposition jefferson parish clerk of jpclerkofcourt form

Find out other Dr15 Forms

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile