Florida Form F 1065 Instructions 2016

What is the Florida Form F 1065 Instructions

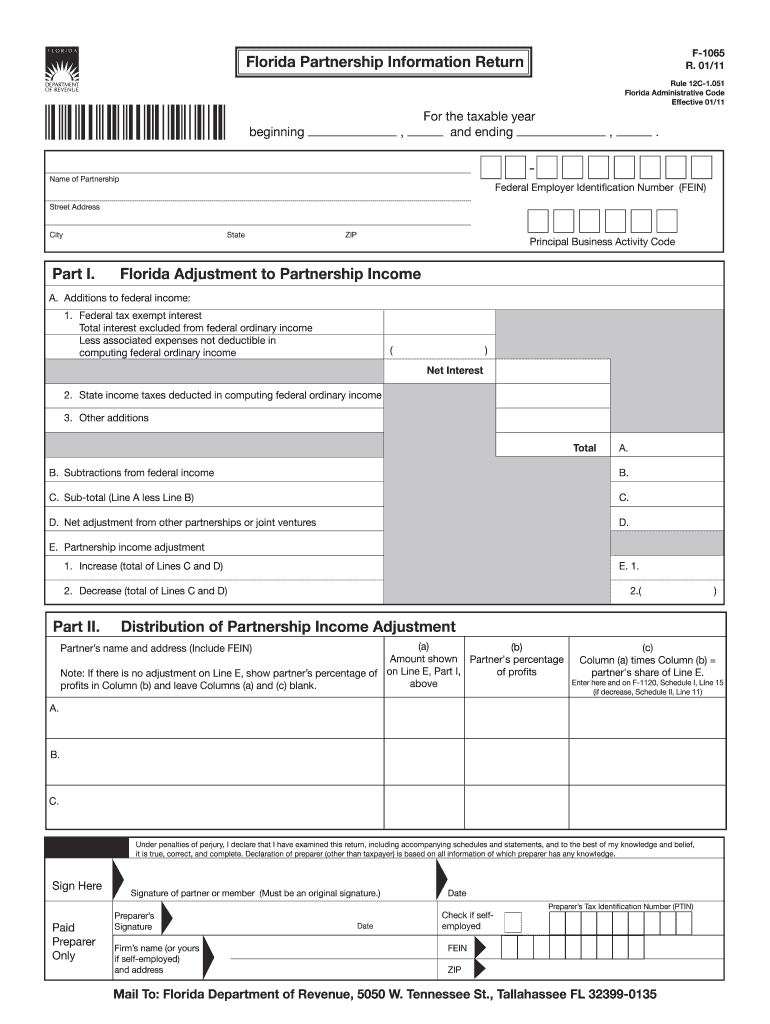

The Florida Form F 1065 Instructions provide detailed guidance for partnerships filing their tax returns in the state of Florida. This form is essential for reporting income, deductions, and credits related to partnership operations. It is specifically designed to ensure compliance with state tax regulations. The instructions outline the necessary steps to accurately complete the form, including information on required schedules and documentation.

Steps to complete the Florida Form F 1065 Instructions

Completing the Florida Form F 1065 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the basic information section, including the partnership's name, address, and federal identification number.

- Report all income earned by the partnership during the tax year.

- Detail all deductible expenses, ensuring that each is categorized correctly.

- Complete any required schedules that pertain to specific income or deductions.

- Review the form for accuracy and completeness before submission.

Legal use of the Florida Form F 1065 Instructions

The Florida Form F 1065 Instructions are legally binding when completed accurately and submitted on time. To ensure compliance, partnerships must adhere to the guidelines set forth in the instructions. This includes understanding the implications of the information reported and the potential penalties for inaccuracies. Proper execution of the form is crucial for maintaining good standing with the Florida Department of Revenue.

Filing Deadlines / Important Dates

Partnerships must be aware of key filing deadlines associated with the Florida Form F 1065. Typically, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships that operate on a calendar year, this means the deadline is April 15. Extensions may be available, but they must be requested in advance to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Florida Form F 1065 can be submitted through various methods. Partnerships have the option to file online, which is often the quickest and most efficient method. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to keep a copy of the submitted form and any confirmation received for your records.

Key elements of the Florida Form F 1065 Instructions

Understanding the key elements of the Florida Form F 1065 Instructions is vital for accurate completion. These elements include:

- Partnership Information: Basic details about the partnership.

- Income Reporting: Sections for detailing various types of income.

- Deductions: Guidelines for claiming allowable expenses.

- Signature Requirements: Information on who must sign the form.

Quick guide on how to complete florida form f 1065 instructions 2011

Prepare Florida Form F 1065 Instructions seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Florida Form F 1065 Instructions on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Florida Form F 1065 Instructions with ease

- Obtain Florida Form F 1065 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or black out sensitive details with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Choose your preferred method of delivering your form, whether by email, text (SMS), a shareable link, or download it to your computer.

Forget the hassles of lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Florida Form F 1065 Instructions while ensuring outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida form f 1065 instructions 2011

Create this form in 5 minutes!

How to create an eSignature for the florida form f 1065 instructions 2011

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What are the Florida Form F 1065 Instructions?

The Florida Form F 1065 Instructions provide guidance for partnerships to report income, deductions, and credits in Florida. This form is crucial for compliance with state tax laws and helps ensure accurate tax reporting. Understanding these instructions is essential for any partnership operating in Florida.

-

How can airSlate SignNow assist with Florida Form F 1065 Instructions?

airSlate SignNow offers an efficient platform for electronically signing and sending the Florida Form F 1065 Instructions documents. With its user-friendly interface, businesses can streamline the eSignature process, ensuring that all required forms are completed and submitted on time. This saves both time and effort while achieving compliance.

-

What features does airSlate SignNow provide for managing Florida Form F 1065 Instructions?

airSlate SignNow includes features such as secure document storage, customizable templates, and real-time tracking for the Florida Form F 1065 Instructions. These tools help businesses manage their forms effectively, ensuring they stay organized and compliant. The platform enhances collaboration among team members while handling sensitive tax documents.

-

Is airSlate SignNow cost-effective for handling Florida Form F 1065 Instructions?

Yes, airSlate SignNow offers a cost-effective solution for managing the Florida Form F 1065 Instructions and other documentation needs. With various pricing plans tailored for businesses of all sizes, users can choose an option that fits their budget while still gaining access to high-quality eSign and document management features.

-

Can I integrate airSlate SignNow with other software for Florida Form F 1065 Instructions?

Absolutely! airSlate SignNow provides integrations with various software solutions, enhancing your workflow for handling the Florida Form F 1065 Instructions. This allows users to connect their existing tools, such as CRM and accounting software, ensuring seamless data transfer and improved efficiency.

-

What benefits does airSlate SignNow offer for businesses preparing Florida Form F 1065 Instructions?

AirSlate SignNow simplifies the preparation of Florida Form F 1065 Instructions by providing automated workflows and document management features. Businesses benefit from quick eSignature capabilities, ensuring timely submission while maintaining compliance. This helps reduce the risk of errors and simplifies the overall process.

-

How can I ensure the security of my Florida Form F 1065 Instructions documents using airSlate SignNow?

airSlate SignNow prioritizes document security for the Florida Form F 1065 Instructions. The platform employs advanced encryption technologies and secure access controls to safeguard your sensitive information. This ensures that your documents are protected throughout the signing and submission process.

Get more for Florida Form F 1065 Instructions

- L33 formular

- Form d proof of claim by a workman or an employee

- Passport withdrawal request letter form

- D37 decree of absolute form

- Flower essence repertory pdf form

- Uniform policy template

- Formulir rawat jalan bni life 101425261

- Sample form transcript redaction request e file the redaction lawd uscourts

Find out other Florida Form F 1065 Instructions

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself