Form it 540B Louisiana Department of Revenue Revenue Louisiana 2019

What is the Form IT 540B Louisiana Department Of Revenue Revenue Louisiana

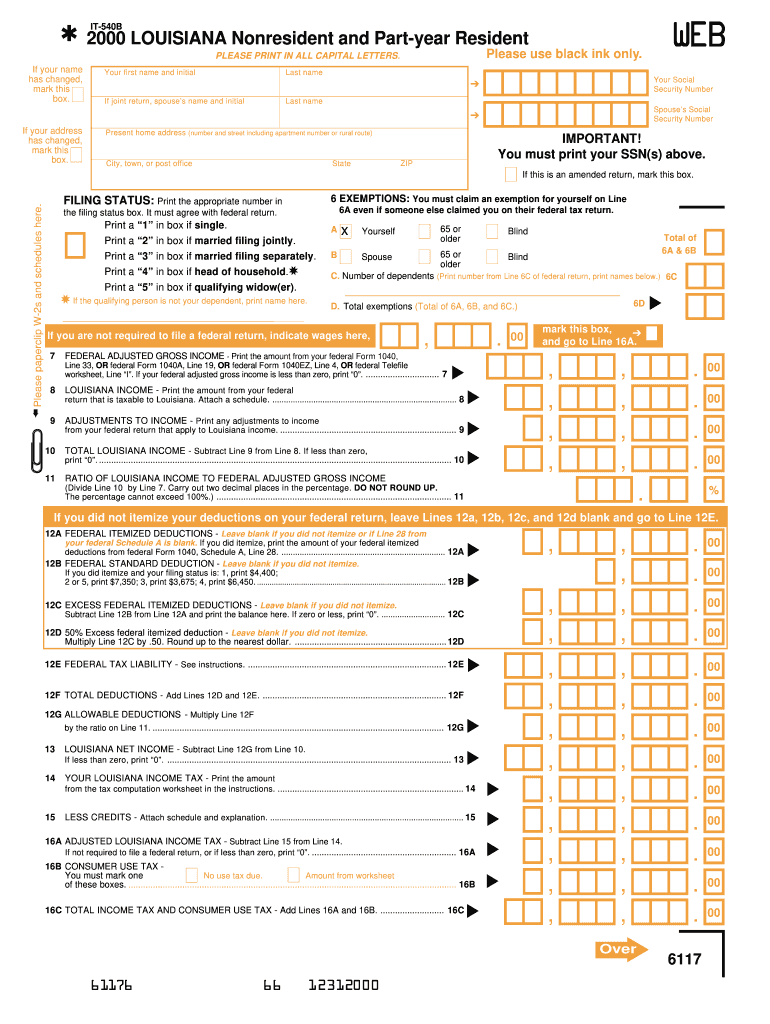

The Form IT 540B is a state tax form used by residents of Louisiana to report their income and calculate their state tax obligations. This form is specifically designed for individuals who are filing their state income tax returns. It includes various sections where taxpayers must provide personal information, income details, deductions, and credits applicable to their situation. Understanding this form is essential for ensuring compliance with Louisiana tax regulations and for accurately determining the amount of tax owed or refund expected.

How to use the Form IT 540B Louisiana Department Of Revenue Revenue Louisiana

Using the Form IT 540B involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary documents, including W-2s, 1099s, and any other income statements. Once the required information is collected, individuals can fill out the form by entering their personal details, reporting their income, and claiming any applicable deductions or credits. After completing the form, it can be submitted electronically or by mail, depending on the taxpayer's preference. It is important to review the form thoroughly before submission to avoid errors that could lead to delays or penalties.

Steps to complete the Form IT 540B Louisiana Department Of Revenue Revenue Louisiana

Completing the Form IT 540B involves a systematic approach to ensure all information is accurately reported. Here are the key steps:

- Gather documentation: Collect all relevant income documents, including W-2s and 1099s.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Include all sources of income in the designated sections.

- Claim deductions: Identify and claim any deductions you qualify for, which can reduce your taxable income.

- Calculate tax: Use the provided tax tables or formulas to determine your tax liability.

- Review the form: Double-check all entries for accuracy and completeness.

- Submit the form: File electronically or mail it to the appropriate Louisiana Department of Revenue address.

Legal use of the Form IT 540B Louisiana Department Of Revenue Revenue Louisiana

The Form IT 540B is legally binding and must be completed in accordance with Louisiana tax laws. To ensure its legal validity, taxpayers must provide accurate and truthful information. The form must be signed and dated by the taxpayer or their authorized representative. Electronic submissions are accepted as long as they comply with the legal frameworks governing eSignatures, such as the ESIGN Act and UETA. It is crucial to retain a copy of the submitted form and any supporting documents for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 540B are critical for compliance with Louisiana tax regulations. Generally, the form must be filed by May fifteenth of the year following the tax year. If May fifteenth falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may be available, which must be requested before the original deadline. Staying informed about these dates helps avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 540B can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Taxpayers can file electronically using the Louisiana Department of Revenue's online portal, which offers a streamlined process.

- Mail: Completed forms can be printed and mailed to the designated address provided by the Louisiana Department of Revenue.

- In-Person: Taxpayers may also choose to submit their forms in person at local tax offices, although this option may be limited based on current regulations.

Quick guide on how to complete form it 540b louisiana department of revenue revenue louisiana

Complete Form IT 540B Louisiana Department Of Revenue Revenue Louisiana seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form IT 540B Louisiana Department Of Revenue Revenue Louisiana on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Form IT 540B Louisiana Department Of Revenue Revenue Louisiana effortlessly

- Locate Form IT 540B Louisiana Department Of Revenue Revenue Louisiana and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors requiring new document copies to be printed. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form IT 540B Louisiana Department Of Revenue Revenue Louisiana and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 540b louisiana department of revenue revenue louisiana

Create this form in 5 minutes!

How to create an eSignature for the form it 540b louisiana department of revenue revenue louisiana

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

Form IT 540B Louisiana Department Of Revenue Revenue Louisiana is a state tax form used by Louisiana residents to file their income taxes. This form allows individuals to report their income and claim deductions or credits. It's essential for accurate tax filing and compliance with Louisiana's tax laws.

-

How can airSlate SignNow help with Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

airSlate SignNow streamlines the process of managing Form IT 540B Louisiana Department Of Revenue Revenue Louisiana by providing an easy-to-use eSigning solution. With our platform, businesses can send, sign, and store this form electronically, simplifying the tax filing process. This enhances efficiency and minimizes paperwork errors.

-

Is there a cost associated with using airSlate SignNow for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs, which include features for handling Form IT 540B Louisiana Department Of Revenue Revenue Louisiana. These plans are competitively priced to ensure cost-effectiveness, providing exceptional value for those seeking an efficient document management solution.

-

What features does airSlate SignNow offer for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

airSlate SignNow provides robust features for managing Form IT 540B Louisiana Department Of Revenue Revenue Louisiana, including customizable templates, electronic signatures, and document storage. Additionally, our platform offers advanced security measures to protect sensitive tax information. This ensures your documents are handled safely and efficiently.

-

Can I integrate airSlate SignNow with other software for processing Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

Absolutely! airSlate SignNow supports various integrations with popular software applications, enhancing your ability to manage Form IT 540B Louisiana Department Of Revenue Revenue Louisiana. These integrations streamline workflows, allowing you to incorporate eSigning into your existing processes seamlessly, which can save time and increase productivity.

-

What benefits does electronic signing offer for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

Using electronic signing for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana provides numerous benefits, including faster turnaround times and improved compliance. Electronic signatures are legally binding and secure, meaning you can submit your tax forms promptly without the hassle of physical documents. This modern approach reduces the risk of lost paperwork and enhances tracking.

-

Is airSlate SignNow compliant with Louisiana laws for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana?

Yes, airSlate SignNow is compliant with all relevant Louisiana laws and regulations concerning electronic signatures for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana. We ensure our platform meets the necessary legal standards, allowing you to confidently use our services for your tax filing needs without worry.

Get more for Form IT 540B Louisiana Department Of Revenue Revenue Louisiana

Find out other Form IT 540B Louisiana Department Of Revenue Revenue Louisiana

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free