Filing StatusLine 5 Louisiana Department of Revenue 2023-2026

Understanding the Filing Status for Form IT-540B

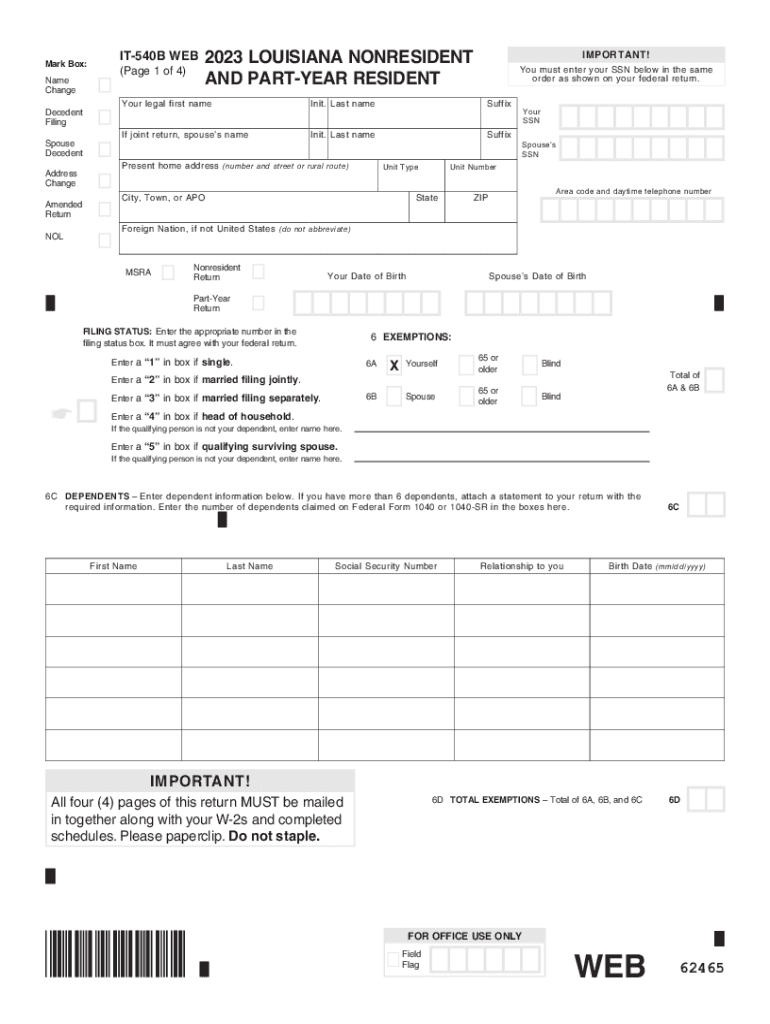

The filing status on the Louisiana IT-540B is crucial for determining how much tax you owe or the refund you may receive. In Louisiana, your filing status can be categorized as single, married filing jointly, married filing separately, or head of household. Each status has different implications for tax rates and deductions. It is important to choose the correct status based on your personal circumstances, as this can significantly affect your tax liability.

Steps to Complete the Filing Status on Form IT-540B

Completing the filing status section on the Louisiana IT-540B involves several key steps:

- Identify your filing status based on your marital situation as of December 31 of the tax year.

- Carefully read the instructions provided on the form to understand the criteria for each status.

- Mark the appropriate box that corresponds to your chosen filing status.

- Ensure that any relevant information, such as spouse details for joint filers, is accurately filled in.

Taking these steps helps ensure that your tax return is processed correctly and efficiently.

Legal Use of Filing Status on Form IT-540B

The filing status you select on the Louisiana IT-540B must align with legal definitions set by the Louisiana Department of Revenue. Misrepresenting your filing status can lead to penalties or audits. It is essential to provide truthful and accurate information, as the state may require documentation to support your filing status, especially in cases of joint filings or claims for head of household.

Eligibility Criteria for Filing Status on Form IT-540B

Eligibility for each filing status on the Louisiana IT-540B is determined by specific criteria:

- Single: You are unmarried or legally separated on the last day of the tax year.

- Married Filing Jointly: You and your spouse agree to file together and are both responsible for the tax due.

- Married Filing Separately: You choose to file separately from your spouse, often for specific tax benefits.

- Head of Household: You must be unmarried and pay more than half the costs of maintaining a home for yourself and a qualifying person.

Understanding these criteria is vital for ensuring compliance with state tax laws.

Required Documents for Filing Status on Form IT-540B

When completing the filing status section on the IT-540B, you may need to gather several documents:

- Proof of marital status, such as a marriage certificate or divorce decree.

- Income statements for both spouses if filing jointly, including W-2s and 1099s.

- Documentation for dependents if claiming head of household status, such as birth certificates or adoption papers.

Having these documents ready can streamline the filing process and help avoid errors.

Filing Deadlines for Form IT-540B

It is important to be aware of the filing deadlines for the Louisiana IT-540B. Typically, the deadline for filing your tax return is May 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Filing on time is essential to avoid penalties and interest on any taxes owed.

Quick guide on how to complete filing statusline 5 louisiana department of revenue

Effortlessly Prepare Filing StatusLine 5 Louisiana Department Of Revenue on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Filing StatusLine 5 Louisiana Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and electronically sign Filing StatusLine 5 Louisiana Department Of Revenue with ease

- Find Filing StatusLine 5 Louisiana Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Filing StatusLine 5 Louisiana Department Of Revenue, ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing statusline 5 louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the filing statusline 5 louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is la it 540b and how does it work with airSlate SignNow?

The la it 540b is a specific form designed for businesses to effectively manage their signatures and document workflows. With airSlate SignNow, users can easily fill out the la it 540b online, send it for signatures, and track its status, all in one streamlined platform.

-

What are the key features of airSlate SignNow for the la it 540b?

AirSlate SignNow offers features like document templates, advanced signature options, and secure storage, making it perfect for handling the la it 540b. Additionally, the platform enables automated workflows and real-time notifications, ensuring all parties stay informed throughout the signing process.

-

How much does airSlate SignNow cost for using the la it 540b?

AirSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently use the la it 540b. Users can choose from monthly or annual subscriptions, allowing companies to find a solution that fits their budget while still enjoying comprehensive eSignature services.

-

Can I integrate airSlate SignNow with other software for the la it 540b?

Yes, airSlate SignNow can seamlessly integrate with various applications to enhance your use of the la it 540b. Whether it’s CRM systems, project management tools, or cloud storage, the integration capabilities allow for a more efficient document management process.

-

What benefits does airSlate SignNow provide for managing the la it 540b?

Using airSlate SignNow to manage the la it 540b offers numerous benefits, including increased efficiency, reduced turnaround time, and improved compliance with legal standards. The user-friendly interface also allows for easy navigation, ensuring that even those unfamiliar with eSignatures can effectively utilize the platform.

-

Is airSlate SignNow secure for handling the la it 540b?

Absolutely! airSlate SignNow prioritizes security, implementing advanced encryption and authentication measures to protect your data when handling the la it 540b. With regular security audits and compliance with industry regulations, you can trust that your documents remain confidential.

-

How can I track the status of my la it 540b documents with airSlate SignNow?

AirSlate SignNow provides real-time tracking for your la it 540b documents, allowing you to see who has signed and who is still pending. Users receive automated alerts when the document has been viewed or signed, ensuring everyone stays updated throughout the process.

Get more for Filing StatusLine 5 Louisiana Department Of Revenue

- All notices required or deemed necessary by the parties shall be written and shall be deemed form

- In consideration of this guaranty lessor has agreed to grant or agreed to continue without form

- The floors skylights and windows that reflect or admit light into any place in the building shall not be covered or obstructed form

- Lease severance and amendment agreement form

- Landlord may sue assignor under the assigned lease agreement for damages including form

- Residential lease agreement home star office form

- Form sd 864lt

- Fillable online district of columbia warning of default on form

Find out other Filing StatusLine 5 Louisiana Department Of Revenue

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later