it 541i 116 Louisiana Department of Revenue 2022

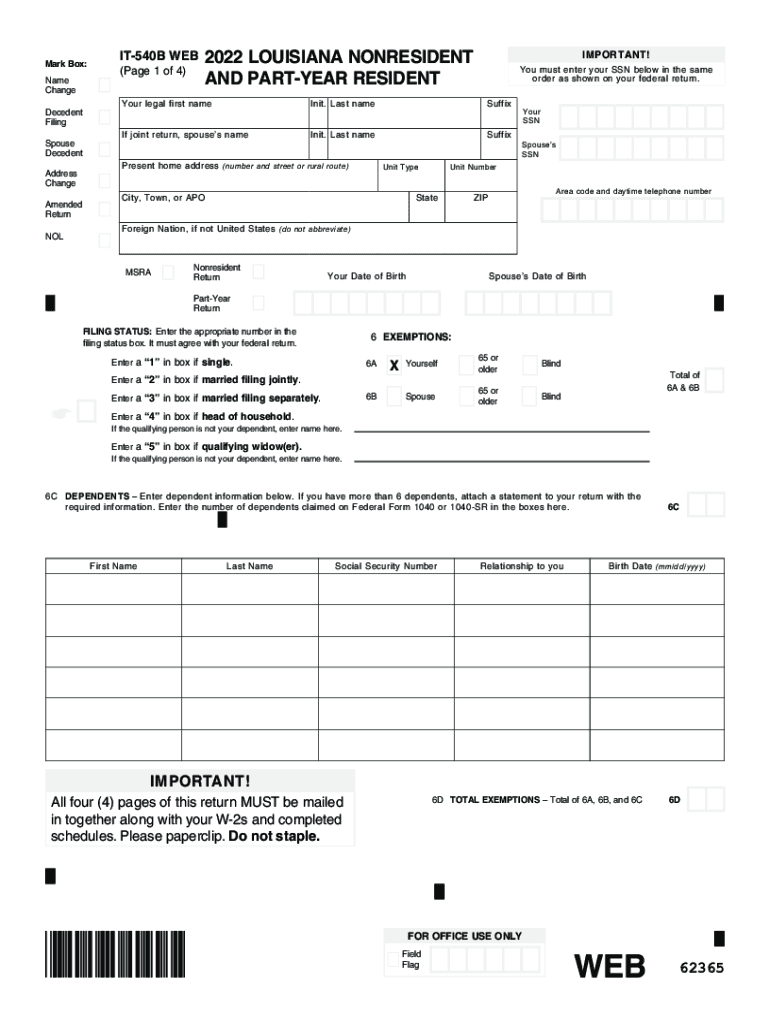

What is the IT-540B Louisiana Department of Revenue?

The IT-540B is a tax form used by nonresidents to report income earned in Louisiana. This form is essential for individuals who do not reside in Louisiana but have income sourced from the state. The IT-540B allows taxpayers to calculate their Louisiana tax liability based on the income earned within the state. Understanding this form is crucial for compliance with Louisiana tax laws and ensuring that nonresidents fulfill their tax obligations accurately.

Steps to complete the IT-540B Louisiana Department of Revenue

Completing the IT-540B involves several key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s or 1099s, that reflect income earned in Louisiana.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Enter the total income earned in Louisiana on the appropriate lines of the form.

- Calculate tax liability: Follow the instructions to compute your tax based on the income reported.

- Sign and date the form: Ensure that you sign the form to validate your submission.

Legal use of the IT-540B Louisiana Department of Revenue

The IT-540B is legally recognized as a valid tax document when completed accurately and submitted on time. It is essential to ensure that all information provided is truthful and complete to avoid penalties. The form must be filed with the Louisiana Department of Revenue by the designated deadline to maintain compliance with state tax laws. Failure to file or inaccuracies can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

The deadline for filing the IT-540B is typically the same as the federal tax deadline, which is usually April 15. However, it is important to check for any specific extensions or changes that may apply to Louisiana tax filings. Filing on time is crucial to avoid late fees and interest charges on any owed taxes.

Required Documents

To complete the IT-540B, you will need the following documents:

- W-2 forms from employers for income earned in Louisiana.

- 1099 forms for any other income sources.

- Records of any deductions or credits you plan to claim.

- Identification documents, such as your Social Security number.

Form Submission Methods (Online / Mail / In-Person)

The IT-540B can be submitted through various methods:

- Online: Use the Louisiana Department of Revenue's online portal to file electronically.

- Mail: Print the completed form and send it to the appropriate address listed on the form.

- In-Person: Visit a local Louisiana Department of Revenue office to submit the form directly.

Quick guide on how to complete it 541i 116 louisiana department of revenue

Accomplish IT 541i 116 Louisiana Department Of Revenue effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to generate, modify, and electronically sign your documents swiftly without delays. Manage IT 541i 116 Louisiana Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to alter and electronically sign IT 541i 116 Louisiana Department Of Revenue effortlessly

- Obtain IT 541i 116 Louisiana Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device. Edit and electronically sign IT 541i 116 Louisiana Department Of Revenue and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 541i 116 louisiana department of revenue

Create this form in 5 minutes!

How to create an eSignature for the it 541i 116 louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow for louisiana nonresident residents?

airSlate SignNow is an efficient electronic signature solution designed to help louisiana nonresident residents send and eSign important documents easily. It streamlines the signing process, ensuring that you can manage your paperwork without hassle. Our platform is user-friendly, making it simple for anyone to get started and manage their document needs.

-

How does pricing work for louisiana nonresident residents using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to the needs of louisiana nonresident residents. Whether you are an individual or a business, you can choose a plan that fits your budget and requirements. We also provide a free trial for new users to explore our features without any commitment.

-

What are the key features of airSlate SignNow for louisiana nonresident residents?

The key features of airSlate SignNow for louisiana nonresident residents include document templates, in-person signing, and automated workflows. These features ensure that you can easily customize and send documents securely. Additionally, our platform supports multiple file formats, making it versatile for any document type you need to eSign.

-

How does airSlate SignNow benefit louisiana nonresident residents?

For louisiana nonresident residents, airSlate SignNow provides a cost-effective solution to manage document signing efficiently. You can save time with our automated processes, which reduce the need for printing and scanning. The ease of use ensures that even those unfamiliar with technology can navigate our platform effortlessly.

-

Is airSlate SignNow secure for louisiana nonresident residents?

Absolutely! airSlate SignNow prioritizes security for all users, including louisiana nonresident residents. We employ industry-standard encryption and comply with regulations to ensure that your documents remain confidential and protected throughout the signing process.

-

Can airSlate SignNow integrate with other tools used by louisiana nonresident residents?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to support the needs of louisiana nonresident residents. Whether you use CRM systems, cloud storage solutions, or project management tools, our integrations allow for a smooth workflow. This enhances productivity and ensures that your documents are easily accessible.

-

What types of documents can louisiana nonresident residents sign with airSlate SignNow?

louisiana nonresident residents can sign a wide variety of documents using airSlate SignNow, including contracts, agreements, and forms. Our platform supports multiple file types, making it easy to handle both simple and complex documentation. This flexibility ensures you can manage all your essential paperwork quickly and efficiently.

Get more for IT 541i 116 Louisiana Department Of Revenue

- Plumbing contractor package texas form

- Brick mason contractor package texas form

- Roofing contractor package texas form

- Electrical contractor package texas form

- Sheetrock drywall contractor package texas form

- Flooring contractor package texas form

- Trim carpentry contractor package texas form

- Fencing contractor package texas form

Find out other IT 541i 116 Louisiana Department Of Revenue

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template