Mass Income Tax Forms 2020

What is the Mass Income Tax Forms

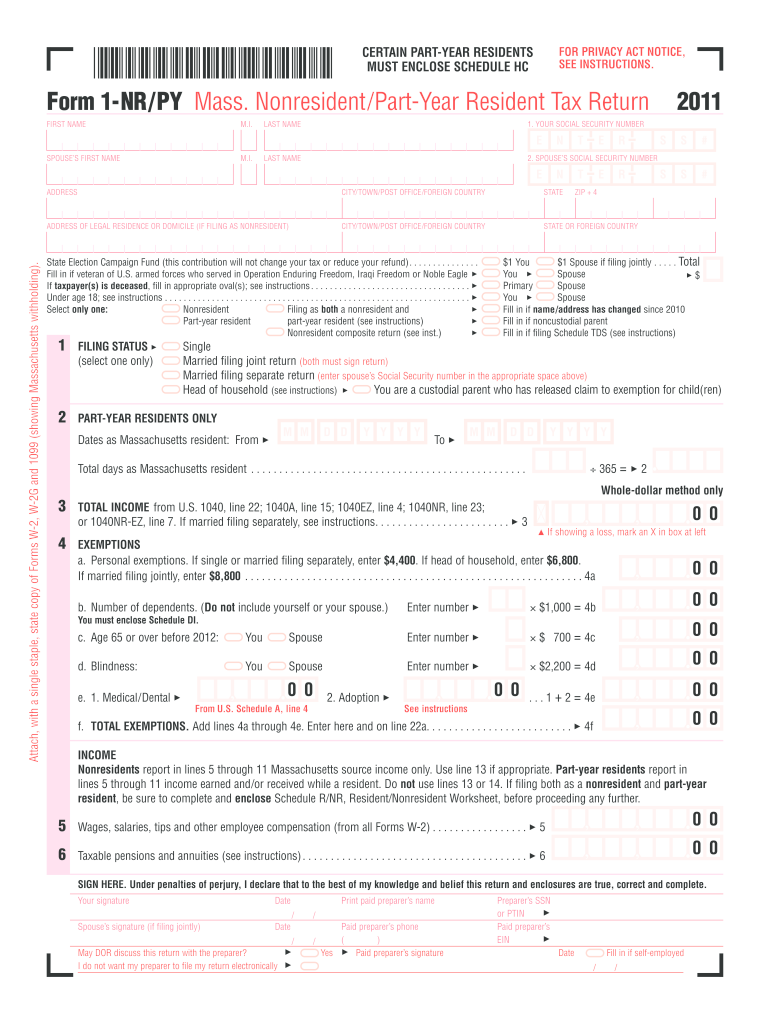

The Mass Income Tax Forms refer to the official documents used by residents of Massachusetts to report their income and calculate their state tax liabilities. These forms are essential for individuals and businesses alike, ensuring compliance with state tax regulations. Typically, the forms include various schedules and worksheets that help taxpayers accurately report their income, deductions, and credits. Understanding these forms is crucial for fulfilling tax obligations and avoiding penalties.

How to use the Mass Income Tax Forms

Using the Mass Income Tax Forms involves several key steps. First, taxpayers should gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals must select the appropriate form based on their filing status and income level. After completing the forms, taxpayers should review their entries for accuracy before submitting them. Utilizing software or online services can streamline this process and ensure compliance with state guidelines.

Steps to complete the Mass Income Tax Forms

Completing the Mass Income Tax Forms can be broken down into a series of manageable steps:

- Collect all relevant income documentation, such as W-2s and 1099s.

- Select the correct form based on your filing status (e.g., Form 1 for residents).

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any eligible deductions and credits to reduce taxable income.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, either electronically or by mail.

Legal use of the Mass Income Tax Forms

The legal use of the Mass Income Tax Forms is governed by state tax laws. These forms must be filled out accurately and submitted on time to avoid penalties. E-signatures are legally recognized in Massachusetts, allowing taxpayers to sign their forms electronically. It is important to ensure that all information provided is truthful and complete, as any discrepancies can lead to audits or legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Mass Income Tax Forms are crucial for compliance. Typically, the deadline for individual taxpayers is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of extensions, which may allow additional time to file, but not to pay any taxes owed. Keeping track of these dates helps avoid late fees and interest charges.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their Mass Income Tax Forms. They can file online through the Massachusetts Department of Revenue's website, which is often the fastest method. Alternatively, forms can be mailed to the appropriate state tax office. In-person submissions may also be possible at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits individual needs.

Quick guide on how to complete mass income tax forms 2011

Effortlessly Prepare Mass Income Tax Forms on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable option to traditional printed and signed documents since you can obtain the proper form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Mass Income Tax Forms on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and Electronically Sign Mass Income Tax Forms Effortlessly

- Find Mass Income Tax Forms and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Mass Income Tax Forms and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mass income tax forms 2011

Create this form in 5 minutes!

How to create an eSignature for the mass income tax forms 2011

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What are Mass Income Tax Forms?

Mass Income Tax Forms are official documents required by the state of Massachusetts for reporting individual income taxes. These forms ensure compliance with state tax laws and help residents calculate their tax obligations accurately. Using airSlate SignNow, you can easily prepare and send these forms securely to ensure timely submission.

-

How can airSlate SignNow help with Mass Income Tax Forms?

airSlate SignNow streamlines the process of preparing and eSigning Mass Income Tax Forms. Our platform simplifies document management, allowing you to fill out, sign, and send your forms digitally. This not only saves time but also enhances the overall experience of managing your tax documents.

-

What features does airSlate SignNow offer for handling Mass Income Tax Forms?

Our platform provides features such as customizable templates for Mass Income Tax Forms, automated workflows, and secure storage. You can ensure that all documents are accessible and can be shared with relevant parties easily. Moreover, our robust eSignature capabilities make signing these forms quick and legally binding.

-

Is airSlate SignNow a cost-effective solution for Mass Income Tax Forms?

Yes, airSlate SignNow offers a cost-effective solution for handling Mass Income Tax Forms. With a variety of pricing plans tailored to fit different business needs, you can choose a plan that best suits your requirements without sacrificing functionality. The efficiency gained through our platform can lead to overall savings on tax preparation.

-

Can airSlate SignNow integrate with other tools for managing Mass Income Tax Forms?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications that can enhance the management of Mass Income Tax Forms. Whether you need to connect with accounting software or a CRM, our platform supports multiple integrations to streamline your workflow.

-

Is it safe to use airSlate SignNow for Mass Income Tax Forms?

Yes, airSlate SignNow prioritizes security, ensuring that your Mass Income Tax Forms and personal information are protected. We utilize advanced encryption and comply with industry standards to keep your documents safe from unauthorized access. Trust our platform for secure transactions and data handling.

-

How can I get started with airSlate SignNow for Mass Income Tax Forms?

Getting started with airSlate SignNow for Mass Income Tax Forms is easy! Simply visit our website to explore pricing plans and sign up for a free trial. You'll have access to all the features necessary to prepare, send, and eSign your documents efficiently.

Get more for Mass Income Tax Forms

- Underline the proper nouns and circle the common nouns with answers form

- Chesapeake public schools physical form

- A20 form

- 1055 scw form

- Film production registration form

- Indusind bank passbook pdf download form

- 01115 rev 91624 texas sales and use tax return form

- Embassy of the arab republic of egypt visa applica form

Find out other Mass Income Tax Forms

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now