Form 1 Nr Py 2018

What is the Form 1 Nr Py?

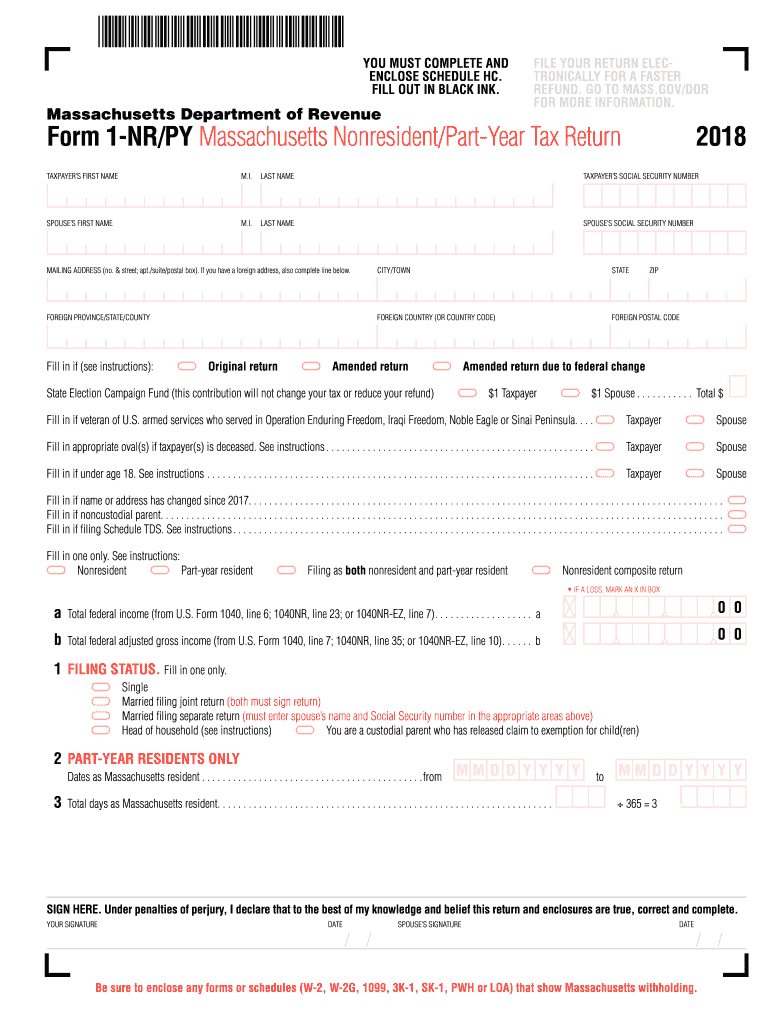

The Form 1 Nr Py is a Massachusetts state tax form designed for non-residents who need to report their income earned within the state. This form is specifically tailored for individuals who do not reside in Massachusetts but have income sourced from the state, such as wages, rental income, or business earnings. Completing this form accurately is essential for compliance with state tax laws and to ensure that non-residents pay the appropriate taxes on their Massachusetts income.

Steps to complete the Form 1 Nr Py

Completing the Form 1 Nr Py involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other relevant income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your Massachusetts-source income, ensuring you include all applicable deductions and credits. After completing the form, review it carefully for any errors before signing and dating it. Finally, submit the form either electronically or by mail, depending on your preference and the guidelines provided by the Massachusetts Department of Revenue.

Legal use of the Form 1 Nr Py

The Form 1 Nr Py is legally recognized for tax reporting purposes in Massachusetts. It is crucial for non-residents to use this form to report their income accurately to avoid potential penalties. The form complies with state tax regulations and allows taxpayers to fulfill their legal obligations regarding income earned in Massachusetts. Additionally, the use of eSignatures on this form is permitted, which enhances the efficiency and security of the filing process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 1 Nr Py is essential for non-residents to avoid late fees and penalties. Typically, the deadline for filing this form aligns with the federal tax deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable for taxpayers to keep track of any updates from the Massachusetts Department of Revenue regarding specific deadlines or changes in tax law that may affect their filing.

Form Submission Methods (Online / Mail / In-Person)

Non-residents have multiple options for submitting the Form 1 Nr Py. The form can be filed electronically through the Massachusetts Department of Revenue’s online portal, which offers a convenient and efficient way to submit tax returns. Alternatively, taxpayers can choose to print the completed form and send it via mail to the appropriate address provided by the state. In-person submissions are also accepted at designated tax offices, although this method may require an appointment. Each submission method has its own advantages, and taxpayers should choose the one that best fits their needs.

Required Documents

When completing the Form 1 Nr Py, certain documents are necessary to ensure accurate reporting of income and deductions. Key documents include W-2 forms from employers, 1099 forms for freelance or contract work, and any other income statements relevant to Massachusetts-source income. Additionally, taxpayers should have documentation for any deductions they plan to claim, such as receipts for business expenses or proof of property taxes paid. Organizing these documents beforehand can streamline the filing process and help prevent errors.

Quick guide on how to complete 1 nr py 2018 2019 form

Your assistance manual on how to prepare your Form 1 Nr Py

If you’re wondering how to generate and submit your Form 1 Nr Py, here are a few brief guidelines on how to streamline tax processing.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to alter, generate, and complete your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures, and return to modify answers as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Form 1 Nr Py in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Form 1 Nr Py in our editor.

- Fill in the mandatory fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delay refunds. It is advisable to check the IRS website for filing guidelines specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 1 nr py 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the 1 nr py 2018 2019 form

How to create an electronic signature for the 1 Nr Py 2018 2019 Form online

How to create an electronic signature for your 1 Nr Py 2018 2019 Form in Chrome

How to generate an electronic signature for putting it on the 1 Nr Py 2018 2019 Form in Gmail

How to make an electronic signature for the 1 Nr Py 2018 2019 Form straight from your smartphone

How to generate an electronic signature for the 1 Nr Py 2018 2019 Form on iOS

How to make an eSignature for the 1 Nr Py 2018 2019 Form on Android devices

People also ask

-

What is Form 1 Nr Py and how does it work with airSlate SignNow?

Form 1 Nr Py is a customizable document template that can be used for various purposes, including contracts and agreements. With airSlate SignNow, users can easily create, edit, and eSign Form 1 Nr Py, streamlining the document workflow and ensuring compliance.

-

How much does it cost to use airSlate SignNow for Form 1 Nr Py?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, starting from a basic plan to advanced features. The cost of using airSlate SignNow for Form 1 Nr Py is competitive, providing excellent value for those who require eSignature capabilities and document management.

-

What features does airSlate SignNow offer for managing Form 1 Nr Py?

airSlate SignNow provides a range of features for managing Form 1 Nr Py, including document templates, real-time collaboration, and secure eSignature options. These features ensure that users can efficiently handle their paperwork while maintaining compliance and security.

-

Can I integrate Form 1 Nr Py with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integration with various applications like CRM systems, Google Drive, and more. This means you can easily connect Form 1 Nr Py with your existing workflows, enhancing productivity and document management.

-

How does airSlate SignNow ensure the security of Form 1 Nr Py documents?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance standards, ensuring that all Form 1 Nr Py documents are protected. Users can trust that their sensitive information remains confidential and secure throughout the signing process.

-

Is it easy to set up and use Form 1 Nr Py with airSlate SignNow?

Absolutely! airSlate SignNow is designed for ease of use, allowing users to set up and use Form 1 Nr Py with minimal effort. The intuitive interface guides users through the process of creating and sending documents for eSignature.

-

What are the benefits of using airSlate SignNow for Form 1 Nr Py over traditional signing methods?

Using airSlate SignNow for Form 1 Nr Py offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced tracking capabilities. This digital approach streamlines your document process, saving time and resources compared to traditional signing methods.

Get more for Form 1 Nr Py

- Shpo cover page utah department of heritage and arts form

- 12928 cover sheet for family court cases form

- Uca re wogm universal credit application real estate form

- Medical surveillance for inactive tuberculosis tb region of peel peelregion form

- Public complaint form for the ohrc

- Ged test application form

- Fillable online saskatchewan income support fax email print form

- Fin 492 form

Find out other Form 1 Nr Py

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast