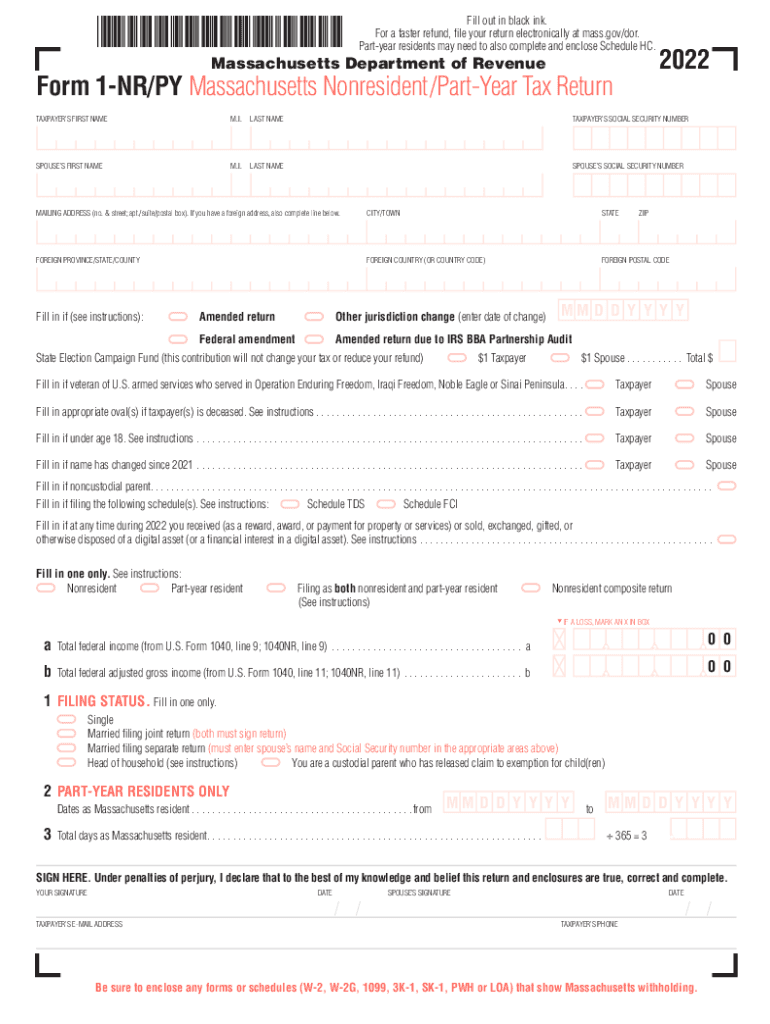

DOR Health Care Forms Mass Gov 2022

What is the W-9 Form?

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States. It is primarily utilized by businesses to collect information from independent contractors, freelancers, and other non-employees. The form provides the necessary taxpayer identification number (TIN) to the requester, which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN). This information is essential for tax reporting purposes, as it allows the payer to accurately report payments made to the individual or entity to the IRS.

Steps to Complete the W-9 Form

Completing the W-9 form involves several straightforward steps:

- Download the form: Obtain the W-9 form from the IRS website or a reliable source.

- Fill in your name: Enter your full name as it appears on your tax return.

- Provide your business name: If applicable, include the name of your business or disregarded entity.

- Check the appropriate box: Indicate your federal tax classification, such as individual, corporation, or partnership.

- Enter your TIN: Provide your SSN or EIN in the designated section.

- Certify your information: Sign and date the form to certify that the information provided is accurate.

IRS Guidelines for the W-9 Form

The IRS has established specific guidelines for the use and submission of the W-9 form. It is important to ensure that the information provided is accurate and up-to-date. The form should be submitted to the requester, not the IRS, and it must be completed before any payments are made. Additionally, if there are any changes to your information, such as a name change or change in business structure, a new W-9 form should be submitted to the requester promptly.

Who Issues the W-9 Form?

The W-9 form is not issued by any specific entity; instead, it is a standardized form provided by the IRS. Any business or individual who requires your taxpayer identification information can request that you complete a W-9 form. This includes employers, financial institutions, and any organization that needs to report payments made to you for services rendered.

Penalties for Non-Compliance

Failure to provide a completed W-9 form when requested can lead to significant penalties. If you do not submit the form, the payer may be required to withhold taxes from your payments at a higher rate, typically at the backup withholding rate of twenty-four percent. Additionally, providing false information on the W-9 can result in penalties imposed by the IRS, including fines and interest on unpaid taxes.

Digital vs. Paper Version of the W-9 Form

The W-9 form can be completed in both digital and paper formats. Many businesses prefer the digital version for its convenience and ease of submission. Electronic signatures are accepted, making it simple to send the completed form via email or through secure document management systems. However, some requesters may still prefer a physical copy, so it is essential to clarify their preference before submitting the form.

Quick guide on how to complete dor health care forms massgov

Complete DOR Health Care Forms Mass gov effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage DOR Health Care Forms Mass gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign DOR Health Care Forms Mass gov with ease

- Find DOR Health Care Forms Mass gov and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign DOR Health Care Forms Mass gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor health care forms massgov

Create this form in 5 minutes!

How to create an eSignature for the dor health care forms massgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W-9 form and why do I need it?

A W-9 form is an IRS document used by individuals and businesses to provide their taxpayer identification number to other parties. If you're wondering what W-9 form is needed for, it's often requested by clients who need to report payments made to you, ensuring compliance with tax regulations.

-

How can airSlate SignNow help me with W-9 forms?

AirSlate SignNow simplifies the process of managing W-9 forms by allowing you to create, send, and eSign them electronically. By understanding what W-9 form you need, you can quickly gather the necessary information and ensure your documents are securely signed and stored.

-

Is there a cost associated with eSigning a W-9 form using airSlate SignNow?

Yes, airSlate SignNow offers a variety of pricing plans, including options that cater to individuals and businesses. Understanding what W-9 form you need to sign can help you select the right plan that suits your document management needs and budget.

-

Can I integrate airSlate SignNow with other applications for W-9 forms?

Absolutely! AirSlate SignNow provides powerful integrations with various applications, allowing you to streamline your workflow. Knowing what W-9 form you need can enhance this process, making it easier to send and manage your documents directly from your preferred tool.

-

What features does airSlate SignNow offer for managing W-9 forms?

AirSlate SignNow offers features like templates, in-person signing, and audit trails specifically designed for managing W-9 forms effectively. Being aware of what W-9 form is required signNowly improves your document handling and ensures that signatures are collected efficiently.

-

How secure is airSlate SignNow for handling W-9 forms?

Security is a top priority for airSlate SignNow. When using our platform for managing your W-9 forms, you can rest assured that all documents are stored securely, protecting your personal and sensitive information, which is essential when dealing with tax-related documents.

-

Can airSlate SignNow help with sending W-9 forms to multiple clients?

Yes, airSlate SignNow is designed for efficiency, enabling you to send W-9 forms to multiple clients simultaneously. This feature eliminates the hassle of manually sending each document, allowing you to focus on understanding what W-9 form is required for each specific transaction.

Get more for DOR Health Care Forms Mass gov

Find out other DOR Health Care Forms Mass gov

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe