Form 1 NRPY Massachusetts NonresidentPart Year Tax 2023-2026

What is the Form 1 NRPY Massachusetts Nonresident Part Year Tax

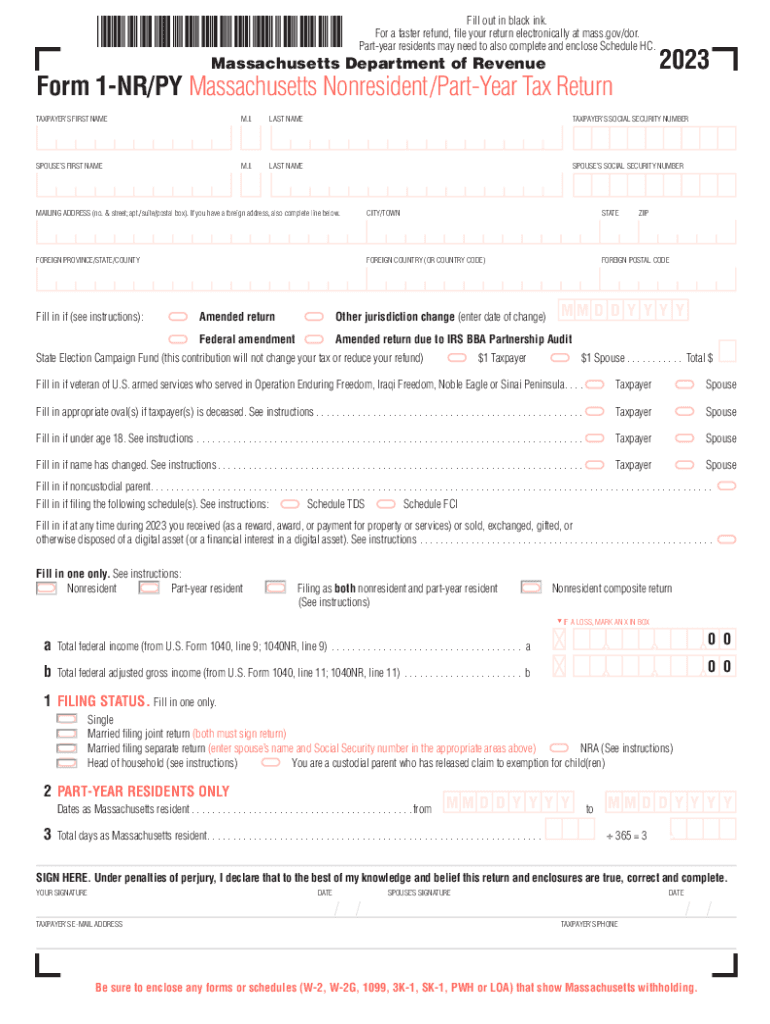

The Form 1 NRPY is a tax document used by nonresidents and part-year residents of Massachusetts to report their income and calculate their state tax obligations. This form is specifically designed for individuals who lived in Massachusetts for part of the tax year or who earned income from Massachusetts sources while residing in another state. It allows taxpayers to accurately report their income, claim deductions, and calculate any tax owed to the state.

Steps to complete the Form 1 NRPY Massachusetts Nonresident Part Year Tax

Completing the Form 1 NRPY involves several steps to ensure accurate reporting of income and deductions. Here are the key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s, 1099s, and any other documentation that reflects your earnings during the tax year.

- Determine residency status: Clearly define the periods you were a resident and nonresident of Massachusetts during the tax year.

- Fill out the form: Begin with your personal information, then report your income earned while a resident and nonresident. Follow the instructions carefully for each section.

- Claim deductions: Identify any deductions you are eligible for, such as those for student loans or other qualifying expenses, and include them in the appropriate sections.

- Calculate tax owed: Use the provided tax tables or formulas to determine your tax liability based on your reported income.

- Review and submit: Double-check all entries for accuracy before submitting the form by mail or electronically, depending on your preference.

Key elements of the Form 1 NRPY Massachusetts Nonresident Part Year Tax

The Form 1 NRPY includes several important sections that taxpayers must complete. Key elements of the form include:

- Personal Information: This section requires your name, address, Social Security number, and filing status.

- Income Reporting: You must report all income earned during the year, distinguishing between Massachusetts-sourced income and income from other states.

- Deductions and Credits: Taxpayers can claim various deductions and credits that apply to their situation, which can help reduce overall tax liability.

- Tax Calculation: This section guides you through calculating your total tax owed based on the income and deductions reported.

- Signature and Date: Finally, the form must be signed and dated to validate the information provided.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form 1 NRPY to avoid penalties. Typically, the form is due on April fifteenth of the year following the tax year. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their taxes accurately.

Eligibility Criteria

To qualify for filing the Form 1 NRPY, taxpayers must meet specific eligibility criteria. These include:

- Being a nonresident or part-year resident of Massachusetts during the tax year.

- Having earned income from Massachusetts sources or having been a resident for part of the year.

- Meeting income thresholds that may determine filing requirements based on residency status.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1 NRPY. The form can be filed electronically through approved e-filing software, which often provides guidance and checks for errors. Alternatively, taxpayers may choose to print the completed form and mail it to the Massachusetts Department of Revenue. In-person submissions are generally not available, as electronic and mail submissions are the preferred methods for filing.

Quick guide on how to complete form 1 nrpy massachusetts nonresidentpart year tax

Effortlessly Prepare Form 1 NRPY Massachusetts NonresidentPart Year Tax on Any Device

Digital document management has gained considerable traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Form 1 NRPY Massachusetts NonresidentPart Year Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Form 1 NRPY Massachusetts NonresidentPart Year Tax with Ease

- Locate Form 1 NRPY Massachusetts NonresidentPart Year Tax and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight crucial sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, through email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 1 NRPY Massachusetts NonresidentPart Year Tax to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 nrpy massachusetts nonresidentpart year tax

Create this form in 5 minutes!

How to create an eSignature for the form 1 nrpy massachusetts nonresidentpart year tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ma form 1 nr py instructions 2018 and why is it important?

The ma form 1 nr py instructions 2018 is essential for properly filing your tax forms and ensuring compliance with state regulations. Understanding these instructions can help you avoid common pitfalls and potential penalties. By mastering the ma form 1 nr py instructions 2018, you can facilitate a smoother tax filing process.

-

How does airSlate SignNow assist with completing the ma form 1 nr py instructions 2018?

airSlate SignNow provides a user-friendly platform that allows you to upload, fill, and eSign the ma form 1 nr py instructions 2018 easily. Our solution streamlines the document management process, making it simpler to stay organized and compliant. This helps businesses save time and reduce errors while preparing important tax documents.

-

What features does airSlate SignNow offer for handling tax-related documents like ma form 1 nr py instructions 2018?

airSlate SignNow offers features such as customizable templates, in-app document editing, and secure eSigning capabilities. These tools are particularly beneficial for efficiently creating and managing documents associated with the ma form 1 nr py instructions 2018. Our platform ensures all your sensitive information is stored securely and accessed easily.

-

Is there a cost associated with using airSlate SignNow for ma form 1 nr py instructions 2018?

Yes, there is a cost associated with utilizing airSlate SignNow, but it is a cost-effective solution that provides signNow value. We offer various pricing plans tailored to meet different business needs regarding the management of documents like the ma form 1 nr py instructions 2018. Evaluating our plans ensures you choose the best option for your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for managing ma form 1 nr py instructions 2018?

Absolutely! airSlate SignNow integrates seamlessly with popular applications, enabling you to streamline your workflow for the ma form 1 nr py instructions 2018. Whether you're using project management tools or customer relationship management (CRM) software, our integrations enhance your document handling efficiency.

-

What are the benefits of using airSlate SignNow for tax document preparation, like ma form 1 nr py instructions 2018?

Using airSlate SignNow for tax document preparation offers substantial benefits, including improved efficiency, enhanced collaboration, and increased security. By leveraging our platform, you can ensure that the preparation of your ma form 1 nr py instructions 2018 is not only accurate but completed in a fraction of the time compared to traditional methods. Our focus on user experience helps reduce stress during tax season.

-

How secure is airSlate SignNow when handling sensitive documents such as ma form 1 nr py instructions 2018?

airSlate SignNow prioritizes your security and employs industry-leading protocols to safeguard your sensitive information. When dealing with documents related to the ma form 1 nr py instructions 2018, you can trust that our encrypted platform protects your data from unauthorized access. Our commitment to security ensures peace of mind for businesses dealing with critical documents.

Get more for Form 1 NRPY Massachusetts NonresidentPart Year Tax

- Housing court supplement to indigency affidavit form

- The commonwealth of massachusetts housing court department form

- Form 15 temporary restraining order masslegalhelp

- The undersigned hereby states under the penalties of form

- Fillable online request for interpreter form fax email print

- Housing court statement of material facts form

- The parties in the above captioned action hereby stipulate and agree form

- To the above named third party defendant form

Find out other Form 1 NRPY Massachusetts NonresidentPart Year Tax

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document