2% Income, Including Interest from Mass 2020

What is the 2% Income, Including Interest From Mass

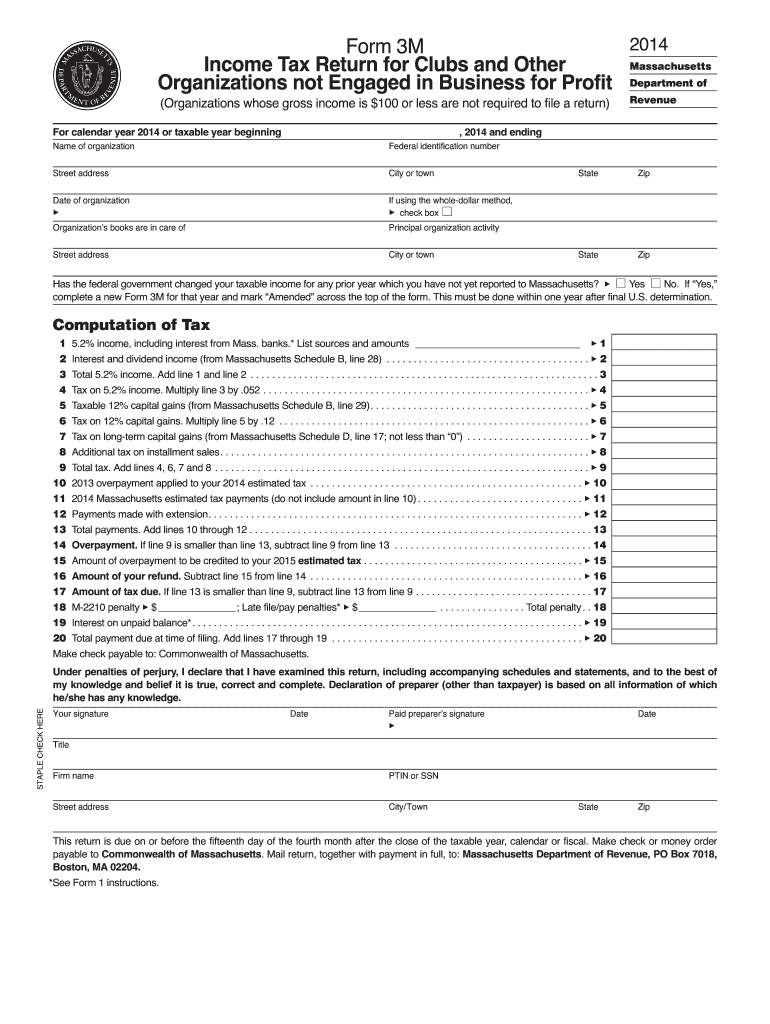

The 2% Income, Including Interest From Mass, is a specific financial form used to report income that is subject to taxation. It typically includes various sources of income, such as interest earned from investments or savings accounts. Understanding this form is crucial for individuals and businesses to ensure accurate tax reporting and compliance with IRS regulations. This form helps in calculating the total income that may be taxable, allowing taxpayers to fulfill their obligations while also identifying potential deductions or credits.

How to use the 2% Income, Including Interest From Mass

Using the 2% Income, Including Interest From Mass involves several steps to ensure accurate completion. First, gather all necessary financial documents, including bank statements and investment records. Next, fill out the form with precise details regarding your income sources. It is essential to report all relevant income accurately to avoid penalties. Once completed, review the form for any errors before submission. Utilizing digital tools can streamline this process, making it easier to fill out and sign the document securely.

Steps to complete the 2% Income, Including Interest From Mass

Completing the 2% Income, Including Interest From Mass requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including interest statements and income records.

- Enter your personal information accurately at the top of the form.

- List all sources of income, ensuring that each entry reflects the correct amounts.

- Double-check your calculations to confirm accuracy.

- Sign and date the form, ensuring compliance with eSignature regulations if submitting electronically.

Legal use of the 2% Income, Including Interest From Mass

The legal use of the 2% Income, Including Interest From Mass is essential for maintaining compliance with tax laws. This form serves as an official document that must be filed with the IRS to report income accurately. Failure to use this form correctly can lead to legal repercussions, including fines or audits. It is important to understand the legal implications of the information reported on this form and to ensure that all entries are truthful and substantiated by documentation.

IRS Guidelines

The IRS provides specific guidelines for the 2% Income, Including Interest From Mass, detailing how to fill out the form and what information is required. These guidelines help taxpayers understand their obligations and the importance of accurate reporting. It is crucial to follow these guidelines closely to avoid errors that could lead to penalties. Taxpayers should regularly check the IRS website or consult a tax professional for the most current information regarding this form.

Eligibility Criteria

Eligibility for using the 2% Income, Including Interest From Mass typically depends on the sources of income being reported. Individuals and businesses that earn interest income or other specified types of income are generally required to use this form. Understanding the eligibility criteria ensures that taxpayers are compliant with IRS regulations and helps them avoid unnecessary complications during the filing process. It is advisable to review the specific requirements outlined by the IRS to confirm eligibility.

Quick guide on how to complete 2 income including interest from mass

Complete 2% Income, Including Interest From Mass effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary format and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle 2% Income, Including Interest From Mass on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to modify and electronically sign 2% Income, Including Interest From Mass with ease

- Obtain 2% Income, Including Interest From Mass and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal authority as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign 2% Income, Including Interest From Mass and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2 income including interest from mass

Create this form in 5 minutes!

How to create an eSignature for the 2 income including interest from mass

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2% Income, Including Interest From Mass?

The 2% Income, Including Interest From Mass, refers to the earnings generated from transactions processed through airSlate SignNow. This can be particularly beneficial for businesses looking to optimize their financial operations while utilizing our document management solutions.

-

How does airSlate SignNow help increase earnings through 2% Income, Including Interest From Mass?

By streamlining the eSigning and document management process, airSlate SignNow enhances operational efficiency. This improved workflow can potentially lead to higher transactional volumes, thus contributing to the 2% Income, Including Interest From Mass.

-

What features does airSlate SignNow offer to support 2% Income, Including Interest From Mass?

airSlate SignNow offers a variety of features, such as customizable templates, automated workflows, and real-time tracking. These tools help ensure that your transactions are not only efficient but also contribute positively toward the 2% Income, Including Interest From Mass.

-

Is airSlate SignNow cost-effective for maximizing 2% Income, Including Interest From Mass?

Yes, airSlate SignNow is designed to be a cost-effective solution. The pricing plans cater to various business needs, allowing you to maximize your 2% Income, Including Interest From Mass without incurring unnecessary expenses.

-

What integrations does airSlate SignNow provide to help with 2% Income, Including Interest From Mass?

airSlate SignNow integrates seamlessly with various popular business tools, including CRM and ERP systems. This connectivity allows for a more streamlined process that can enhance your 2% Income, Including Interest From Mass by improving data flow and transaction accuracy.

-

Can I track my 2% Income, Including Interest From Mass with airSlate SignNow?

Absolutely! airSlate SignNow provides robust reporting features that enable you to track your transactions and monitor your 2% Income, Including Interest From Mass. This insight helps you make informed business decisions and optimize your strategies.

-

What are the benefits of using airSlate SignNow for 2% Income, Including Interest From Mass?

Using airSlate SignNow can lead to simplified processes, reduced turnaround times, and ultimately greater profitability. The enhanced efficiency can signNowly contribute to your 2% Income, Including Interest From Mass by ensuring faster transaction completions.

Get more for 2% Income, Including Interest From Mass

- Senior night questionnaire pdf form

- Maran tankers application form

- Florida vehicle registration template form

- Monroe county michigan dog license form

- Unconditional release form real estate bc

- Vehicle expense worksheet form

- Withdrawal request form

- Sample professional will apa practice organization form

Find out other 2% Income, Including Interest From Mass

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form