Massachusetts Form 355q 2015

What is the Massachusetts Form 355q

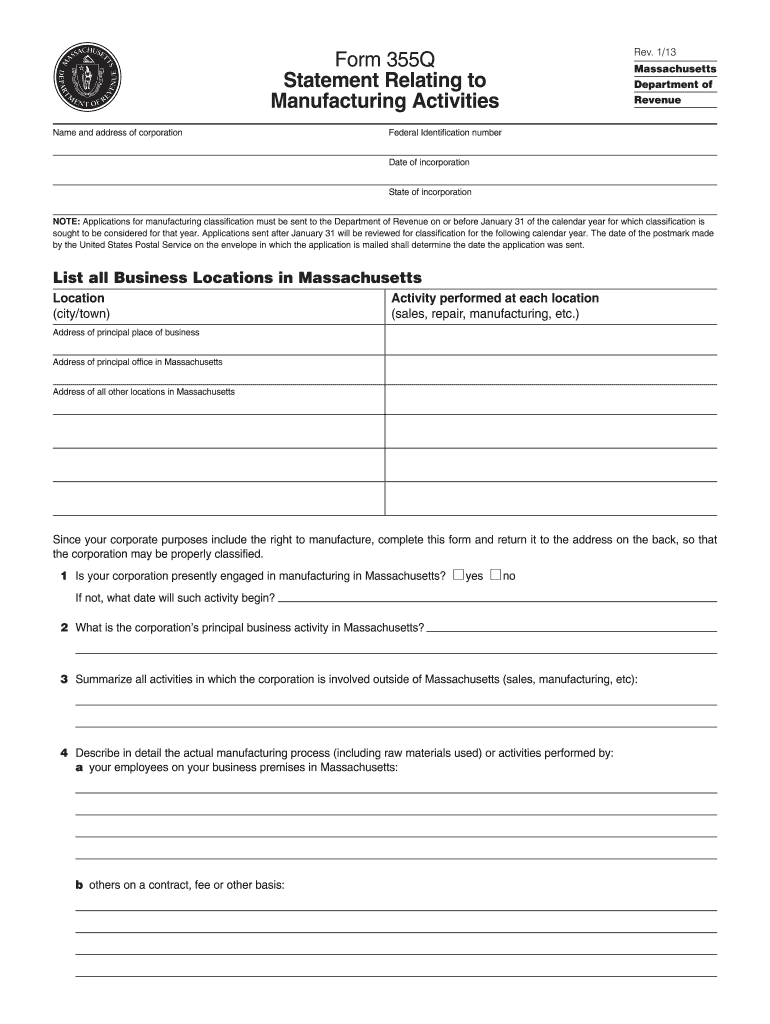

The Massachusetts Form 355Q is a tax form specifically designed for corporations that have made an election to be treated as a qualified subchapter S corporation. This form is used to report the income, deductions, and credits of the corporation to the Massachusetts Department of Revenue. It is essential for ensuring compliance with state tax laws and for calculating the corporation's tax liability accurately.

How to use the Massachusetts Form 355q

To use the Massachusetts Form 355Q, corporations must gather all necessary financial information, including income statements, balance sheets, and records of deductions and credits. The form requires detailed reporting of the corporation's financial activities throughout the tax year. It is crucial to follow the instructions carefully to ensure accurate completion and submission.

Steps to complete the Massachusetts Form 355q

Completing the Massachusetts Form 355Q involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for accuracy and compliance with Massachusetts tax regulations.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the form to the Massachusetts Department of Revenue by the specified deadline.

Legal use of the Massachusetts Form 355q

The Massachusetts Form 355Q is legally binding when completed and submitted according to state regulations. It is important for corporations to ensure that all information provided is accurate and truthful to avoid penalties or legal issues. The form serves as an official document for tax purposes and must be treated with the same level of care as any other legal document.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the Massachusetts Form 355Q to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is generally due by March 15. It is advisable to check for any changes in deadlines or specific requirements for the current tax year.

Form Submission Methods (Online / Mail / In-Person)

The Massachusetts Form 355Q can be submitted through various methods, ensuring flexibility for corporations. Options include:

- Online submission through the Massachusetts Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address provided in the instructions.

- In-person submission at designated state offices, if applicable.

Key elements of the Massachusetts Form 355q

Key elements of the Massachusetts Form 355Q include sections for reporting income, deductions, and credits. Corporations must provide detailed information regarding:

- Total income earned during the tax year.

- Specific deductions that the corporation is eligible to claim.

- Any applicable tax credits that may reduce the overall tax liability.

Quick guide on how to complete massachusetts form 355q 2013

Manage Massachusetts Form 355q effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the features necessary to generate, modify, and eSign your documents rapidly without any delays. Handle Massachusetts Form 355q on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The optimal method to modify and eSign Massachusetts Form 355q with ease

- Acquire Massachusetts Form 355q and select Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Massachusetts Form 355q to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts form 355q 2013

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is Massachusetts Form 355q?

Massachusetts Form 355q is a tax form used for corporate excise tax returns within the state of Massachusetts. It allows businesses to report their income to the Massachusetts Department of Revenue. Understanding how to complete this form is crucial for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with Massachusetts Form 355q?

airSlate SignNow streamlines the process of completing and submitting Massachusetts Form 355q by providing an easy-to-use eSigning platform. Users can upload the form, fill it out electronically, and send it for signatures without the need for printing. This efficiency reduces the likelihood of errors and speeds up submission.

-

Is there a cost associated with using airSlate SignNow for Massachusetts Form 355q?

airSlate SignNow offers a range of pricing plans tailored to different business needs, making it a cost-effective solution for completing Massachusetts Form 355q. Most plans include features like unlimited document signing and storage. By utilizing this service, businesses can save on both time and operational costs.

-

What features does airSlate SignNow offer for handling legal documents like Massachusetts Form 355q?

airSlate SignNow includes features such as customizable templates, secure storage, and audit trails, which are essential for managing legal documents like Massachusetts Form 355q. Users benefit from built-in compliance checks and the ability to track document status in real-time. These features enhance accountability and streamline workflows.

-

Can Massachusetts Form 355q be completed on mobile devices using airSlate SignNow?

Yes, airSlate SignNow has a mobile-friendly platform that allows users to complete and eSign Massachusetts Form 355q on any mobile device. This flexibility means users can manage their documents from anywhere, which is particularly useful for busy professionals on the go. The mobile app ensures you never miss a deadline.

-

Does airSlate SignNow integrate with other software for processing Massachusetts Form 355q?

airSlate SignNow offers seamless integrations with popular accounting and document management software, facilitating the efficient handling of Massachusetts Form 355q. This means users can easily link their existing systems to streamline data flow and maintain complete records. Integration ensures a smooth and error-free process.

-

What are the benefits of using airSlate SignNow for Massachusetts Form 355q over traditional methods?

Using airSlate SignNow for Massachusetts Form 355q provides numerous advantages over traditional paper methods, including increased speed, reduced costs, and enhanced security. The electronic platform minimizes the risk of lost documents and provides a clear audit trail for accountability. Moreover, it simplifies collaboration among team members, making the process more efficient.

Get more for Massachusetts Form 355q

- 20 rs bond paper pdf download form

- Alamance county concealed carry permit form

- Cat pedigree certificate template form

- Exhibit cover sheet template form

- Air assault packing list form

- Cms 486 form

- Bulletin no 2643 15 los angeles unified school district form

- Rtl application login north carolina medical board form

Find out other Massachusetts Form 355q

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure