Form 3 Partnership Return of Income Ma PDF Fillable 2020

What is the Form 3 Partnership Return Of Income Ma Pdf Fillable

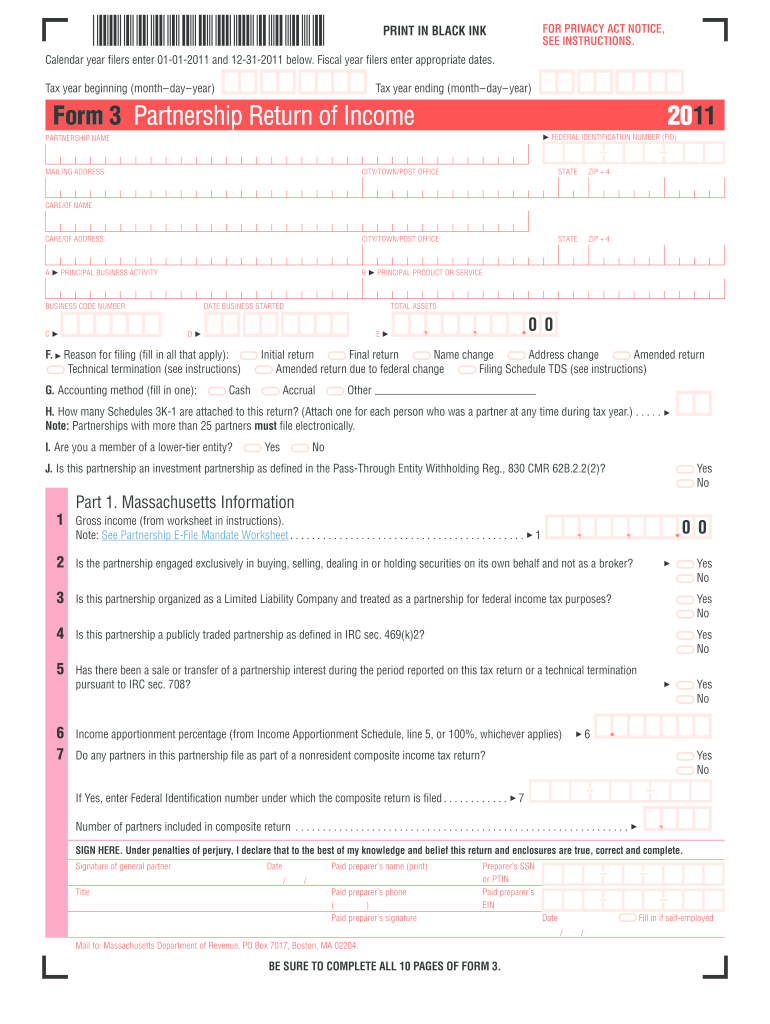

The Form 3 Partnership Return of Income MA PDF Fillable is a tax document specifically designed for partnerships operating in Massachusetts. This form is used to report the income, deductions, and credits of a partnership for a given tax year. Partnerships must file this return to comply with state tax laws and to ensure that all income is accurately reported to the Massachusetts Department of Revenue. The fillable PDF format allows for easy completion and submission, facilitating a more efficient filing process.

Steps to complete the Form 3 Partnership Return Of Income Ma Pdf Fillable

Completing the Form 3 Partnership Return of Income MA PDF Fillable involves several key steps:

- Download the form from an official source or access it through a digital platform that supports fillable PDFs.

- Enter the partnership's basic information, including the name, address, and federal employer identification number (EIN).

- Report total income earned by the partnership during the tax year, including ordinary business income and other income sources.

- Detail any deductions that the partnership is eligible for, such as operating expenses, salaries, and other allowable deductions.

- Calculate the partnership's tax liability based on the reported income and deductions.

- Ensure that all signatures are included, typically from the partners or authorized representatives.

- Review the completed form for accuracy before submission.

How to obtain the Form 3 Partnership Return Of Income Ma Pdf Fillable

The Form 3 Partnership Return of Income MA PDF Fillable can be obtained through various methods. It is available for download on the Massachusetts Department of Revenue website. Additionally, many tax preparation software programs may include this form as part of their offerings. Users can also request a physical copy from the state tax office if needed. Ensuring that you have the most current version of the form is crucial for compliance with state regulations.

Legal use of the Form 3 Partnership Return Of Income Ma Pdf Fillable

The legal use of the Form 3 Partnership Return of Income MA PDF Fillable is essential for partnerships to meet their tax obligations. This form must be filed accurately and on time to avoid penalties. The information provided on the form must be truthful and complete, as it is subject to review by the Massachusetts Department of Revenue. Filing this form electronically through a secure platform can enhance its legal validity, especially when proper eSignature protocols are followed.

Key elements of the Form 3 Partnership Return Of Income Ma Pdf Fillable

Key elements of the Form 3 Partnership Return of Income MA PDF Fillable include:

- Partnership Information: Basic details about the partnership, including its name and EIN.

- Income Reporting: Sections to report various types of income earned by the partnership.

- Deductions: Areas to list allowable deductions that reduce taxable income.

- Tax Calculation: A section for determining the total tax liability based on reported income and deductions.

- Signature Section: A place for partners or authorized representatives to sign the form, affirming its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3 Partnership Return of Income MA PDF Fillable are crucial for compliance. Typically, the form must be filed by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the deadline is April 15. It is important to be aware of any extensions that may apply and to ensure that the form is submitted on time to avoid penalties.

Quick guide on how to complete form 3 partnership return of income ma pdf fillable 2011

Complete Form 3 Partnership Return Of Income Ma Pdf Fillable effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily retrieve the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Handle Form 3 Partnership Return Of Income Ma Pdf Fillable on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Form 3 Partnership Return Of Income Ma Pdf Fillable with ease

- Find Form 3 Partnership Return Of Income Ma Pdf Fillable and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 3 Partnership Return Of Income Ma Pdf Fillable and ensure outstanding communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3 partnership return of income ma pdf fillable 2011

Create this form in 5 minutes!

How to create an eSignature for the form 3 partnership return of income ma pdf fillable 2011

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Form 3 Partnership Return Of Income Ma Pdf Fillable?

The Form 3 Partnership Return Of Income Ma Pdf Fillable is a standardized document used by partnerships in Massachusetts to report income, deductions, and other related information. With airSlate SignNow, you can easily create and fill this form online, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with the Form 3 Partnership Return Of Income Ma Pdf Fillable?

airSlate SignNow streamlines the process of completing the Form 3 Partnership Return Of Income Ma Pdf Fillable by providing an intuitive interface for filling out and electronically signing documents. Our platform simplifies collaboration among partners, ensuring everyone can access and submit the form efficiently.

-

Is the Form 3 Partnership Return Of Income Ma Pdf Fillable compliant with state requirements?

Yes, the Form 3 Partnership Return Of Income Ma Pdf Fillable provided by airSlate SignNow complies with all Massachusetts state requirements. Our templates are regularly updated to reflect any changes in tax laws, ensuring your submissions are accurate and timely.

-

What are the pricing options for using airSlate SignNow for the Form 3 Partnership Return Of Income Ma Pdf Fillable?

airSlate SignNow offers flexible pricing plans to suit businesses of all sizes, including options for unlimited sending and signing of documents like the Form 3 Partnership Return Of Income Ma Pdf Fillable. You can choose a plan that best fits your needs, ensuring cost-effective solutions without sacrificing features.

-

Can I integrate airSlate SignNow with other applications for the Form 3 Partnership Return Of Income Ma Pdf Fillable?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and more. This allows you to easily access and manage your Form 3 Partnership Return Of Income Ma Pdf Fillable and other documents from your preferred platforms.

-

What are the benefits of using airSlate SignNow for the Form 3 Partnership Return Of Income Ma Pdf Fillable?

Using airSlate SignNow for the Form 3 Partnership Return Of Income Ma Pdf Fillable offers several benefits, including enhanced efficiency, reduced paperwork, and faster turnaround times. Additionally, the platform's electronic signature capabilities ensure secure and legally binding submissions.

-

How does airSlate SignNow ensure the security of my Form 3 Partnership Return Of Income Ma Pdf Fillable?

airSlate SignNow prioritizes the security of your documents, including the Form 3 Partnership Return Of Income Ma Pdf Fillable, with features like end-to-end encryption, secure servers, and compliance with data protection regulations. Your information remains confidential and safe while being processed.

Get more for Form 3 Partnership Return Of Income Ma Pdf Fillable

Find out other Form 3 Partnership Return Of Income Ma Pdf Fillable

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online