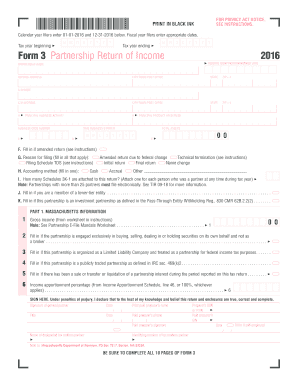

Form 3 Partnership Return 2016

What is the Form 3 Partnership Return

The Form 3 Partnership Return is a tax document specifically designed for partnerships to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for partnerships operating in the United States, as it ensures compliance with federal tax regulations. The information provided on this form helps the IRS assess the partnership's tax obligations and ensures that each partner's share of income is accurately reported on their individual tax returns.

Steps to complete the Form 3 Partnership Return

Completing the Form 3 Partnership Return involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial information, including income statements, expense reports, and partner contributions. Next, follow these steps:

- Fill in the partnership's basic information, including name, address, and Employer Identification Number (EIN).

- Report total income from all sources, including sales and other revenue streams.

- Detail allowable deductions, such as business expenses and depreciation.

- Calculate the partnership's taxable income by subtracting total deductions from total income.

- Allocate each partner's share of income, deductions, and credits according to the partnership agreement.

- Review the completed form for accuracy before submitting it.

Legal use of the Form 3 Partnership Return

The Form 3 Partnership Return is legally binding and must be completed in accordance with IRS regulations. Partnerships are required to file this form annually, ensuring that all income and deductions are reported accurately. Failure to file the Form 3 can result in penalties, including fines and interest on unpaid taxes. It is essential for partnerships to understand their legal obligations and maintain accurate records to support the information reported on the form.

Filing Deadlines / Important Dates

Filing the Form 3 Partnership Return must be done by specific deadlines to avoid penalties. Generally, partnerships must file their return by the fifteenth day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can apply for an extension, which typically allows for an additional six months to file. However, it is important to note that an extension to file does not extend the time to pay any taxes due.

Form Submission Methods (Online / Mail / In-Person)

Partnerships have several options for submitting the Form 3 Partnership Return. The form can be filed electronically through the IRS e-file system, which is a secure and efficient method that allows for quicker processing times. Alternatively, partnerships can submit a paper version of the form by mailing it to the appropriate IRS address based on their location. In-person submissions are generally not recommended for tax forms, as electronic filing is encouraged for efficiency and security.

Required Documents

To accurately complete the Form 3 Partnership Return, several documents are required. These include:

- Financial statements detailing income and expenses for the tax year.

- Partnership agreement outlining the distribution of income and responsibilities among partners.

- Records of any contributions made by partners.

- Prior year tax returns, if applicable, to ensure consistency in reporting.

Quick guide on how to complete form 3 partnership return 2016

Your assistance manual on how to prepare your Form 3 Partnership Return

If you’re interested in learning how to formulate and send your Form 3 Partnership Return, here are a few straightforward instructions to simplify tax declaration.

Initially, you just need to set up your airSlate SignNow profile to revolutionize your online document handling. airSlate SignNow is a highly user-friendly and powerful document tool that allows you to modify, generate, and finalize your tax paperwork effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and revert to modify responses when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to finish your Form 3 Partnership Return in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Form 3 Partnership Return in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Use the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to electronically file your taxes with airSlate SignNow. Please be aware that filing on paper can lead to return errors and delay refunds. Before e-filing your taxes, ensure you check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct form 3 partnership return 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

Create this form in 5 minutes!

How to create an eSignature for the form 3 partnership return 2016

How to make an electronic signature for your Form 3 Partnership Return 2016 online

How to make an eSignature for the Form 3 Partnership Return 2016 in Google Chrome

How to create an electronic signature for signing the Form 3 Partnership Return 2016 in Gmail

How to create an eSignature for the Form 3 Partnership Return 2016 straight from your smartphone

How to generate an eSignature for the Form 3 Partnership Return 2016 on iOS devices

How to make an eSignature for the Form 3 Partnership Return 2016 on Android devices

People also ask

-

What is the Form 3 Partnership Return and why is it important?

The Form 3 Partnership Return is a tax document required for partnerships to report their income, deductions, and credits to the IRS. Properly filing the Form 3 Partnership Return ensures compliance with tax regulations and helps avoid penalties. Utilizing tools like airSlate SignNow can streamline the process of signing and submitting these essential documents.

-

How can airSlate SignNow help with filing the Form 3 Partnership Return?

airSlate SignNow simplifies the process of preparing and submitting the Form 3 Partnership Return by enabling users to electronically sign and send documents securely. With its user-friendly interface, businesses can easily manage their partnership returns and ensure timely submissions. This saves time and reduces the risk of errors in the filing process.

-

What are the pricing options for using airSlate SignNow for the Form 3 Partnership Return?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage their Form 3 Partnership Return efficiently. You can choose from monthly or annual subscriptions, with options for additional features as needed. The cost-effective solution ensures you get great value while handling your partnership tax documents.

-

Does airSlate SignNow support integrations with accounting software for the Form 3 Partnership Return?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms, making it easier to manage your Form 3 Partnership Return. These integrations allow you to import necessary data and documents directly into the platform, streamlining your workflow. This feature enhances efficiency and helps maintain accurate records for your partnership.

-

What features of airSlate SignNow make it suitable for managing the Form 3 Partnership Return?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage, all tailored to facilitate the management of the Form 3 Partnership Return. Users can create templates for recurring documents, ensuring consistency and saving time during the filing process. These features enhance collaboration among partners and accountants alike.

-

Is airSlate SignNow compliant with legal standards for the Form 3 Partnership Return?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management, ensuring that your Form 3 Partnership Return is filed in accordance with IRS regulations. The platform adheres to industry security standards, providing peace of mind that your sensitive information is protected during the signing process.

-

Can I track the status of my Form 3 Partnership Return using airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their Form 3 Partnership Return in real-time. You can see when documents are sent, viewed, signed, and completed, ensuring you stay informed throughout the filing process. This transparency helps manage deadlines effectively.

Get more for Form 3 Partnership Return

- The patient mentioned above is at present from infectious diseases and is in good form

- Forwarding order form

- Purchase order forms online 17647

- Post falls high school high school transcript form

- Hsbc hk business internet banking form

- Sos ga form

- Mississippi pdf fillable form 73 033

- Management spreadsheet contract template form

Find out other Form 3 Partnership Return

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template