Mass Dor Form K 1 Fillable 2012

What is the Mass Dor Form K-1 Fillable

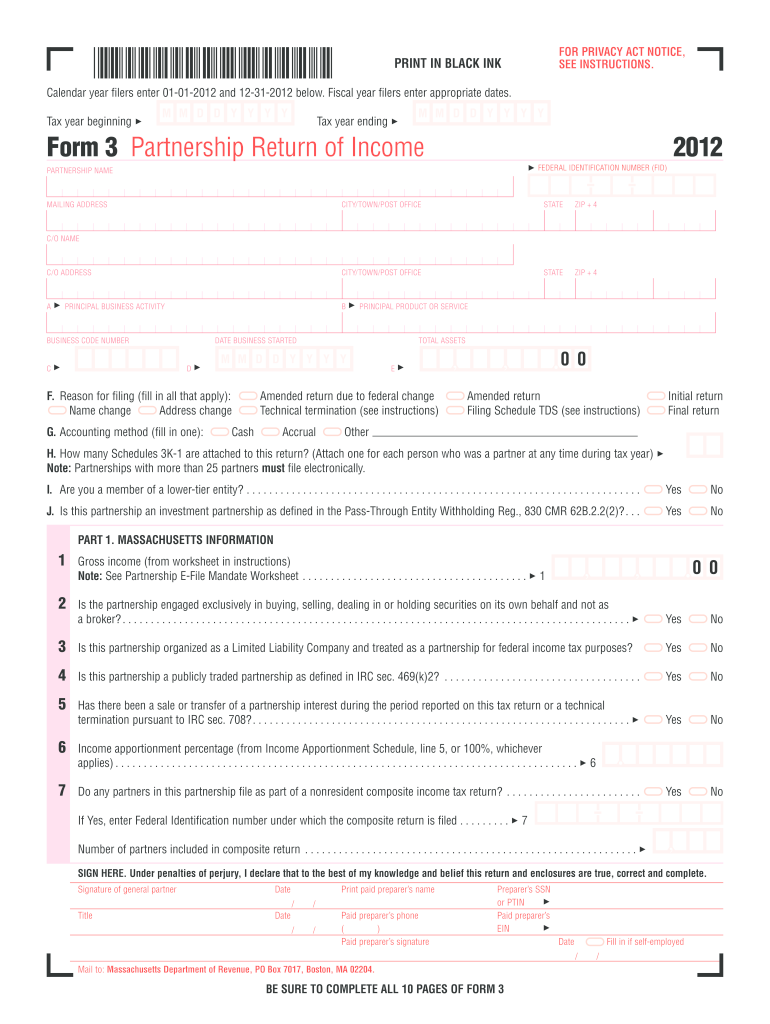

The Mass Dor Form K-1 Fillable is a tax form used in Massachusetts to report income, deductions, and credits from partnerships, S corporations, and certain estates or trusts. This form is essential for individuals who receive income from these entities, as it provides the necessary information for accurate tax reporting. The fillable version allows users to complete the form electronically, making the process more efficient and reducing the likelihood of errors associated with handwritten entries.

How to use the Mass Dor Form K-1 Fillable

To use the Mass Dor Form K-1 Fillable, start by downloading the form from an official source. Once you have the form, you can fill it out directly on your computer. Enter all required information, including your name, address, and details about the income received from the partnership or corporation. After completing the form, review it for accuracy. You can then eSign it using a secure electronic signature solution, ensuring compliance with legal requirements.

Steps to complete the Mass Dor Form K-1 Fillable

Completing the Mass Dor Form K-1 Fillable involves several key steps:

- Download the form from an official source.

- Open the form in a PDF reader that supports fillable forms.

- Enter your personal information, including your name and address.

- Fill in the income details as provided by the partnership or S corporation.

- Check for any deductions or credits applicable to your situation.

- Review the completed form for accuracy.

- eSign the form using a trusted electronic signature solution.

Legal use of the Mass Dor Form K-1 Fillable

The Mass Dor Form K-1 Fillable is legally recognized when completed accurately and submitted in accordance with Massachusetts tax laws. The form must be filed with the Massachusetts Department of Revenue, along with your personal income tax return. Using an electronic signature on the form is permitted, provided it meets the criteria set by the Electronic Signatures in Global and National Commerce (ESIGN) Act. Ensure that all information is truthful and complete to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Mass Dor Form K-1 Fillable typically align with the state income tax return deadlines. Generally, individual tax returns are due on April fifteenth. However, if you require an extension, you can file for one, which usually extends the deadline to October fifteenth. It is crucial to stay informed about any changes to these dates, as they can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Mass Dor Form K-1 Fillable can be submitted through various methods. You can file it online through the Massachusetts Department of Revenue's e-filing system, which is often the fastest and most efficient way. Alternatively, you can print the completed form and mail it to the appropriate address provided by the Department of Revenue. In-person submission is also an option at designated tax offices, though this may require prior appointment or specific hours of operation.

Quick guide on how to complete mass dor form k 1 fillable 2012

Your assistance manual on how to prepare your Mass Dor Form K 1 Fillable

If you’re eager to discover how to generate and submit your Mass Dor Form K 1 Fillable, below are a few straightforward instructions to simplify the tax filing process.

To get started, you just need to sign up for your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that allows you to edit, create, and finalize your income tax documents with ease. With its editor, you can alternate between textual content, check boxes, and eSignatures and revert to amend answers as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the steps outlined below to finalize your Mass Dor Form K 1 Fillable in just minutes:

- Sign up for your account and start working on PDFs in a matter of minutes.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Mass Dor Form K 1 Fillable in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes digitally with airSlate SignNow. Please be aware that submitting in paper form can heighten return errors and postpone reimbursements. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct mass dor form k 1 fillable 2012

FAQs

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

Create this form in 5 minutes!

How to create an eSignature for the mass dor form k 1 fillable 2012

How to generate an eSignature for the Mass Dor Form K 1 Fillable 2012 online

How to generate an electronic signature for your Mass Dor Form K 1 Fillable 2012 in Google Chrome

How to generate an eSignature for putting it on the Mass Dor Form K 1 Fillable 2012 in Gmail

How to generate an eSignature for the Mass Dor Form K 1 Fillable 2012 straight from your mobile device

How to create an eSignature for the Mass Dor Form K 1 Fillable 2012 on iOS devices

How to make an electronic signature for the Mass Dor Form K 1 Fillable 2012 on Android

People also ask

-

What is the Mass Dor Form K 1 Fillable and why is it important?

The Mass Dor Form K 1 Fillable is a tax form required by Massachusetts for reporting income for partners in a partnership. It is important as it ensures compliance with tax regulations while making it easier for partners to prepare their tax returns accurately. With airSlate SignNow, you can easily fill out and eSign this form online, streamlining the process and saving time.

-

How can I access the Mass Dor Form K 1 Fillable through airSlate SignNow?

You can access the Mass Dor Form K 1 Fillable directly from airSlate SignNow's platform. Simply log in or create an account, navigate to the templates section, and you will find the fillable version of the form ready for your use. This allows for seamless completion and submission of your tax forms.

-

Is there a cost associated with using the Mass Dor Form K 1 Fillable on airSlate SignNow?

airSlate SignNow offers a range of pricing plans, starting with a free trial to test the features, including the Mass Dor Form K 1 Fillable. After the trial, users can choose a subscription that best fits their needs. This cost-effective solution makes it easy for businesses to manage their document signing and filling processes.

-

What features does airSlate SignNow provide for filling out the Mass Dor Form K 1 Fillable?

airSlate SignNow provides several features that enhance the filling out of the Mass Dor Form K 1 Fillable, such as easy text editing, digital signatures, automatic field detection, and cloud storage integration. These features make completing the form fast and user-friendly, ensuring that you can focus on other important tasks.

-

Can I integrate airSlate SignNow with other software to manage the Mass Dor Form K 1 Fillable?

Yes, airSlate SignNow offers integrations with various software platforms to maximize productivity. You can connect it with tools like Google Drive, Salesforce, and Dropbox to streamline the management of the Mass Dor Form K 1 Fillable. This ensures that you have all your documents organized and accessible in one place.

-

What are the benefits of using airSlate SignNow for the Mass Dor Form K 1 Fillable?

Using airSlate SignNow for the Mass Dor Form K 1 Fillable provides signNow benefits, including enhanced security, ease of use, and time-saving capabilities. The digital signing process eliminates the need for printing and mailing, allowing for quicker submissions. Moreover, having everything stored in the cloud means you can access your documents anytime and anywhere.

-

How does airSlate SignNow ensure the security of the Mass Dor Form K 1 Fillable?

airSlate SignNow prioritizes security and ensures that all documents, including the Mass Dor Form K 1 Fillable, are protected with advanced encryption. Additionally, the platform complies with legal standards for eSignature, which provides peace of mind that your sensitive information is safe. Regular security audits further enhance the integrity of your data.

Get more for Mass Dor Form K 1 Fillable

- Texas fillable tax exemption form 2004

- Texas hotel tax exempt form 2004

- Texas resale certificate rev 12 024 2002 form

- Title agent certification of agentamp39s quarterly tax reports form t s5 tdi texas

- A complete tax exemption certificate form 721 c

- 69com 2010 form

- Utah claim for refund of fees or sales tax for motor vehicles tc 55a form

- Utah tc 65 2016 form

Find out other Mass Dor Form K 1 Fillable

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement