PDF Form 3 Partnership Return of Income Mass Gov 2020

Overview of the Massachusetts Form 3 Partnership Return of Income

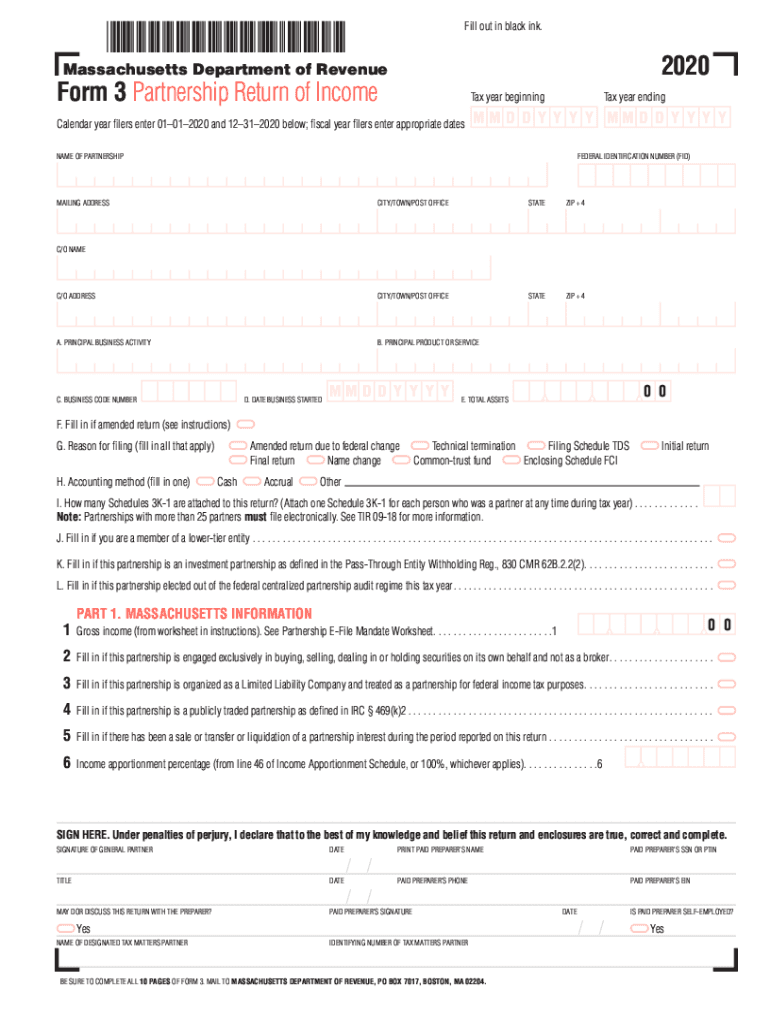

The Massachusetts Form 3, officially known as the Massachusetts Partnership Return of Income, is essential for partnerships operating within the state. This form allows partnerships to report their income, deductions, and credits to the Massachusetts Department of Revenue. It is crucial for ensuring compliance with state tax laws and for the accurate distribution of tax responsibilities among partners.

Steps to Complete the Massachusetts Form 3

Filling out the Massachusetts Form 3 involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and prior tax returns.

- Complete the identification section, providing the partnership's name, address, and federal employer identification number (EIN).

- Report total income and deductions in the appropriate sections, ensuring all calculations are accurate.

- Allocate income and deductions to each partner based on the partnership agreement.

- Sign and date the form, ensuring that all partners are aware of the information reported.

Legal Use of the Massachusetts Form 3

The Massachusetts Form 3 is legally binding when completed accurately and submitted on time. It serves as an official record of the partnership's financial activities and tax obligations. Compliance with state laws regarding the form's submission is essential to avoid penalties and ensure that partners fulfill their tax responsibilities. The form must be filed annually, reflecting the partnership's financial performance for the preceding year.

Filing Deadlines for the Massachusetts Form 3

Partnerships must adhere to specific filing deadlines for the Massachusetts Form 3. Generally, the form is due on the fifteenth day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by April 15. It is important to file on time to avoid late fees and ensure compliance with state tax regulations.

Required Documents for the Massachusetts Form 3

When preparing to complete the Massachusetts Form 3, certain documents are essential:

- Financial statements detailing income and expenses.

- Partnership agreement outlining the distribution of income and responsibilities among partners.

- Prior year tax returns, if applicable, to ensure consistency and accuracy in reporting.

- Any supporting documentation for deductions and credits claimed.

Form Submission Methods for the Massachusetts Form 3

The Massachusetts Form 3 can be submitted through various methods, providing flexibility for partnerships. Options include:

- Online submission via the Massachusetts Department of Revenue’s e-filing portal, which is often the fastest method.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated state tax offices, although this may require an appointment.

Key Elements of the Massachusetts Form 3

Understanding the key elements of the Massachusetts Form 3 is vital for accurate completion. The form includes sections for:

- Partnership identification information.

- Total income and deductions.

- Partner allocations, detailing how income and deductions are divided among partners.

- Signature lines for authorized partners, confirming the accuracy of the information provided.

Quick guide on how to complete pdf 2020 form 3 partnership return of income massgov

Utilize PDF Form 3 Partnership Return Of Income Mass gov effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents promptly without delays. Handle PDF Form 3 Partnership Return Of Income Mass gov on any device with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and electronically sign PDF Form 3 Partnership Return Of Income Mass gov effortlessly

- Obtain PDF Form 3 Partnership Return Of Income Mass gov and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign PDF Form 3 Partnership Return Of Income Mass gov and ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2020 form 3 partnership return of income massgov

Create this form in 5 minutes!

How to create an eSignature for the pdf 2020 form 3 partnership return of income massgov

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Massachusetts Form 3 and when do I need to use it?

The Massachusetts Form 3 is a version of the state’s corporate tax return specifically designed for corporations doing business in Massachusetts. You need to use this form if your business is incorporated in Massachusetts or does business within the state. Ensuring that you eSign and submit this form accurately is crucial for compliance.

-

How can airSlate SignNow help me with the Massachusetts Form 3?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, including the Massachusetts Form 3. You can streamline your process by electronically managing the necessary signatures and submissions, which saves time and reduces paperwork.

-

Is airSlate SignNow cost-effective for businesses filing the Massachusetts Form 3?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be cost-effective for businesses of all sizes. By leveraging our platform’s features, you can save on administrative costs associated with printing, mailing, and tracking the Massachusetts Form 3.

-

What features does airSlate SignNow offer that are beneficial for managing the Massachusetts Form 3?

airSlate SignNow offers features such as templates, automatic reminders, and secure cloud storage, all of which can simplify the management of the Massachusetts Form 3. This ensures that all documents are easily accessible and that deadlines for submission are met.

-

Can I integrate airSlate SignNow with other tools I use for tax processing?

Absolutely! airSlate SignNow integrates with a variety of tools that can help streamline your tax processing, including CRM systems and accounting software. This seamless integration allows for a more efficient workflow when dealing with the Massachusetts Form 3.

-

What benefits will I gain from using airSlate SignNow for my Massachusetts Form 3 filings?

Using airSlate SignNow to manage your Massachusetts Form 3 filings provides you with a quicker turnaround for approvals, enhanced security for sensitive documents, and improved accuracy in submissions. This can lead to a smoother filing experience and peace of mind for your business.

-

Is it easy to track the status of my Massachusetts Form 3 with airSlate SignNow?

Yes, airSlate SignNow provides comprehensive tracking features that allow you to monitor the status of your Massachusetts Form 3 and any related documents. You can receive real-time updates and notifications, ensuring you stay informed throughout the process.

Get more for PDF Form 3 Partnership Return Of Income Mass gov

Find out other PDF Form 3 Partnership Return Of Income Mass gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors