International Fuels Tax Agreement for Motor Carriers IFTA 2020

What is the International Fuels Tax Agreement For Motor Carriers IFTA

The International Fuels Tax Agreement for Motor Carriers (IFTA) is a cooperative agreement among U.S. states and Canadian provinces designed to simplify the reporting of fuel use by motor carriers that operate in multiple jurisdictions. Under this agreement, motor carriers pay fuel taxes based on the miles driven in each jurisdiction rather than filing separate tax returns for each state or province. This streamlined approach helps reduce administrative burdens and ensures compliance with fuel tax regulations across participating regions.

How to use the International Fuels Tax Agreement For Motor Carriers IFTA

Using the International Fuels Tax Agreement involves several key steps. First, a motor carrier must register with their base jurisdiction, which is typically where the business is established. After registration, the carrier receives an IFTA license and decals for their vehicles. Carriers must maintain accurate records of miles driven and fuel purchased in each jurisdiction. At the end of each quarter, they must file an IFTA tax return that summarizes this information, allowing for the calculation of taxes owed or refunds due.

Steps to complete the International Fuels Tax Agreement For Motor Carriers IFTA

Completing the IFTA process involves a series of steps:

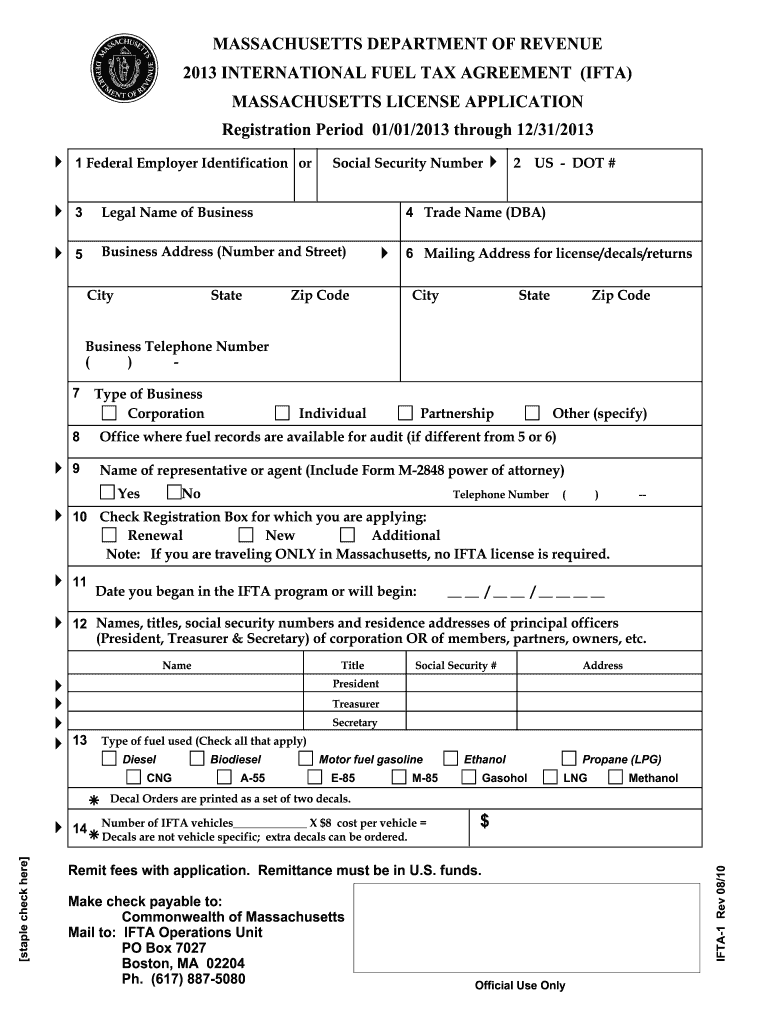

- Register with your base jurisdiction: Provide necessary business information and pay any applicable fees.

- Obtain IFTA decals: Once registered, you'll receive decals to display on your vehicles.

- Track mileage and fuel purchases: Maintain detailed records of miles driven in each jurisdiction and fuel bought.

- File quarterly tax returns: Submit your IFTA return to your base jurisdiction, detailing your fuel use and mileage.

- Pay any taxes owed or claim refunds: Based on your return, settle any outstanding taxes or receive refunds for overpayments.

Legal use of the International Fuels Tax Agreement For Motor Carriers IFTA

The legal use of the International Fuels Tax Agreement is governed by specific regulations that ensure compliance with tax laws. Carriers must adhere to the rules set forth by their base jurisdiction and maintain accurate records to substantiate their IFTA filings. Failure to comply with these regulations can result in penalties, including fines and potential audits. It is essential for motor carriers to understand their obligations under the agreement to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the International Fuels Tax Agreement are crucial for compliance. Motor carriers must submit their IFTA tax returns quarterly, typically by the end of the month following the close of each quarter. The deadlines are as follows:

- Quarter 1: April 30

- Quarter 2: July 31

- Quarter 3: October 31

- Quarter 4: January 31

Timely filing is essential to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Non-compliance with the International Fuels Tax Agreement can lead to significant penalties for motor carriers. These penalties may include:

- Late filing fees: Charged for failing to submit tax returns by the due date.

- Interest on unpaid taxes: Accrued on any taxes owed that are not paid by the deadline.

- Revocation of IFTA license: In cases of repeated non-compliance, a carrier's IFTA license may be revoked, preventing them from operating legally in multiple jurisdictions.

Understanding these penalties can help carriers maintain compliance and avoid unnecessary costs.

Quick guide on how to complete international fuels tax agreement for motor carriers ifta

Complete International Fuels Tax Agreement For Motor Carriers IFTA smoothly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage International Fuels Tax Agreement For Motor Carriers IFTA on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign International Fuels Tax Agreement For Motor Carriers IFTA effortlessly

- Obtain International Fuels Tax Agreement For Motor Carriers IFTA and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunting, or mistakes that require printing out new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Edit and eSign International Fuels Tax Agreement For Motor Carriers IFTA and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct international fuels tax agreement for motor carriers ifta

Create this form in 5 minutes!

How to create an eSignature for the international fuels tax agreement for motor carriers ifta

The best way to make an eSignature for your PDF document online

The best way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the International Fuels Tax Agreement For Motor Carriers IFTA?

The International Fuels Tax Agreement For Motor Carriers IFTA is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers. This agreement allows carriers to file a single quarterly fuel tax return, making compliance easier and more efficient. It is essential for ensuring that fuel taxes are properly assessed and distributed among jurisdictions.

-

How can airSlate SignNow help with IFTA compliance?

AirSlate SignNow streamlines the document management process for International Fuels Tax Agreement For Motor Carriers IFTA by enabling users to easily prepare and eSign necessary forms. This solution reduces the administrative burden and ensures accuracy in reporting, helping motor carriers stay compliant with IFTA regulations. With our platform, documents can be quickly shared and signed, ensuring timely submissions.

-

What are the costs associated with using airSlate SignNow for IFTA documentation?

The pricing for airSlate SignNow is competitive and designed to offer a cost-effective solution for managing International Fuels Tax Agreement For Motor Carriers IFTA documentation. Subscription plans vary based on features and the number of users, allowing businesses to choose a package that fits their budget. Additionally, the savings in time and resources complement the overall value of the service.

-

Does airSlate SignNow offer features specifically for IFTA reporting?

Yes, airSlate SignNow includes features specifically designed to assist with International Fuels Tax Agreement For Motor Carriers IFTA reporting. Users can create templates for IFTA-related documents, track signatures in real-time, and access signed documents securely. These features facilitate compliance and ensure that all necessary documentation is precise and readily accessible.

-

Can airSlate SignNow integrate with other tools for IFTA management?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting and fleet management software to enhance the management of International Fuels Tax Agreement For Motor Carriers IFTA. This interoperability streamlines data transfers and documentation processes, allowing for consolidated reporting and improved efficiency. The integration capabilities are designed to support businesses in optimizing their IFTA compliance workflows.

-

What are the benefits of using airSlate SignNow for IFTA documentation?

Using airSlate SignNow for International Fuels Tax Agreement For Motor Carriers IFTA documentation provides numerous benefits, including time savings, enhanced organization, and improved accuracy in filings. The platform's user-friendly interface allows quick document preparation and signing, reducing the risk of errors often found in manual processes. Additionally, better document security ensures sensitive information remains protected.

-

Is airSlate SignNow user-friendly for first-time users dealing with IFTA?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible even for first-time users navigating the International Fuels Tax Agreement For Motor Carriers IFTA. The intuitive interface guides users through document preparation and eSigning processes. Comprehensive support resources, including tutorials and customer service, further enhance the experience for those new to IFTA documentation.

Get more for International Fuels Tax Agreement For Motor Carriers IFTA

Find out other International Fuels Tax Agreement For Motor Carriers IFTA

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online