Loan Out Affidavit Allocation 2020

What is the Loan Out Affidavit Allocation

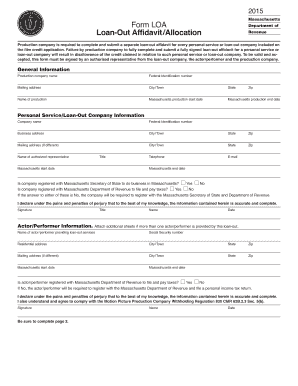

The Loan Out Affidavit Allocation is a legal document used primarily in the entertainment industry. It serves to allocate income and expenses related to loan-out corporations, which are entities created to provide services of individuals, such as actors or musicians. This form ensures that the income generated by the individual is correctly reported and taxed under the appropriate entity, thereby preventing issues with the IRS and maintaining compliance with tax laws.

How to use the Loan Out Affidavit Allocation

Using the Loan Out Affidavit Allocation involves several steps to ensure accuracy and compliance. First, gather all necessary information, including the individual's legal name, the loan-out corporation's details, and relevant financial data. Next, fill out the form with precise information regarding income sources and expenses. After completing the form, it should be signed and dated by the appropriate parties. Finally, submit the form to the relevant tax authority or organization requiring it, ensuring that all submission guidelines are followed.

Key elements of the Loan Out Affidavit Allocation

Several key elements must be included in the Loan Out Affidavit Allocation to ensure its validity. These include:

- Identifying Information: Full legal names and addresses of both the individual and the loan-out corporation.

- Income Details: A breakdown of all income sources attributed to the loan-out corporation.

- Expense Reporting: A detailed account of expenses incurred during the production or service period.

- Signatures: Required signatures from the individual and authorized representatives of the loan-out corporation.

- Date of Execution: The date when the affidavit is signed, which is crucial for compliance purposes.

Steps to complete the Loan Out Affidavit Allocation

Completing the Loan Out Affidavit Allocation involves a systematic approach:

- Gather Documentation: Collect all necessary financial records and identification documents.

- Fill Out the Form: Enter the required information accurately, ensuring all sections are completed.

- Review for Accuracy: Double-check all entries for correctness to avoid potential issues.

- Obtain Signatures: Ensure that all required parties sign the document to validate it.

- Submit the Form: Send the completed form to the appropriate tax authority or organization.

Legal use of the Loan Out Affidavit Allocation

The Loan Out Affidavit Allocation is legally binding when executed correctly. It must adhere to federal and state regulations regarding income reporting and taxation. Failure to comply with these legal standards can lead to penalties, including fines or audits by the IRS. Therefore, it is essential to understand the legal implications of this document and ensure that it is filled out accurately and submitted on time.

Eligibility Criteria

To use the Loan Out Affidavit Allocation, certain eligibility criteria must be met. Typically, this form is utilized by individuals who operate through a loan-out corporation, such as freelancers in the entertainment industry. The individual must have a valid tax identification number and must be actively engaged in providing services through their loan-out corporation. Additionally, the corporation must be in good standing with state regulations and tax obligations.

Quick guide on how to complete loan out affidavit allocation

Complete Loan Out Affidavit Allocation effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Loan Out Affidavit Allocation on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to alter and electronically sign Loan Out Affidavit Allocation without hassle

- Obtain Loan Out Affidavit Allocation and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and electronically sign Loan Out Affidavit Allocation and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loan out affidavit allocation

Create this form in 5 minutes!

How to create an eSignature for the loan out affidavit allocation

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is a Loan Out Affidavit Allocation?

A Loan Out Affidavit Allocation is a legal document that specifies how funds are allocated in a loan agreement. It provides clarity on payment terms and conditions, ensuring all parties understand their financial responsibilities. Understanding this document is crucial for effective financial management in contractual agreements.

-

How can airSlate SignNow assist with Loan Out Affidavit Allocation?

airSlate SignNow streamlines the process of creating and signing Loan Out Affidavit Allocations. Our platform allows you to customize templates, making it easy to generate the required documents. With robust e-signing features, you can ensure that all stakeholders can sign quickly and securely.

-

What are the benefits of using airSlate SignNow for Loan Out Affidavit Allocations?

Using airSlate SignNow for Loan Out Affidavit Allocations enhances efficiency and reduces errors. Our intuitive interface and powerful document management tools enable users to handle multiple agreements simultaneously. Moreover, real-time tracking ensures that you never miss a signature or deadline.

-

Is there a cost associated with using airSlate SignNow for Loan Out Affidavit Allocations?

Yes, there is a cost associated with using airSlate SignNow, which offers various pricing plans tailored to meet different business needs. Our plans provide access to essential features required for managing Loan Out Affidavit Allocations effectively. You can choose a plan that aligns best with your organization’s budget and requirements.

-

Can I integrate airSlate SignNow with my existing systems for Loan Out Affidavit Allocations?

Absolutely! airSlate SignNow supports integration with various third-party applications, which makes it easier to manage your Loan Out Affidavit Allocations alongside your existing tools. This seamless integration helps maintain workflow efficiency and ensures that all your systems are connected.

-

How secure is airSlate SignNow for managing Loan Out Affidavit Allocations?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your Loan Out Affidavit Allocations and personal information. Regular audits and compliance with industry standards ensure that your documents are safe and secure.

-

What types of businesses can benefit from Loan Out Affidavit Allocations through airSlate SignNow?

Any business that utilizes loans or financing agreements can benefit from Loan Out Affidavit Allocations through airSlate SignNow. This includes small businesses, corporations, and individual freelancers who need clarity and legal backing in their financial transactions. Our solution is versatile enough to cater to various industries and business sizes.

Get more for Loan Out Affidavit Allocation

Find out other Loan Out Affidavit Allocation

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template