Partner's Instructions for Schedule K 1 Form 1065 2020

What is the Partner's Instructions For Schedule K-1 Form 1065

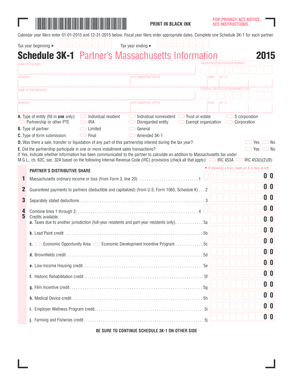

The Partner's Instructions for Schedule K-1 Form 1065 is a crucial document used by partnerships in the United States to report income, deductions, and credits to their partners. This form is part of the IRS Form 1065, which is the U.S. Return of Partnership Income. Each partner receives a Schedule K-1 that outlines their share of the partnership's income, losses, and other tax-related items. Understanding this form is essential for accurate tax reporting and compliance.

Steps to Complete the Partner's Instructions For Schedule K-1 Form 1065

Completing the Partner's Instructions for Schedule K-1 Form 1065 involves several key steps:

- Gather necessary financial information from the partnership's accounting records.

- Fill out the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits accurately, using the partnership's financial statements as a reference.

- Ensure all calculations are correct to avoid discrepancies in tax reporting.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Partner's Instructions For Schedule K-1 Form 1065

The legal use of the Partner's Instructions for Schedule K-1 Form 1065 is essential for ensuring compliance with IRS regulations. This form must be completed accurately to reflect each partner's share of the partnership's income and deductions. Failure to provide accurate information can lead to penalties or audits. It is important that partnerships retain copies of the completed forms for their records and provide partners with their respective K-1s in a timely manner.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Partner's Instructions for Schedule K-1 Form 1065. Generally, the partnership return (Form 1065) is due on the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. Partners should receive their Schedule K-1s by this date to ensure they can accurately report their income on their individual tax returns.

Examples of Using the Partner's Instructions For Schedule K-1 Form 1065

Examples of using the Partner's Instructions for Schedule K-1 Form 1065 include various scenarios where partners need to report their income from the partnership. For instance, a partner in a real estate investment partnership would use the K-1 to report rental income and any associated deductions. Similarly, a partner in a consulting firm would report their share of the firm's profits and losses. Each partner's K-1 helps them accurately reflect their financial situation on their personal tax returns.

Required Documents

To complete the Partner's Instructions for Schedule K-1 Form 1065, several documents are typically required:

- Partnership financial statements, including profit and loss statements.

- Records of all income and expenses incurred by the partnership.

- Previous year’s tax returns for reference.

- Any relevant agreements that outline the distribution of income among partners.

Who Issues the Form

The Partner's Instructions for Schedule K-1 Form 1065 is issued by the partnership itself. Each partnership is responsible for preparing and distributing the K-1 forms to its partners. This internal process ensures that each partner receives accurate information regarding their share of the partnership's income, deductions, and credits. The partnership must ensure that the information provided on the K-1 is consistent with the partnership's overall tax return filed with the IRS.

Quick guide on how to complete 2018 partners instructions for schedule k 1 form 1065

Effortlessly Prepare Partner's Instructions For Schedule K 1 Form 1065 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Partner's Instructions For Schedule K 1 Form 1065 across any platform using airSlate SignNow mobile apps for Android or iOS and streamline your document-related tasks today.

How to Modify and eSign Partner's Instructions For Schedule K 1 Form 1065 with Ease

- Find Partner's Instructions For Schedule K 1 Form 1065 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight essential parts of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to share your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Partner's Instructions For Schedule K 1 Form 1065 to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 partners instructions for schedule k 1 form 1065

Create this form in 5 minutes!

How to create an eSignature for the 2018 partners instructions for schedule k 1 form 1065

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What are the Partner's Instructions For Schedule K 1 Form 1065?

The Partner's Instructions For Schedule K 1 Form 1065 provide detailed guidelines on how partners in a partnership should report their earnings and losses on their tax returns. The instructions cover important topics like profit sharing, contributions, and distributions, which are crucial for tax compliance.

-

How can airSlate SignNow help with the Partner's Instructions For Schedule K 1 Form 1065?

airSlate SignNow simplifies the process of signing and managing the Partner's Instructions For Schedule K 1 Form 1065 by offering an intuitive eSigning platform. Users can easily generate, send, and eSign the necessary documents, ensuring compliance and efficiency in completing tax forms.

-

What are the pricing options for using airSlate SignNow to manage Partnership documents?

airSlate SignNow offers several pricing plans that cater to different business needs when managing Partnership documents, including those related to the Partner's Instructions For Schedule K 1 Form 1065. Whether you are a small startup or a large enterprise, our flexible plans ensure you find a cost-effective solution that meets your requirements.

-

Can airSlate SignNow integrate with accounting software for Schedule K 1 documentation?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage documents related to the Partner's Instructions For Schedule K 1 Form 1065. Integrating these tools allows for streamlined workflows, ensuring that you have all necessary information at your fingertips and maintaining accurate records.

-

What features does airSlate SignNow offer for eSigning documents like Schedule K 1?

airSlate SignNow provides a range of features tailored for eSigning documents, including the Partner's Instructions For Schedule K 1 Form 1065. Features such as customizable templates, bulk sending, and real-time tracking empower users to manage their signing process efficiently without sacrificing security or compliance.

-

How secure is airSlate SignNow when handling sensitive documents like Schedule K 1?

airSlate SignNow prioritizes the security of your documents, particularly sensitive ones like the Partner's Instructions For Schedule K 1 Form 1065. Our platform uses advanced encryption and ensures compliance with industry standards, safeguarding all information while facilitating a smooth eSigning experience.

-

Can I track the status of my Schedule K 1 forms with airSlate SignNow?

Absolutely! With airSlate SignNow, users can easily track the status of all their Schedule K 1 forms, including those following the Partner's Instructions For Schedule K 1 Form 1065. The platform provides real-time notifications and status updates, allowing you to stay informed throughout the signing process.

Get more for Partner's Instructions For Schedule K 1 Form 1065

Find out other Partner's Instructions For Schedule K 1 Form 1065

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template