Massachusetts State Tax Rates and Who Pays in 2023

Understanding the Massachusetts 3K Form

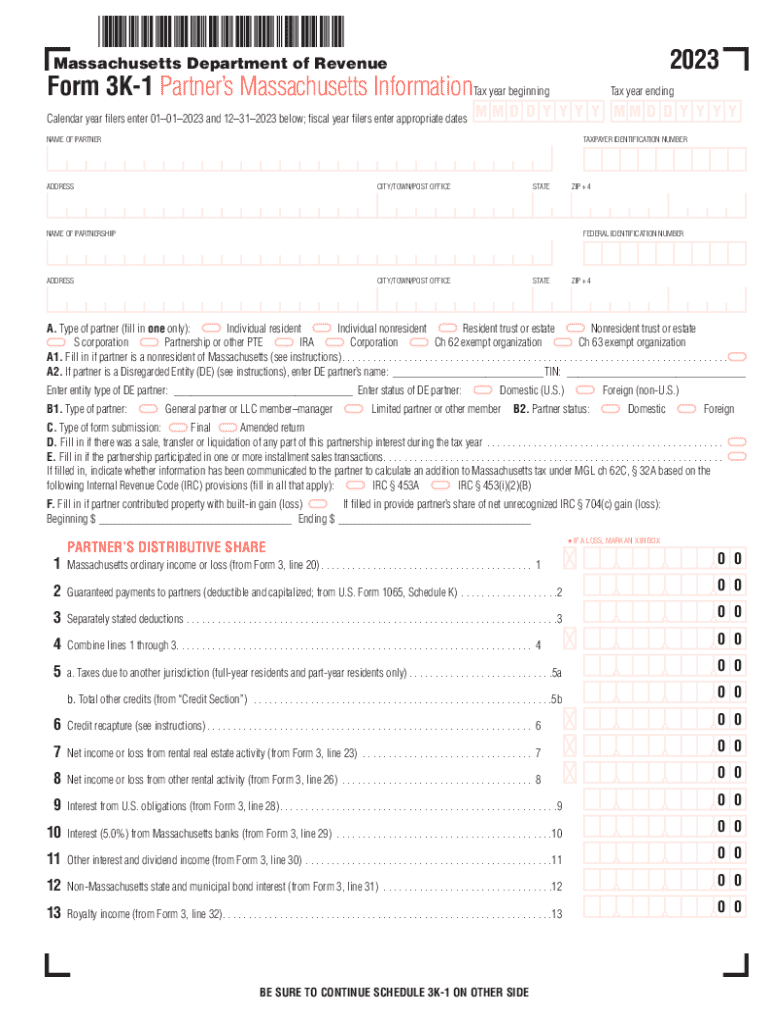

The Massachusetts 3K form, also known as the Schedule 3K, is primarily used for reporting income and deductions for partnerships in Massachusetts. This form is essential for ensuring compliance with state tax regulations. It details the income earned, expenses incurred, and the distribution of profits among partners. Each partner receives a Schedule K-1, which they use to report their share of the partnership's income on their individual tax returns.

Steps to Complete the Massachusetts 3K Form

Completing the Massachusetts 3K form involves several key steps:

- Gather Required Information: Collect all financial records related to the partnership, including income statements, expense reports, and prior year tax returns.

- Fill Out the Form: Enter the partnership's income, deductions, and credits accurately. Ensure that all figures are supported by documentation.

- Distribute K-1s: After completing the form, provide each partner with their respective Schedule K-1, which outlines their share of the income and deductions.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid potential penalties.

- Submit the Form: File the completed Massachusetts 3K form by the deadline, either electronically or by mail.

Filing Deadlines for the Massachusetts 3K Form

The filing deadline for the Massachusetts 3K form typically aligns with the federal tax deadline. Partnerships must file their 3K form by the fifteenth day of the third month following the close of their tax year. For partnerships operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is crucial to file the necessary forms to avoid late penalties.

Required Documents for Filing the Massachusetts 3K Form

When preparing to file the Massachusetts 3K form, certain documents are essential:

- Financial Statements: Income statements and balance sheets that reflect the partnership's financial status.

- Expense Receipts: Documentation of all business-related expenses incurred throughout the year.

- Prior Year Tax Returns: Previous returns can provide a reference point for current filings.

- Partner Information: Details of each partner, including their ownership percentage and tax identification numbers.

Legal Use of the Massachusetts 3K Form

The Massachusetts 3K form is legally required for partnerships operating within the state. Failing to file this form can result in penalties, including fines and interest on unpaid taxes. It is important for partnerships to understand their obligations under Massachusetts tax law to ensure compliance and avoid potential legal issues.

Examples of Using the Massachusetts 3K Form

Consider a partnership consisting of three members who share profits equally. Each member must report their share of the partnership's income on their individual tax returns using the K-1 provided from the 3K form. For instance, if the partnership earned $150,000 in net income, each partner would report $50,000 on their personal tax return. This example illustrates how the 3K form facilitates accurate reporting of income and ensures that all partners fulfill their tax responsibilities.

Quick guide on how to complete massachusetts state tax rates and who pays in

Execute Massachusetts State Tax Rates And Who Pays In seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any holdups. Manage Massachusetts State Tax Rates And Who Pays In on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Massachusetts State Tax Rates And Who Pays In effortlessly

- Locate Massachusetts State Tax Rates And Who Pays In and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using the tools specifically available from airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and then click on the Done button to record your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with a few clicks from any device of your choice. Alter and eSign Massachusetts State Tax Rates And Who Pays In and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts state tax rates and who pays in

Create this form in 5 minutes!

How to create an eSignature for the massachusetts state tax rates and who pays in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts 3K fillable form?

The Massachusetts 3K fillable form is a digital document designed for easy completion and submission. It allows users to fill out necessary information electronically, streamlining the process for both individuals and businesses. With airSlate SignNow, you can easily create and manage these forms.

-

How can I access the Massachusetts 3K fillable form?

You can access the Massachusetts 3K fillable form through the airSlate SignNow platform. Simply sign up for an account, and you will have the ability to create, fill, and eSign this form. Our user-friendly interface makes it easy to navigate and find the forms you need.

-

What are the pricing options for using Massachusetts 3K fillable forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose from monthly or annual subscriptions, which provide access to the Massachusetts 3K fillable forms and other features. Check our website for the latest pricing details and promotions.

-

What features does airSlate SignNow offer for Massachusetts 3K fillable forms?

airSlate SignNow provides a range of features for Massachusetts 3K fillable forms, including eSigning, document sharing, and real-time collaboration. You can also customize your forms and automate workflows to enhance efficiency. These features make managing your documents easier and more effective.

-

What are the benefits of using Massachusetts 3K fillable forms?

Using Massachusetts 3K fillable forms offers numerous benefits, such as reducing paperwork and saving time. The digital format allows for quick edits and easy sharing, which enhances productivity. Additionally, eSigning ensures that your documents are legally binding and secure.

-

Can I integrate Massachusetts 3K fillable forms with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage your Massachusetts 3K fillable forms efficiently. This integration helps streamline your document management process.

-

Is it secure to use Massachusetts 3K fillable forms on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Massachusetts 3K fillable forms are protected. We use advanced encryption and authentication methods to safeguard your data, giving you peace of mind while managing your documents online.

Get more for Massachusetts State Tax Rates And Who Pays In

- Fencing contract for contractor pennsylvania form

- Hvac contract for contractor pennsylvania form

- Landscape contract for contractor pennsylvania form

- Pennsylvania commercial form

- Excavator contract for contractor pennsylvania form

- Renovation contract for contractor pennsylvania form

- Concrete mason contract for contractor pennsylvania form

- Demolition contract for contractor pennsylvania form

Find out other Massachusetts State Tax Rates And Who Pays In

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure