Massachusetts Department of Revenue Form 3K 1 2024-2026

What is the Massachusetts Department Of Revenue Form 3K-1

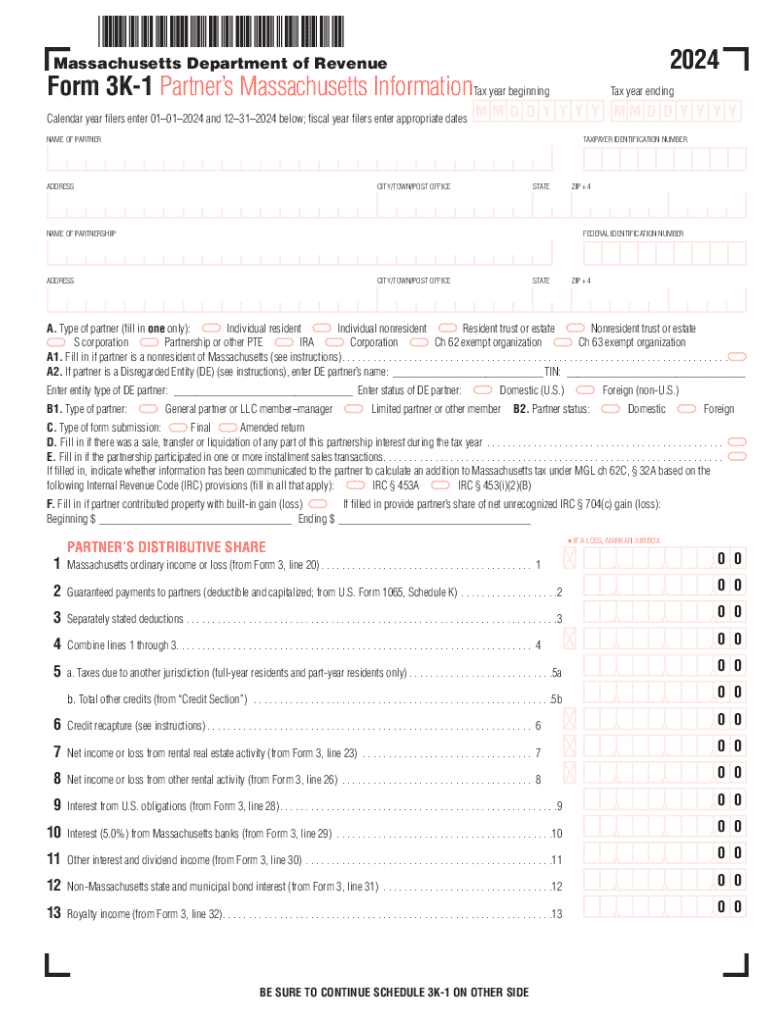

The Massachusetts Department of Revenue Form 3K-1 is a tax document used primarily for reporting income, deductions, and credits for partnerships and S corporations operating within the state. This form is essential for both the entity and its members, as it provides a detailed breakdown of each member's share of the entity's income, losses, and other tax-related information. The Form 3K-1 is a critical component in ensuring compliance with state tax regulations and helps facilitate accurate tax filings for individual taxpayers.

Steps to complete the Massachusetts Department Of Revenue Form 3K-1

Completing the Massachusetts Form 3K-1 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information from the partnership or S corporation, including income statements and balance sheets. Next, fill out the form by entering the entity's name, identification number, and the specific tax year. Then, report each member's share of income, deductions, and credits in the designated sections. It is crucial to double-check all entries for accuracy before submitting the form. Finally, ensure that all members receive their copies of the Form 3K-1 for their personal tax filings.

How to obtain the Massachusetts Department Of Revenue Form 3K-1

The Massachusetts Form 3K-1 can be obtained directly from the Massachusetts Department of Revenue's official website. The form is available in both printable and fillable PDF formats, allowing users to complete it digitally or by hand. Additionally, tax preparation software often includes the Form 3K-1, making it accessible for those who prefer electronic filing. It is important to ensure that you are using the correct version of the form for the applicable tax year to avoid any compliance issues.

Key elements of the Massachusetts Department Of Revenue Form 3K-1

Several key elements must be included when completing the Massachusetts Form 3K-1. These include:

- Entity Information: Name, address, and identification number of the partnership or S corporation.

- Member Information: Details for each member, including their share of income, deductions, and credits.

- Income Reporting: Total income earned by the entity and how it is allocated among members.

- Deductions and Credits: Any applicable deductions and credits that members can claim based on their share.

Accurate reporting of these elements is essential for proper tax compliance and to ensure that each member can accurately report their income on their individual tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Form 3K-1 typically align with the tax return deadlines for partnerships and S corporations. Generally, the form must be filed by the fifteenth day of the third month following the end of the tax year. For entities operating on a calendar year, this means the deadline is March 15. It is important to keep track of these dates to avoid penalties and ensure timely filing for all members involved.

Penalties for Non-Compliance

Failing to file the Massachusetts Form 3K-1 on time or providing inaccurate information can result in significant penalties. These may include fines imposed by the Massachusetts Department of Revenue, which can escalate based on the length of the delay and the severity of the inaccuracies. Additionally, members may face difficulties in claiming deductions or credits on their personal tax returns if the Form 3K-1 is not filed correctly or on time. It is crucial to adhere to all filing requirements to avoid these potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form 3k 1

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form 3k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Schedule 3K?

The Massachusetts Schedule 3K is a tax form used by partnerships and S corporations to report income, deductions, and credits. It is essential for businesses operating in Massachusetts to accurately complete this form to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Massachusetts Schedule 3K?

airSlate SignNow simplifies the process of preparing and eSigning the Massachusetts Schedule 3K by providing an intuitive platform for document management. With our solution, you can easily send, receive, and store your tax documents securely, ensuring that your filings are timely and accurate.

-

What features does airSlate SignNow offer for managing the Massachusetts Schedule 3K?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are particularly beneficial for managing the Massachusetts Schedule 3K. These tools help streamline the workflow, reduce errors, and enhance collaboration among team members.

-

Is airSlate SignNow cost-effective for businesses filing the Massachusetts Schedule 3K?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file the Massachusetts Schedule 3K. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value while managing your document signing needs efficiently.

-

Can I integrate airSlate SignNow with other software for filing the Massachusetts Schedule 3K?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, making it easier to manage your Massachusetts Schedule 3K filings. This integration ensures that your data flows smoothly between platforms, reducing manual entry and potential errors.

-

What are the benefits of using airSlate SignNow for the Massachusetts Schedule 3K?

Using airSlate SignNow for the Massachusetts Schedule 3K provides numerous benefits, including enhanced security, faster turnaround times, and improved accuracy. Our platform allows you to focus on your business while we handle the complexities of document management and eSigning.

-

How secure is airSlate SignNow when handling the Massachusetts Schedule 3K?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Massachusetts Schedule 3K. You can trust that your sensitive information is safe and secure while using our platform.

Get more for Massachusetts Department Of Revenue Form 3K 1

Find out other Massachusetts Department Of Revenue Form 3K 1

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation