PDF Form 3K 1 Partner's Massachusetts InformationTax Mass Gov 2020

What is the Massachusetts Schedule 3K-1?

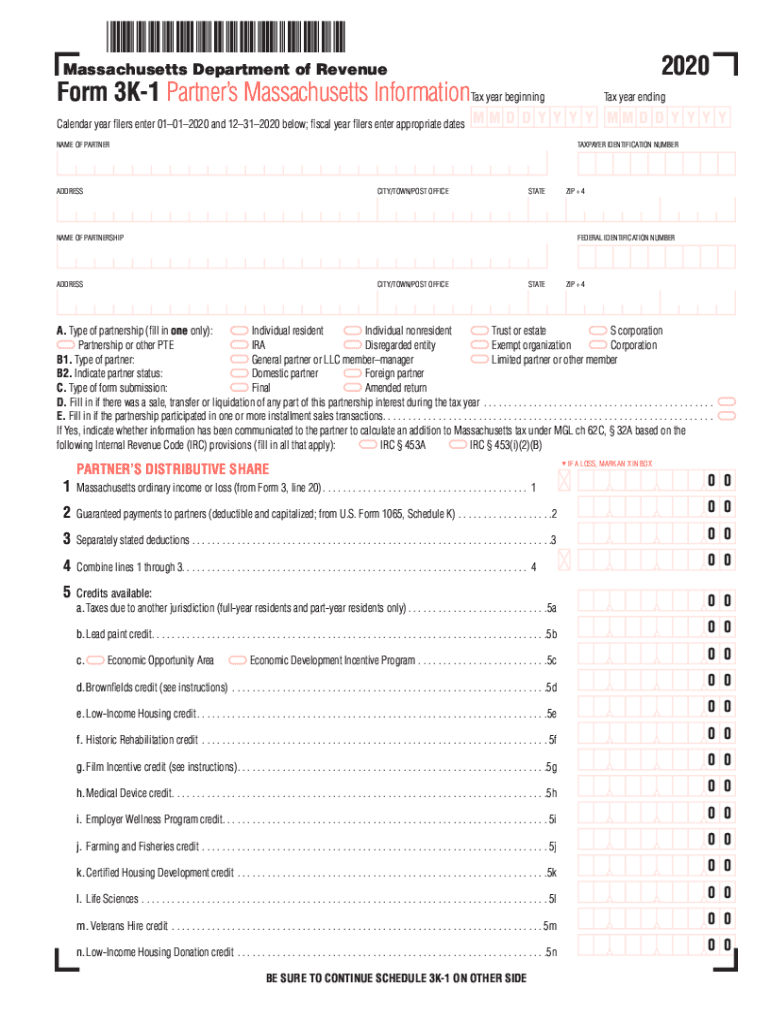

The Massachusetts Schedule 3K-1 is a tax form used by partnerships to report income, deductions, and credits to the state of Massachusetts. This form provides essential information about each partner's share of the partnership's income, which is necessary for individual partners to accurately file their personal income tax returns. The Schedule 3K-1 is similar to the IRS Form K-1 but is specifically tailored to meet Massachusetts tax regulations.

Key Elements of the Massachusetts Schedule 3K-1

The Schedule 3K-1 includes several critical sections that detail the financial activities of the partnership. Key elements include:

- Partner Information: This section identifies each partner, including their name, address, and taxpayer identification number.

- Income Allocation: The form outlines the partner's share of ordinary business income, rental income, and other income types.

- Deductions and Credits: It lists any deductions or credits allocated to the partner, which can reduce their overall tax liability.

- Other Information: This may include details about distributions made to the partner and any other relevant financial data.

Steps to Complete the Massachusetts Schedule 3K-1

Completing the Massachusetts Schedule 3K-1 involves several steps to ensure accuracy and compliance. Here’s a straightforward process:

- Gather necessary financial documents, including partnership income statements and expense reports.

- Fill out the partner's information section with accurate details.

- Calculate the partner's share of income, deductions, and credits based on the partnership's financial data.

- Double-check all entries for accuracy and completeness.

- Provide a copy of the completed Schedule 3K-1 to each partner for their records and tax filing.

Filing Deadlines for the Massachusetts Schedule 3K-1

Timely filing of the Massachusetts Schedule 3K-1 is crucial to avoid penalties. The deadlines typically align with the partnership's tax return due date, which is usually the fifteenth day of the fourth month following the end of the partnership's tax year. For most partnerships operating on a calendar year, this means the form is due by April 15. It is important for partners to receive their Schedule 3K-1 in advance to prepare their personal tax returns.

Legal Use of the Massachusetts Schedule 3K-1

The Massachusetts Schedule 3K-1 is legally binding and must be prepared in accordance with state tax laws. Partners rely on this form to report their income accurately to the Massachusetts Department of Revenue. Failure to provide accurate information can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential to ensure that all information reported on the Schedule 3K-1 is correct and complete.

Digital vs. Paper Version of the Massachusetts Schedule 3K-1

Both digital and paper versions of the Massachusetts Schedule 3K-1 are accepted for filing. The digital version allows for easier data entry and may reduce the likelihood of errors. Additionally, electronic filing can expedite the processing of returns. However, some partnerships may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, ensuring compliance with filing requirements is essential.

Quick guide on how to complete pdf 2020 form 3k 1 partners massachusetts informationtax massgov

Complete PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov effortlessly on any device

Managing documents online has become increasingly favored by both companies and individuals. It offers a great eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your files swiftly without delays. Manage PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to adjust and eSign PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov with ease

- Obtain PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2020 form 3k 1 partners massachusetts informationtax massgov

Create this form in 5 minutes!

How to create an eSignature for the pdf 2020 form 3k 1 partners massachusetts informationtax massgov

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the ma schedule 3k 1 feature in airSlate SignNow?

The ma schedule 3k 1 feature in airSlate SignNow allows users to manage and streamline their document signing process effectively. This feature ensures that all parties involved can easily eSign documents, helping businesses save time and enhance their productivity.

-

How much does the ma schedule 3k 1 feature cost?

Pricing for the ma schedule 3k 1 feature within airSlate SignNow varies depending on the selected plan. We offer various pricing options to accommodate different business sizes and needs, ensuring that you receive a cost-effective solution.

-

What benefits does using ma schedule 3k 1 provide for businesses?

Implementing the ma schedule 3k 1 feature helps businesses streamline their document workflows, improve security, and reduce the time spent on manual processes. This leads to enhanced efficiency and a better overall customer experience.

-

Can I integrate the ma schedule 3k 1 feature with other applications?

Yes, airSlate SignNow supports integrations with various popular applications, making it easy to incorporate the ma schedule 3k 1 feature into your existing workflow. This flexibility allows you to enhance productivity and maintain seamless operations.

-

Is it easy to use the ma schedule 3k 1 feature?

Absolutely! The ma schedule 3k 1 feature is designed with user-friendliness in mind. Even those with minimal technical skills can quickly learn to navigate and utilize the platform effectively for eSigning and document management.

-

What types of documents can I send using ma schedule 3k 1?

With ma schedule 3k 1, you can send a wide variety of documents, including contracts, agreements, and forms that require signatures. This versatility makes it a valuable tool for any business needing secure and legally binding eSignatures.

-

Is customer support available for users of ma schedule 3k 1?

Yes, airSlate SignNow provides comprehensive customer support for users utilizing the ma schedule 3k 1 feature. Our dedicated support team is available to assist you with any questions or issues you may encounter.

Get more for PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov

Find out other PDF Form 3K 1 Partner's Massachusetts InformationTax Mass gov

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement