Power of Attorney and Declaration of Representative the Tax Adviser 2018

What is the Power Of Attorney And Declaration Of Representative The Tax Adviser

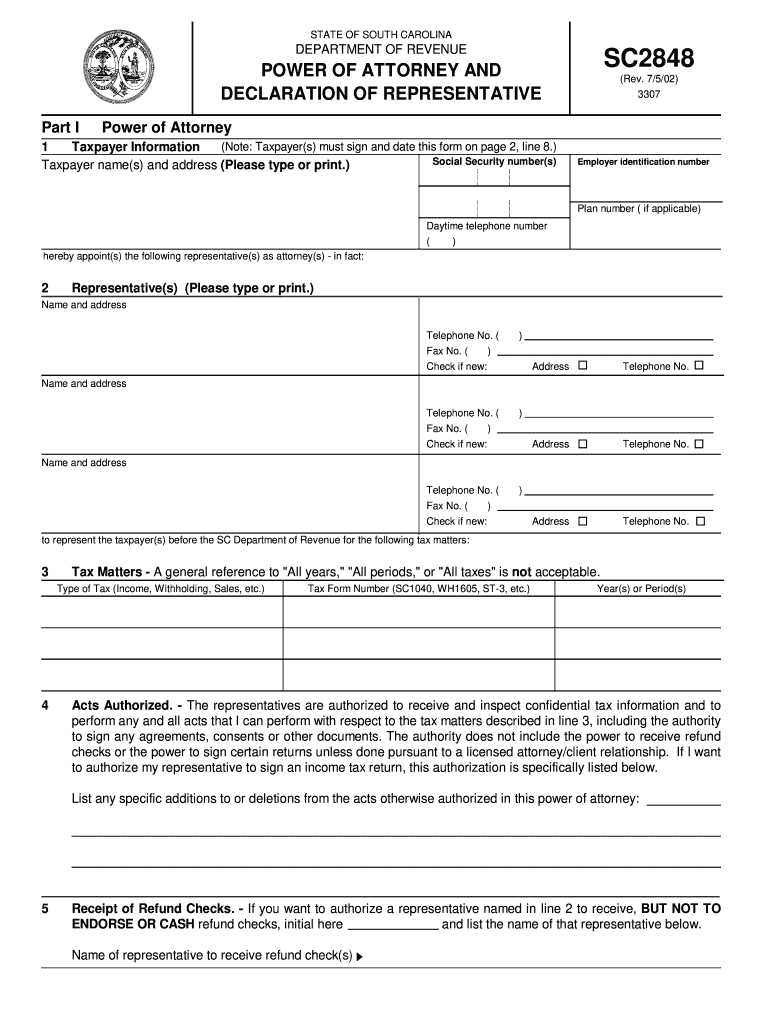

The Power of Attorney and Declaration of Representative for the Tax Adviser is a legal document that allows a designated individual, typically a tax professional, to act on behalf of a taxpayer in matters related to tax filings and communications with the IRS. This document grants the representative the authority to receive confidential tax information, sign tax returns, and represent the taxpayer in front of the IRS. It is crucial for ensuring that the taxpayer's interests are adequately represented and that all necessary tax obligations are met.

Key Elements of the Power Of Attorney And Declaration Of Representative The Tax Adviser

Several key elements define the Power of Attorney and Declaration of Representative. These include:

- Designation of Representative: This specifies who is authorized to act on behalf of the taxpayer.

- Scope of Authority: This outlines the specific powers granted, such as signing documents and accessing tax information.

- Duration: The document may specify how long the authority lasts, which can be until revoked or for a set period.

- Taxpayer Information: The taxpayer's details, including name, address, and taxpayer identification number, must be included.

Steps to Complete the Power Of Attorney And Declaration Of Representative The Tax Adviser

Completing the Power of Attorney and Declaration of Representative involves several important steps:

- Obtain the Form: Access the official form, typically IRS Form 2848, which is used for this purpose.

- Fill Out the Form: Provide accurate information regarding the taxpayer and the designated representative.

- Sign and Date: The taxpayer must sign and date the form to validate it.

- Submit the Form: Send the completed form to the IRS, either electronically or via mail, depending on the submission method chosen.

Legal Use of the Power Of Attorney And Declaration Of Representative The Tax Adviser

The legal use of the Power of Attorney and Declaration of Representative is governed by IRS regulations. It must be executed properly to ensure that the representative can legally act on behalf of the taxpayer. This includes adhering to specific guidelines regarding the completion and submission of the form. The document must also comply with relevant state laws, which can vary, making it essential for taxpayers to understand both federal and state requirements.

IRS Guidelines

The IRS provides specific guidelines for the use of the Power of Attorney and Declaration of Representative. These guidelines include:

- Ensuring the form is filled out completely and accurately.

- Submitting the form to the appropriate IRS office based on the taxpayer's location.

- Understanding that the representative must be a qualified individual, such as a licensed attorney or certified public accountant.

Form Submission Methods (Online / Mail / In-Person)

There are various methods for submitting the Power of Attorney and Declaration of Representative form to the IRS:

- Online Submission: Taxpayers can submit the form electronically through authorized e-file providers.

- Mail: The completed form can be mailed to the appropriate IRS address, which depends on the taxpayer's location.

- In-Person: In certain situations, taxpayers may choose to deliver the form in person at a local IRS office.

Quick guide on how to complete power of attorney and declaration of representative the tax adviser

Effortlessly Complete Power Of Attorney And Declaration Of Representative The Tax Adviser on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Power Of Attorney And Declaration Of Representative The Tax Adviser on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Power Of Attorney And Declaration Of Representative The Tax Adviser

- Locate Power Of Attorney And Declaration Of Representative The Tax Adviser and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Power Of Attorney And Declaration Of Representative The Tax Adviser and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct power of attorney and declaration of representative the tax adviser

Create this form in 5 minutes!

How to create an eSignature for the power of attorney and declaration of representative the tax adviser

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Power Of Attorney And Declaration Of Representative The Tax Adviser?

The Power Of Attorney And Declaration Of Representative The Tax Adviser is a legal document that authorizes a tax adviser to act on your behalf in tax matters. This document allows the tax adviser to represent you in communications with tax authorities, ensuring your interests are managed effectively. It's crucial for individuals and businesses needing assistance with their tax filings.

-

How can airSlate SignNow help with the Power Of Attorney And Declaration Of Representative The Tax Adviser?

airSlate SignNow streamlines the process of creating and signing the Power Of Attorney And Declaration Of Representative The Tax Adviser. With our user-friendly platform, you can quickly generate these documents, obtain signatures, and securely store them. This saves time and ensures compliance with legal requirements.

-

Is there a cost associated with using airSlate SignNow for the Power Of Attorney And Declaration Of Representative The Tax Adviser?

Yes, airSlate SignNow offers various pricing plans based on your business needs, which include features for managing the Power Of Attorney And Declaration Of Representative The Tax Adviser. Our plans are cost-effective, making it easy for businesses of all sizes to access essential e-signature services. Check our pricing page for detailed information on the available options.

-

What benefits do I gain from using airSlate SignNow for my Power Of Attorney And Declaration Of Representative The Tax Adviser?

Using airSlate SignNow for your Power Of Attorney And Declaration Of Representative The Tax Adviser offers numerous benefits, including enhanced security, faster processing times, and reduced paper waste. Our platform allows you to manage documents digitally, ensuring accessibility and convenience. Additionally, you can track all activities related to your documents for peace of mind.

-

Are there integrations available with airSlate SignNow for the Power Of Attorney And Declaration Of Representative The Tax Adviser?

Absolutely, airSlate SignNow integrates seamlessly with various software and applications, enhancing your workflow for the Power Of Attorney And Declaration Of Representative The Tax Adviser. Whether you use customer relationship management (CRM) tools or accounting software, our integrations facilitate easy document management and signature collection. This ensures that your tax documents are always up-to-date and readily accessible.

-

How secure is the Power Of Attorney And Declaration Of Representative The Tax Adviser process with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and compliance standards to protect your Power Of Attorney And Declaration Of Representative The Tax Adviser documents. Our platform regularly undergoes security audits and adheres to industry regulations, ensuring that your sensitive information remains safe. You can trust that your documents are secure when using our services.

-

What types of businesses can benefit from the Power Of Attorney And Declaration Of Representative The Tax Adviser with airSlate SignNow?

Any business that engages in tax-related activities can benefit from the Power Of Attorney And Declaration Of Representative The Tax Adviser using airSlate SignNow. Small businesses, freelancers, and larger corporations can simplify their tax processes signNowly. Our platform streamlines document handling, making it ideal for any organization that requires timely and efficient tax representation.

Get more for Power Of Attorney And Declaration Of Representative The Tax Adviser

Find out other Power Of Attorney And Declaration Of Representative The Tax Adviser

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document