Sc Excise Tax Form 2020

What is the Sc Excise Tax Form

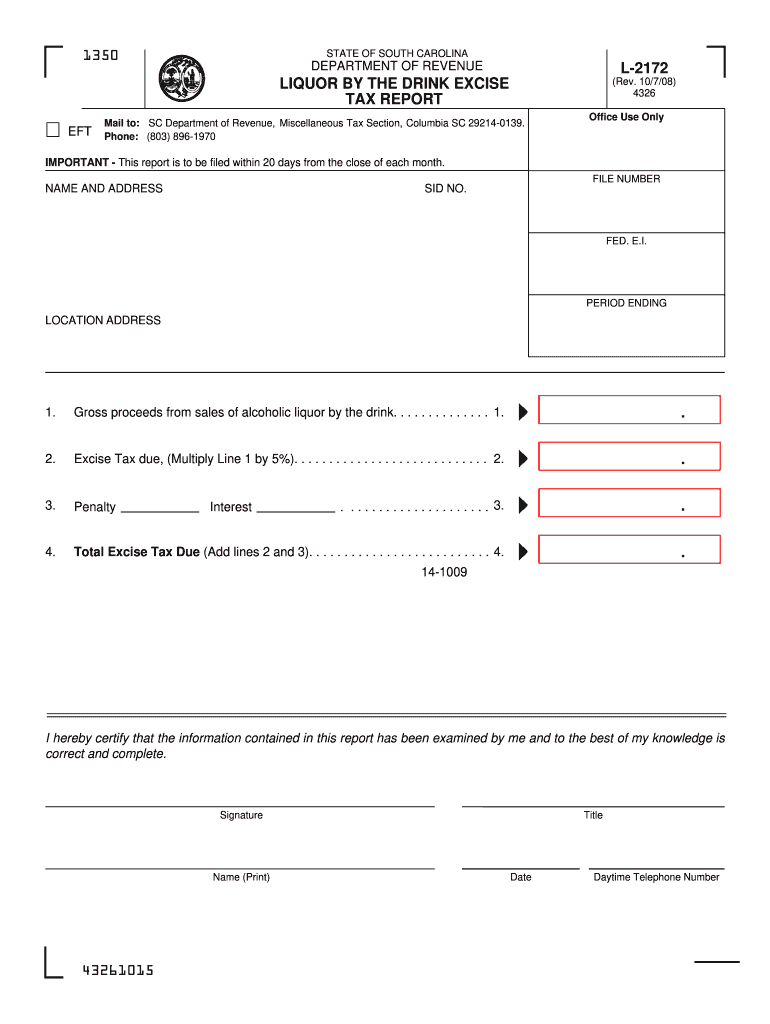

The Sc Excise Tax Form is a specific document used for reporting and paying excise taxes in South Carolina. Excise taxes are typically imposed on specific goods, such as fuel, tobacco, and alcohol, and are often included in the price of the product. This form is essential for businesses and individuals who are required to report their excise tax liabilities to the state government. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax laws.

How to use the Sc Excise Tax Form

Using the Sc Excise Tax Form involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the South Carolina Department of Revenue website or other authorized sources. Next, fill out the form accurately, providing all necessary information regarding your excise tax obligations. This includes details about the type of excise tax being reported, the amount due, and any relevant business information. After completing the form, review it for accuracy before submitting it to the appropriate state agency.

Steps to complete the Sc Excise Tax Form

Completing the Sc Excise Tax Form requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the Sc Excise Tax Form.

- Gather all necessary documentation, including sales records and previous tax filings.

- Fill in your business information, including your name, address, and tax identification number.

- Detail the specific excise taxes being reported, including quantities and rates.

- Calculate the total amount due based on the information provided.

- Review the form for accuracy and completeness.

- Submit the form by the designated deadline, either online or via mail.

Legal use of the Sc Excise Tax Form

The Sc Excise Tax Form must be used in accordance with South Carolina tax laws. This means that all information provided on the form must be truthful and accurate. Falsifying information can lead to penalties, including fines and legal repercussions. Additionally, it is important to keep copies of submitted forms and any supporting documentation for your records, as these may be required in the event of an audit or inquiry by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Sc Excise Tax Form vary depending on the type of excise tax being reported. Generally, these forms must be submitted on a monthly or quarterly basis. It is essential to be aware of the specific deadlines relevant to your situation to avoid late fees or penalties. Keeping a calendar of important dates can help ensure timely compliance with all filing requirements.

Who Issues the Form

The Sc Excise Tax Form is issued by the South Carolina Department of Revenue. This state agency is responsible for the administration of tax laws and the collection of taxes, including excise taxes. For any inquiries regarding the form, including its completion and submission, individuals and businesses should contact the Department of Revenue directly for assistance.

Quick guide on how to complete sc excise tax form 2008

Complete Sc Excise Tax Form seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Sc Excise Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign Sc Excise Tax Form effortlessly

- Find Sc Excise Tax Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark key sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you’d like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or errors that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Sc Excise Tax Form and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc excise tax form 2008

Create this form in 5 minutes!

How to create an eSignature for the sc excise tax form 2008

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the SC Excise Tax Form and why is it important?

The SC Excise Tax Form is a crucial document used by businesses in South Carolina to report and remit excise taxes. It's important because it ensures compliance with state regulations and helps avoid potential penalties for non-filing. Using airSlate SignNow simplifies the process of completing and submitting this form electronically.

-

How can airSlate SignNow help with completing the SC Excise Tax Form?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and sign the SC Excise Tax Form online. With our eSignature feature, signatures can be added securely, ensuring that your form is completed efficiently and accurately. This streamlines the process and reduces the time you spend on paperwork.

-

Is there a cost associated with using airSlate SignNow for the SC Excise Tax Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses when filing the SC Excise Tax Form. Our competitive pricing ensures that you receive maximum value for a powerful eSigning solution. Consider starting with a free trial to see how it fits your requirements.

-

Can I integrate airSlate SignNow with other software to manage the SC Excise Tax Form?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of business applications, allowing you to manage the SC Excise Tax Form alongside your existing workflows. Whether using CRM systems or document management tools, our integrations enhance efficiency and facilitate better document organization.

-

What are the benefits of using airSlate SignNow for the SC Excise Tax Form?

Using airSlate SignNow for the SC Excise Tax Form offers numerous benefits, including time savings, greater accuracy, and enhanced security. Our platform ensures your documents are signed within minutes and securely stored, eliminating the hassle of paper documents. This enhances your overall efficiency in managing tax compliance.

-

How secure is the airSlate SignNow platform for handling the SC Excise Tax Form?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the SC Excise Tax Form. Our platform employs industry-standard encryption and secure data storage practices to protect your information. You can confidently use our service, knowing that your documents are safe and compliant.

-

Can multiple users collaborate on the SC Excise Tax Form with airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration among multiple users on the SC Excise Tax Form. You can invite team members to contribute, review, and sign the document, ensuring everyone is on the same page. This feature streamlines the collaboration process and facilitates quicker approvals.

Get more for Sc Excise Tax Form

Find out other Sc Excise Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors