Liquor by the Drink Excise Tax ReportL 2172 SC GOV 2022-2026

Understanding the SC Liquor By The Drink Excise Tax Report (L-2172)

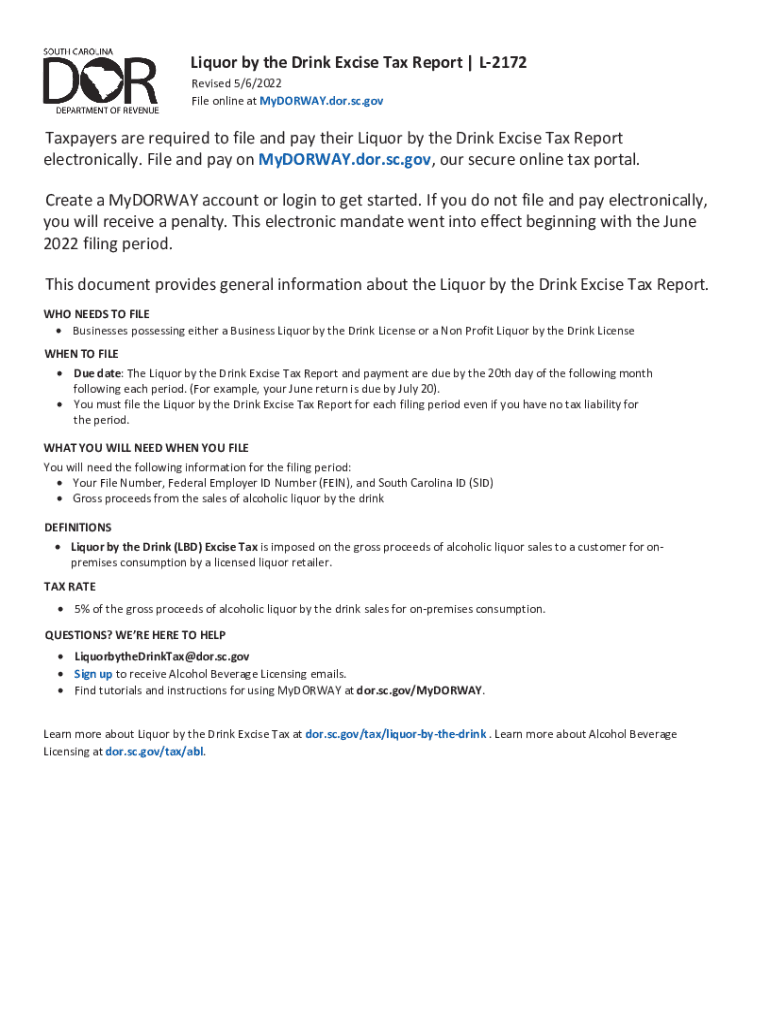

The SC Liquor By The Drink Excise Tax Report, also known as form L-2172, is a crucial document for businesses that serve alcoholic beverages in South Carolina. This form is designed to report the excise tax owed on liquor sold by the drink. The tax is imposed on establishments that sell alcohol for consumption on the premises, and it is essential for compliance with state regulations. Understanding this form helps businesses manage their tax obligations effectively and ensures they adhere to state laws.

Steps to Complete the SC Liquor By The Drink Excise Tax Report (L-2172)

Completing the L-2172 form involves several key steps to ensure accuracy and compliance. First, gather all necessary sales data for the reporting period, including the total amount of liquor sold. Next, calculate the excise tax based on the applicable rates set by the state. Fill out the form by entering the required information, such as the business name, address, and total tax due. Finally, review the completed form for any errors before submitting it to the South Carolina Department of Revenue.

Required Documents for the SC Liquor By The Drink Excise Tax Report (L-2172)

To successfully complete the L-2172 form, certain documents are necessary. These typically include:

- Sales records for the reporting period, detailing liquor sales.

- Previous L-2172 forms, if applicable, for reference.

- Any correspondence with the South Carolina Department of Revenue regarding tax matters.

Having these documents on hand can streamline the process and help ensure that all information reported is accurate.

Legal Use of the SC Liquor By The Drink Excise Tax Report (L-2172)

The L-2172 form is legally binding and must be completed in accordance with South Carolina tax laws. Businesses must ensure that the information provided is truthful and accurate to avoid penalties. The form serves as an official record of the excise tax owed and is subject to review by the state. Proper use of this form not only fulfills legal obligations but also contributes to responsible business practices within the alcohol service industry.

Filing Deadlines for the SC Liquor By The Drink Excise Tax Report (L-2172)

Timely filing of the L-2172 form is essential to avoid late fees and penalties. The South Carolina Department of Revenue typically sets specific deadlines based on the reporting period. Businesses should be aware of these deadlines and plan accordingly to ensure that their forms are submitted on time. Missing the deadline can result in additional charges and complications with tax compliance.

Form Submission Methods for the SC Liquor By The Drink Excise Tax Report (L-2172)

The L-2172 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the South Carolina Department of Revenue's website.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated Department of Revenue offices.

Choosing the right submission method can help ensure that the form is processed efficiently.

Quick guide on how to complete liquor by the drink excise tax reportl 2172 scgov

Complete Liquor By The Drink Excise Tax ReportL 2172 SC GOV effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delay. Manage Liquor By The Drink Excise Tax ReportL 2172 SC GOV on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to edit and eSign Liquor By The Drink Excise Tax ReportL 2172 SC GOV with ease

- Locate Liquor By The Drink Excise Tax ReportL 2172 SC GOV and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight crucial parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Liquor By The Drink Excise Tax ReportL 2172 SC GOV to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct liquor by the drink excise tax reportl 2172 scgov

Create this form in 5 minutes!

People also ask

-

What is SC liquor tax and how does it apply to my business?

SC liquor tax refers to the taxes imposed on the sale of alcoholic beverages in South Carolina. Businesses selling liquor must comply with state regulations regarding the collection and reporting of these taxes. Understanding SC liquor tax is essential for ensuring your company's compliance and financial health.

-

How does airSlate SignNow help with managing SC liquor tax documentation?

airSlate SignNow provides an efficient platform for managing all your SC liquor tax documentation electronically. With our eSignature capabilities, you can quickly sign and send documents required for SC liquor tax compliance without any hassle. This streamlined process saves time and ensures accuracy in your tax filings.

-

Are there any additional fees associated with SC liquor tax management using airSlate SignNow?

When using airSlate SignNow for SC liquor tax management, we offer a transparent pricing model with no hidden fees. You pay for the features that best suit your business needs, allowing you to allocate resources efficiently while managing SC liquor tax documentation seamlessly.

-

What features does airSlate SignNow offer to simplify SC liquor tax filings?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage that simplify SC liquor tax filings. These tools help you keep your documents organized and ensure that all necessary paperwork is ready for submission, reducing the risk of errors.

-

Can I integrate airSlate SignNow with my existing accounting software for SC liquor tax purposes?

Yes, airSlate SignNow easily integrates with a variety of accounting software to support SC liquor tax purposes. This integration allows you to synchronize your documents and transactions, ensuring that all your SC liquor tax-related records are accurately maintained and readily accessible.

-

What are the benefits of using airSlate SignNow for SC liquor tax management?

Using airSlate SignNow for SC liquor tax management provides benefits such as improved compliance, reduced paperwork, and faster processing times. Our platform enhances your overall document management, giving you peace of mind knowing that your SC liquor tax documents are handled efficiently.

-

Is airSlate SignNow suitable for small businesses dealing with SC liquor tax?

Absolutely! AirSlate SignNow is designed to be user-friendly and cost-effective, making it suitable for small businesses grappling with SC liquor tax issues. Our flexible plans cater to the specific needs of smaller businesses, helping them manage their documents without overspending.

Get more for Liquor By The Drink Excise Tax ReportL 2172 SC GOV

- Warning of default on commercial lease nebraska form

- Warning of default on residential lease nebraska form

- Landlord tenant closing statement to reconcile security deposit nebraska form

- Ne name for form

- Name change notification form nebraska

- Commercial building or space lease nebraska form

- Nebraska relative caretaker legal documents package nebraska form

- Nebraska standby temporary guardian legal documents package nebraska form

Find out other Liquor By The Drink Excise Tax ReportL 2172 SC GOV

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed