South Carolina Department of Revenue Form C 268 2018

What is the South Carolina Department Of Revenue Form C 268

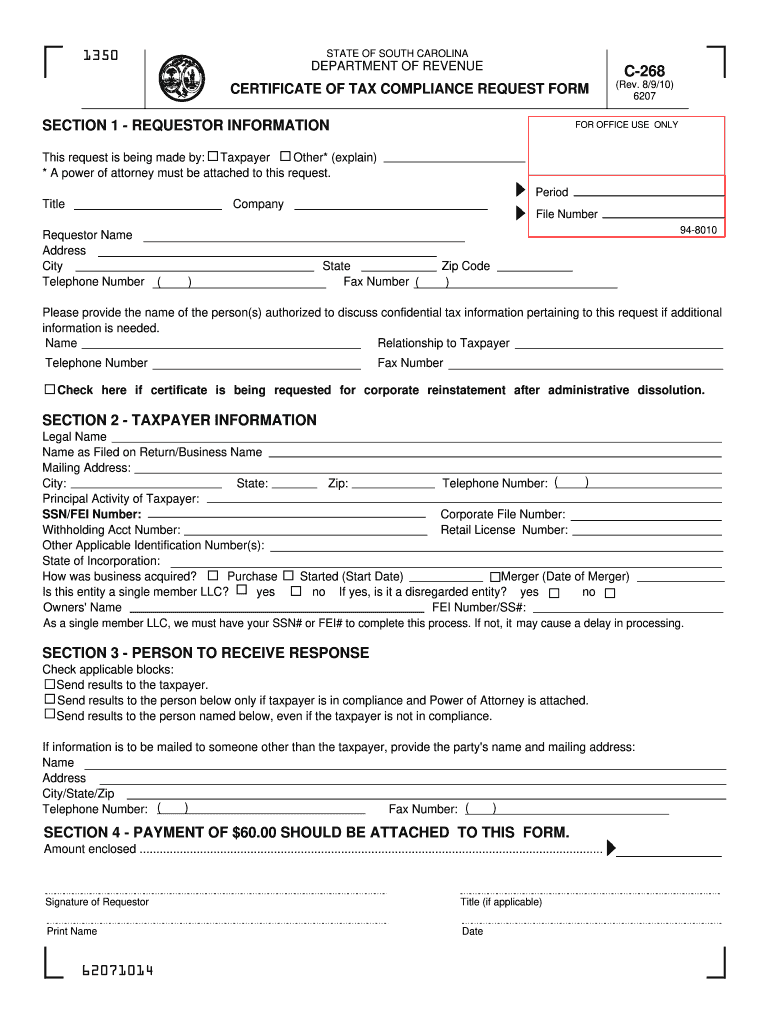

The South Carolina Department Of Revenue Form C 268 is a specific tax form used for reporting certain financial information to the state revenue department. This form is essential for individuals and businesses that need to disclose their tax liabilities accurately. It is primarily used for tax compliance purposes, ensuring that taxpayers meet their obligations under South Carolina tax laws.

How to use the South Carolina Department Of Revenue Form C 268

Using the South Carolina Department Of Revenue Form C 268 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form by entering the required information in the designated fields. Ensure that all figures are accurate and reflect your current financial situation. Finally, review the completed form for any errors before submission to avoid delays or penalties.

Steps to complete the South Carolina Department Of Revenue Form C 268

Completing the South Carolina Department Of Revenue Form C 268 requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, including income statements and expense records.

- Access the form from the South Carolina Department Of Revenue website or other official sources.

- Fill in personal identification information, including your name, address, and Social Security number.

- Input your financial data accurately, ensuring all calculations are correct.

- Review the form thoroughly for any mistakes or omissions.

- Sign and date the form before submission.

Legal use of the South Carolina Department Of Revenue Form C 268

The legal use of the South Carolina Department Of Revenue Form C 268 is governed by state tax laws. This form must be completed accurately and submitted by the required deadlines to ensure compliance. Failure to use the form correctly can result in penalties, including fines or additional tax liabilities. It is essential to understand the legal implications of the information provided on this form, as it may be subject to review by the state revenue department.

Form Submission Methods

The South Carolina Department Of Revenue Form C 268 can be submitted through various methods. Taxpayers have the option to file the form online via the South Carolina Department Of Revenue's electronic filing system. Alternatively, the form can be mailed to the appropriate department address or submitted in person at designated state offices. Each submission method has specific guidelines and deadlines, so it is crucial to choose the most convenient and compliant option.

Filing Deadlines / Important Dates

Filing deadlines for the South Carolina Department Of Revenue Form C 268 are critical for compliance. Typically, the form must be submitted by the state’s tax deadline, which aligns with federal tax filing dates. Taxpayers should be aware of any specific dates that may apply to their situation, such as extensions or changes in filing requirements. Keeping track of these deadlines helps avoid late fees and ensures timely processing of tax returns.

Quick guide on how to complete south carolina department of revenue form c 268 2010

Complete South Carolina Department Of Revenue Form C 268 smoothly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle South Carolina Department Of Revenue Form C 268 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign South Carolina Department Of Revenue Form C 268 effortlessly

- Find South Carolina Department Of Revenue Form C 268 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to confirm your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign South Carolina Department Of Revenue Form C 268 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct south carolina department of revenue form c 268 2010

Create this form in 5 minutes!

How to create an eSignature for the south carolina department of revenue form c 268 2010

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the South Carolina Department Of Revenue Form C 268?

The South Carolina Department Of Revenue Form C 268 is a tax form used for certain tax-related transactions within the state. This form is essential for businesses to report specific income and deductions. Understanding its purpose ensures compliance with state laws and effective tax management.

-

How can airSlate SignNow help with the South Carolina Department Of Revenue Form C 268?

airSlate SignNow provides users an efficient way to complete and eSign the South Carolina Department Of Revenue Form C 268. You can fill out the form digitally, ensuring accuracy and reducing the chances of errors. Our solution also streamlines the signing process, making it quick and convenient.

-

Is there a cost associated with using airSlate SignNow for the South Carolina Department Of Revenue Form C 268?

Yes, airSlate SignNow offers affordable pricing plans tailored to fit different business needs. The cost varies based on the features and tools included in your plan. Investing in our platform enhances efficiency when managing your South Carolina Department Of Revenue Form C 268 and other documents.

-

What features does airSlate SignNow offer for handling the South Carolina Department Of Revenue Form C 268?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking. These features simplify the process of completing the South Carolina Department Of Revenue Form C 268, allowing users to manage paperwork more efficiently. Additionally, our platform offers integration options for seamless workflow.

-

Can I integrate airSlate SignNow with other software for managing the South Carolina Department Of Revenue Form C 268?

Absolutely! airSlate SignNow supports integrations with various popular applications such as Google Drive and Dropbox. These integrations allow users to access and manage their South Carolina Department Of Revenue Form C 268 in conjunction with their existing tools, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the South Carolina Department Of Revenue Form C 268?

Using airSlate SignNow for the South Carolina Department Of Revenue Form C 268 streamlines the document management process. Our platform reduces turnaround time and increases accuracy through digital forms and eSigning capabilities. Additionally, it ensures that your documents are securely stored and easily accessible.

-

Is airSlate SignNow secure for submitting the South Carolina Department Of Revenue Form C 268?

Yes, airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption protocols and secure storage to protect all information, including the South Carolina Department Of Revenue Form C 268. You can submit your documents with confidence knowing they are safe from unauthorized access.

Get more for South Carolina Department Of Revenue Form C 268

- Pgcps shared housing form

- Wsib form 7 932191

- Cara isi borang cpd lb form

- Usarec form 3 1

- Dd form 2475

- Temporary power request santa rosa county santarosa fl form

- Request for electrical inspection for release of power request for electrical inspection for release of power form

- National school lunch program approval letter form

Find out other South Carolina Department Of Revenue Form C 268

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online