Dor Sc Govforms SiteForms1350 DEPARTMENT of REVENUE C 268 CERTIFICATE of TAX 2022

Understanding the South Carolina Certificate of Tax Compliance

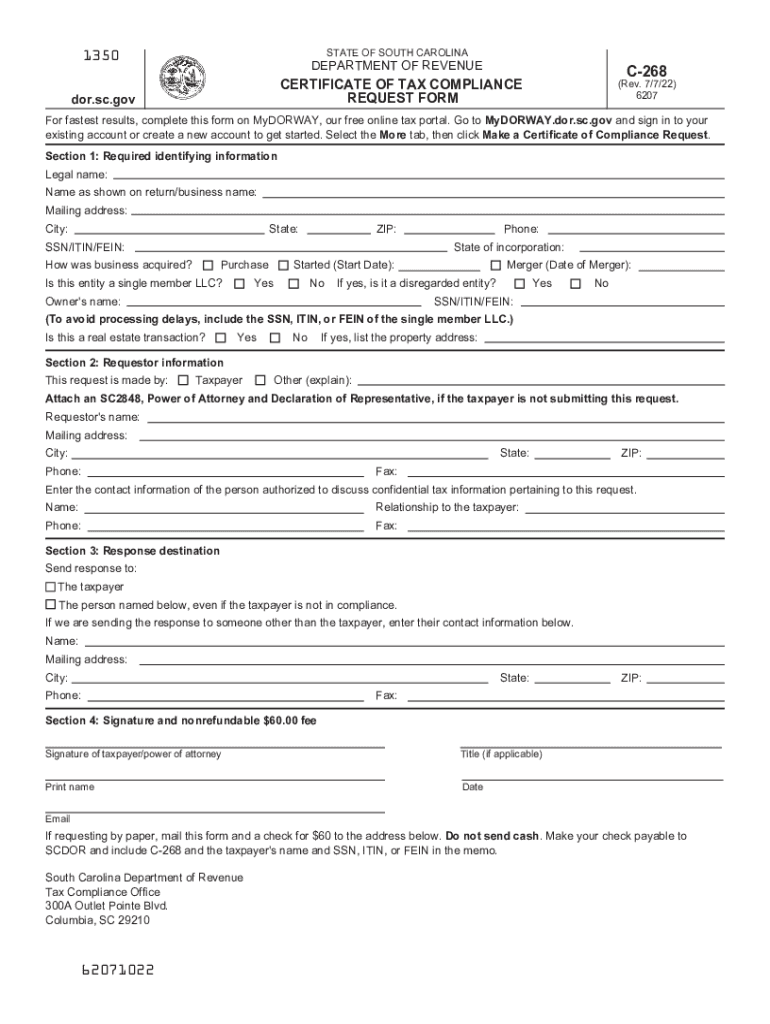

The South Carolina Certificate of Tax Compliance is a crucial document issued by the South Carolina Department of Revenue (SCDOR). This certificate verifies that a business or individual has fulfilled all tax obligations to the state. It is often required for various transactions, including business licenses, permits, or when applying for loans. The certificate serves as proof that the taxpayer is in good standing with the state’s tax authority.

Steps to Complete the South Carolina C-268 Form

Completing the South Carolina C-268 form, which is the official request for the Certificate of Tax Compliance, involves several key steps:

- Gather necessary information, including your tax identification number and details about your tax filings.

- Access the C-268 form on the SCDOR website or through authorized platforms.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form online, by mail, or in person, as per your preference.

Required Documents for the C-268 Form

When applying for the Certificate of Tax Compliance, certain documents may be necessary to support your request. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Tax returns or documentation showing compliance with state tax obligations.

- Any additional forms or documents specified by the SCDOR.

Legal Use of the Certificate of Tax Compliance

The Certificate of Tax Compliance has legal significance and can be used in various circumstances. It is often required for:

- Obtaining business licenses and permits.

- Securing financing or loans from financial institutions.

- Participating in government contracts or bidding processes.

Ensuring that you possess this certificate can facilitate smoother business operations and compliance with state regulations.

Submission Methods for the C-268 Form

There are multiple ways to submit the South Carolina C-268 form, allowing for flexibility based on your needs:

- Online Submission: Complete and submit the form through the SCDOR's online portal, ensuring immediate processing.

- Mail Submission: Print the completed form and send it to the designated address provided by the SCDOR.

- In-Person Submission: Visit a local SCDOR office to submit the form directly and receive immediate assistance.

State-Specific Rules for Tax Compliance

Each state has its own regulations regarding tax compliance, and South Carolina is no exception. Familiarizing yourself with the specific rules can help ensure compliance and avoid penalties. Key aspects include:

- Understanding filing deadlines for various tax types.

- Recognizing the importance of maintaining accurate records of all tax filings.

- Being aware of any changes in state tax laws that may affect your compliance status.

Staying informed about these rules can help you maintain good standing with the SCDOR.

Quick guide on how to complete dorscgovforms siteforms1350 department of revenue c 268 certificate of tax

Complete Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process now.

How to modify and eSign Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX with ease

- Obtain Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign function, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorscgovforms siteforms1350 department of revenue c 268 certificate of tax

Create this form in 5 minutes!

People also ask

-

What is a certificate of tax compliance in South Carolina?

A certificate of tax compliance in South Carolina is a document issued by the South Carolina Department of Revenue. It verifies that a business has paid all required taxes and is in good standing. This certificate is often necessary when applying for licenses, contracts, or financing.

-

How can airSlate SignNow help with obtaining a certificate of tax compliance in South Carolina?

airSlate SignNow provides a seamless way to eSign the documents needed for your certificate of tax compliance in South Carolina. Our platform simplifies the document sending and signing process, ensuring that you can quickly complete any necessary paperwork. With our intuitive interface, you can efficiently manage your compliance documents.

-

What are the pricing options for airSlate SignNow when preparing for a certificate of tax compliance in South Carolina?

airSlate SignNow offers various pricing plans to suit different business needs, including options tailored for small businesses and larger enterprises. Pricing is competitive, allowing you to choose a plan that supports your operations without excessive costs. The investment provides access to helpful features that simplify obtaining tax compliance documentation.

-

What features does airSlate SignNow offer that are beneficial for handling tax compliance documents in South Carolina?

airSlate SignNow features electronic signatures, template management, and real-time document tracking, which are crucial for managing tax compliance documents in South Carolina. These features not only enhance efficiency but also ensure that all signed documents are securely stored and easily accessible. You can streamline the preparation of your certificate of tax compliance.

-

Why is it important to have a certificate of tax compliance in South Carolina?

Having a certificate of tax compliance in South Carolina is important as it demonstrates your business's financial responsibility and adherence to state tax laws. This certificate can be required for securing contracts, licensing, and financing opportunities. Being compliant can also enhance your business credibility and foster trust with clients.

-

Can airSlate SignNow integrate with other tools to assist in obtaining a certificate of tax compliance in South Carolina?

Yes, airSlate SignNow offers integrations with various third-party applications and services that can help manage the process of obtaining a certificate of tax compliance in South Carolina. These integrations allow for better workflow management, enabling you to pull data from existing systems and keep documents organized. This makes it easier to stay on top of compliance needs.

-

What are the benefits of using airSlate SignNow for eSigning tax compliance documents?

Using airSlate SignNow for eSigning tax compliance documents offers several benefits, including time savings, enhanced security, and improved tracking capabilities. With electronic signatures, you can expedite the signing process, reducing delays associated with traditional methods. Furthermore, our platform ensures that each document is securely signed and stored, providing peace of mind.

Get more for Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX

- Complex will with credit shelter marital trust for large estates north dakota form

- Nd separation form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497317680 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497317681 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497317682 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497317683 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497317684 form

- North dakota divorce get form

Find out other Dor sc govforms siteForms1350 DEPARTMENT OF REVENUE C 268 CERTIFICATE OF TAX

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple