Form St 3 2019

What is the Form St 3

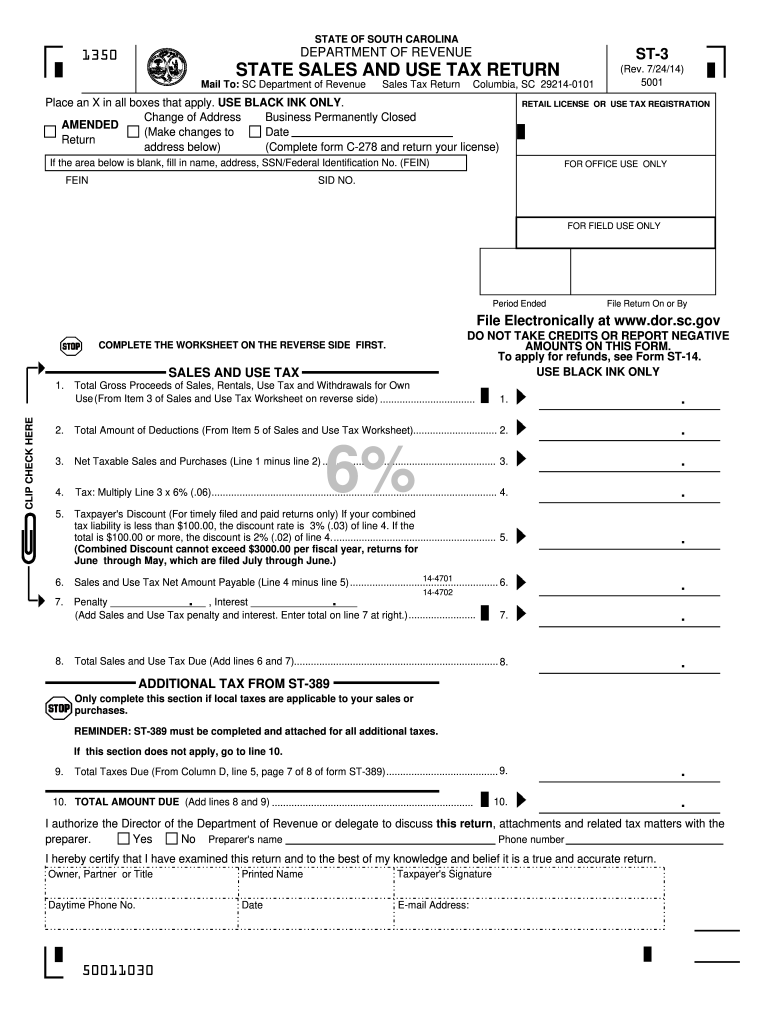

The Form St 3 is a specific document used primarily for sales tax exemption purposes in the United States. This form allows eligible organizations, such as non-profits and government entities, to purchase goods or services without incurring sales tax. By providing this form to sellers, exempt organizations can facilitate tax-free transactions, ensuring compliance with state tax regulations.

How to use the Form St 3

To effectively use the Form St 3, eligible organizations must complete the form accurately and provide it to vendors at the time of purchase. This includes filling out the organization’s name, address, and the reason for the exemption. It is essential to ensure that the form is signed by an authorized representative of the organization to validate the exemption claim. Vendors are required to keep this form on file as proof of the tax-exempt status for their records.

Steps to complete the Form St 3

Completing the Form St 3 involves several straightforward steps:

- Gather necessary information about your organization, including its legal name and address.

- Indicate the reason for the tax exemption, ensuring it aligns with state regulations.

- Provide the name and title of the authorized representative who will sign the form.

- Review the completed form for accuracy before submission.

- Sign and date the form to validate it.

Legal use of the Form St 3

The legal use of the Form St 3 is crucial for maintaining compliance with state tax laws. Organizations must ensure they meet the eligibility criteria for tax exemption and use the form solely for qualifying purchases. Misuse of the form, such as using it for personal purchases or for items not eligible for exemption, can lead to penalties and fines. It is important to understand the legal implications of using the form to avoid any potential issues.

Filing Deadlines / Important Dates

While the Form St 3 itself does not have specific filing deadlines, organizations must be aware of the timelines associated with their purchases. It is advisable to provide the form to vendors at the time of transaction to ensure that the sales tax exemption is applied correctly. Additionally, organizations should keep track of any changes in state tax laws that may affect their eligibility for using the Form St 3.

Form Submission Methods (Online / Mail / In-Person)

The Form St 3 is typically submitted directly to vendors rather than to a government agency. Organizations can present the form in person, mail it, or submit it electronically, depending on the vendor's requirements. It is essential to confirm with the vendor about their preferred method of receiving the form to ensure that the tax exemption is honored.

Quick guide on how to complete 2014 form st 3

Manage Form St 3 easily on any device

Digital document handling has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed forms, allowing you to access the correct document and securely save it online. airSlate SignNow equips you with all the tools necessary to create, revise, and eSign your documents swiftly without delays. Manage Form St 3 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form St 3 effortlessly

- Find Form St 3 and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important parts of the documents or hide sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Form St 3 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form st 3

Create this form in 5 minutes!

How to create an eSignature for the 2014 form st 3

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is Form St 3 and how can airSlate SignNow help?

Form St 3 is a tax form used for reporting and paying taxes. With airSlate SignNow, you can easily create, send, and eSign Form St 3 digitally, streamlining your tax filing process and ensuring compliance with tax regulations.

-

How does airSlate SignNow support eSigning of Form St 3?

airSlate SignNow allows you to eSign Form St 3 securely and legally. Our platform provides an intuitive interface that guides you through the signing process, making it simple to sign documents anytime and anywhere.

-

What are the pricing plans for using airSlate SignNow for Form St 3?

Our pricing plans are designed to be cost-effective, ensuring you get great value when managing documents like Form St 3. We offer flexible plans to meet various needs, including pay-per-use options and monthly subscriptions tailored for both individuals and businesses.

-

Can I send Form St 3 directly through airSlate SignNow?

Yes, you can send Form St 3 directly from airSlate SignNow. Our platform enables you to upload your completed form, add recipient details, and send it out for eSigning in just a few clicks.

-

What features does airSlate SignNow provide for managing Form St 3?

AirSlate SignNow offers powerful features for managing Form St 3, including template creation, automated workflows, and status tracking. These tools help you streamline your document management process and enhance collaboration.

-

Is it possible to integrate airSlate SignNow with other applications for Form St 3 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow for Form St 3. Connect with CRM systems, cloud storage services, and project management tools to maximize efficiency.

-

What security measures are in place for eSigning Form St 3 with airSlate SignNow?

Your security is our priority. When eSigning Form St 3 on airSlate SignNow, your data is protected with industry-standard encryption, secure authentication, and compliance with electronic signature laws.

Get more for Form St 3

Find out other Form St 3

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple