Uniform Policies and Procedures Manual for Value Adjustment Boards 2009

What is the FL 490port transfer assessment form?

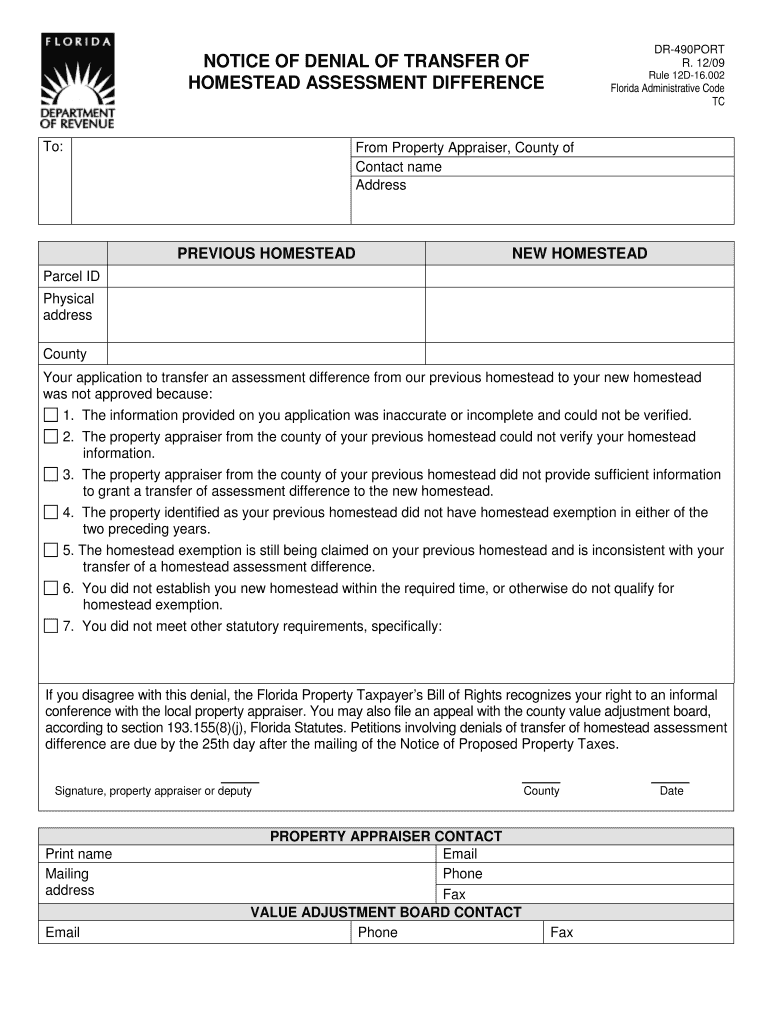

The FL 490port transfer assessment form is a crucial document used in the property assessment process in the United States. This form is specifically designed for property owners who wish to transfer their homestead exemption benefits when moving to a new property. It ensures that the assessment of property taxes reflects the appropriate exemptions and benefits that the owner is entitled to. Understanding this form is essential for homeowners looking to maintain their tax advantages during a relocation.

Steps to complete the FL 490port transfer assessment form

Completing the FL 490port transfer assessment form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your previous property details and the new property address. Next, fill out the form with accurate data, ensuring that all sections are completed. Pay particular attention to the eligibility criteria for the homestead exemption, as this will affect your tax benefits. Once the form is filled out, review it for any errors before submission. Finally, submit the form to the appropriate local tax authority, either online or by mail, depending on your jurisdiction's requirements.

Legal use of the FL 490port transfer assessment form

The legal use of the FL 490port transfer assessment form is governed by state laws regarding property taxes and homestead exemptions. This form must be completed and submitted in accordance with the regulations set forth by local tax authorities. It is important to ensure that the information provided is truthful and accurate, as any discrepancies could lead to penalties or denial of the homestead exemption. Familiarity with state-specific rules and compliance requirements is essential for the legal validity of the form.

Eligibility criteria for the FL 490port transfer assessment form

Eligibility for using the FL 490port transfer assessment form typically includes criteria such as ownership of the property, the nature of the homestead exemption, and the timeline for the property transfer. Homeowners must have previously claimed a homestead exemption on their prior property and must be moving to a new primary residence. Additionally, the new property must meet the necessary qualifications for the exemption. It is advisable to review local regulations to confirm eligibility before completing the form.

Form submission methods for the FL 490port transfer assessment form

Submitting the FL 490port transfer assessment form can typically be done through various methods, including online submission, mailing a physical copy, or in-person delivery to the local tax office. Each method may have specific requirements and processing times, so it is important to choose the most efficient option based on your circumstances. Online submission is often preferred for its speed and convenience, while in-person submission may provide immediate confirmation of receipt.

Key elements of the FL 490port transfer assessment form

The FL 490port transfer assessment form includes several key elements that must be accurately completed. These elements typically consist of the property owner's name, previous and new property addresses, details regarding the homestead exemption, and any relevant identification numbers. Additionally, the form may require signatures from the property owner and possibly other parties involved in the transfer. Ensuring that all key elements are correctly filled out is essential for the successful processing of the form.

Quick guide on how to complete uniform policies and procedures manual for value adjustment boards

Complete Uniform Policies And Procedures Manual For Value Adjustment Boards seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Uniform Policies And Procedures Manual For Value Adjustment Boards on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Uniform Policies And Procedures Manual For Value Adjustment Boards effortlessly

- Locate Uniform Policies And Procedures Manual For Value Adjustment Boards and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Uniform Policies And Procedures Manual For Value Adjustment Boards and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uniform policies and procedures manual for value adjustment boards

Create this form in 5 minutes!

How to create an eSignature for the uniform policies and procedures manual for value adjustment boards

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the FL 490port transfer assessment form?

The FL 490port transfer assessment form is a comprehensive document designed for businesses to streamline their transfer assessment processes. This form ensures that all necessary information is collected efficiently, enabling quicker decision-making and compliance with industry standards.

-

How can I access the FL 490port transfer assessment form?

You can easily access the FL 490port transfer assessment form through airSlate SignNow's user-friendly platform. Once you create an account, you can download the form or fill it out electronically for immediate use, saving time and resources.

-

Is the FL 490port transfer assessment form customizable?

Yes, the FL 490port transfer assessment form can be fully customized to meet your business's specific needs. With airSlate SignNow, you can modify fields, add branding elements, and tailor the form to ensure it aligns with your operational requirements.

-

What are the benefits of using the FL 490port transfer assessment form?

Using the FL 490port transfer assessment form streamlines your workflow by facilitating quicker data collection and reducing manual errors. This form also enhances compliance and ensures that all necessary documentation is collected correctly and efficiently.

-

How much does it cost to use the FL 490port transfer assessment form with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the FL 490port transfer assessment form. Pricing varies based on features and user needs, but the cost-effectiveness of our solutions ensures you get great value for your investment.

-

Can the FL 490port transfer assessment form be integrated with other tools?

Absolutely! The FL 490port transfer assessment form can seamlessly integrate with various business applications, including CRMs and workflow management systems. This integration helps ensure data consistency and efficiency across all platforms you use.

-

Is the FL 490port transfer assessment form secure?

Yes, the FL 490port transfer assessment form utilizes robust security measures to protect your sensitive information. airSlate SignNow prioritizes data safety with encryption and secure cloud storage, ensuring that your documents are safe from unauthorized access.

Get more for Uniform Policies And Procedures Manual For Value Adjustment Boards

- Planilla trimestral departamento del trabajo form

- Bpomas additional member form

- Reiseregning skjema form

- Chalazion consent form

- Oppenheimer ira distribution request form

- Cloze ing in on science form

- Mixed addition and subtraction word problems for grade 3 pdf form

- California death certificate form pdf

Find out other Uniform Policies And Procedures Manual For Value Adjustment Boards

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document