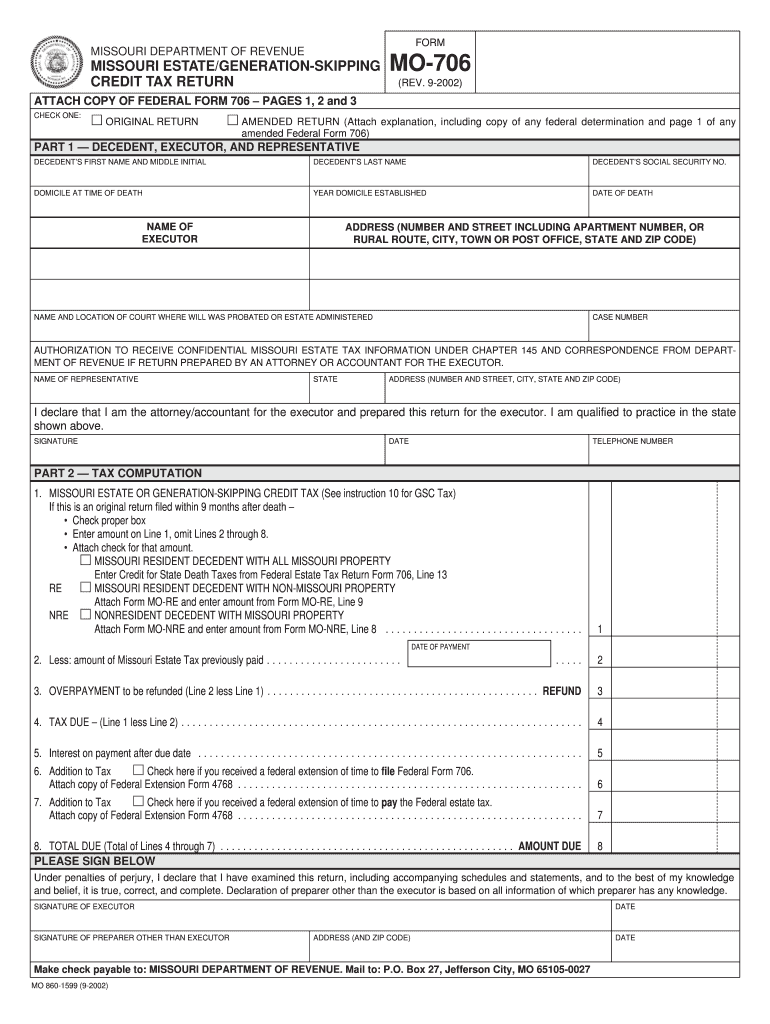

MISSOURI DEPARTMENT of REVENUE MO 706 MISSOURI ESTATE Form

What is the Missouri Department of Revenue MO 706 Estate Tax Return?

The Missouri Department of Revenue MO 706 Estate Tax Return is a form used to report the estate taxes owed by the estate of a deceased individual. This form is essential for estates that exceed the exemption threshold set by the state of Missouri. The estate tax is assessed on the value of the deceased's assets, including real estate, personal property, and financial accounts. Completing this form accurately ensures compliance with state tax laws and helps facilitate the proper distribution of the estate's assets.

Steps to Complete the Missouri Department of Revenue MO 706 Estate Tax Return

Completing the Missouri MO 706 Estate Tax Return involves several key steps:

- Gather necessary documents, including the death certificate, asset valuations, and any prior tax returns.

- Determine the gross estate value by assessing all assets owned by the deceased at the time of death.

- Calculate allowable deductions, such as debts, funeral expenses, and administrative costs.

- Complete the MO 706 form by accurately entering the gross estate value, deductions, and calculating the net taxable estate.

- Review the form for accuracy and ensure all required signatures are included.

- Submit the completed form to the Missouri Department of Revenue by the established deadline.

Required Documents for the Missouri MO 706 Estate Tax Return

When filing the Missouri MO 706 Estate Tax Return, it is important to have the following documents ready:

- The death certificate of the deceased individual.

- Valuations of all assets, including real estate, bank accounts, and investments.

- Documentation of any debts or liabilities owed by the estate.

- Records of funeral expenses and administrative costs related to settling the estate.

- Any prior tax returns that may affect the current estate tax calculation.

Filing Deadlines for the Missouri MO 706 Estate Tax Return

The filing deadline for the Missouri MO 706 Estate Tax Return is typically nine months after the date of death of the individual. However, extensions may be available under certain circumstances. It is crucial to adhere to this deadline to avoid penalties and interest on unpaid taxes. If additional time is needed, filing for an extension with the Missouri Department of Revenue can provide the necessary relief.

Legal Use of the Missouri MO 706 Estate Tax Return

The Missouri MO 706 Estate Tax Return serves a legal purpose by ensuring that the estate complies with state tax laws. Filing this return is a legal requirement for estates that exceed the exemption limit. Failure to file can result in penalties, interest, and potential legal complications for the estate's executor. Proper completion and submission of the form help protect the executor and beneficiaries from legal liabilities.

Digital vs. Paper Version of the Missouri MO 706 Estate Tax Return

The Missouri MO 706 Estate Tax Return can be completed and submitted in both digital and paper formats. The digital version offers the advantage of easier filing and tracking, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurately provided and that the submission is made by the deadline.

Quick guide on how to complete missouri department of revenue mo 706 missouri estate

Finalize MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents swiftly without delays. Manage MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE on any device with airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The easiest method to modify and electronically sign MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE with ease

- Obtain MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE and click Get Form to begin.

- Utilize our provided tools to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the missouri department of revenue mo 706 missouri estate

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the DOR MO706 estate tax return and who needs to file it?

The DOR MO706 estate tax return is a form required by the state of Missouri for estates exceeding a certain value threshold. It's essential for executors or administrators of estates to file this return to comply with state tax laws. If your loved one had substantial assets, it's crucial to understand the requirements for filing the DOR MO706 estate tax return.

-

How can airSlate SignNow assist with the DOR MO706 estate tax return process?

airSlate SignNow simplifies the documentation process by allowing you to easily prepare and eSign the DOR MO706 estate tax return. With our user-friendly platform, you can ensure that all necessary documents are filled correctly and signed electronically, streamlining the overall estate handling process. This makes it easier for executors to fulfill their responsibilities quickly.

-

Is there a cost associated with using airSlate SignNow for DOR MO706 estate tax return preparation?

Yes, there is a cost associated with using airSlate SignNow, but it remains a budget-friendly solution compared to traditional methods. Our pricing plans are designed to cater to various user needs, and using our platform can save you time and resources while preparing the DOR MO706 estate tax return. Explore our pricing options to find the best fit for you.

-

What features does airSlate SignNow offer for preparing the DOR MO706 estate tax return?

airSlate SignNow provides features like template creation, seamless document sharing, and electronic signature capabilities to assist with the DOR MO706 estate tax return. These functionalities help ensure that your documents are accurate and submitted on time. Additionally, our platform offers integrations with other tools to enhance your document management workflow.

-

Can I integrate airSlate SignNow with other software for managing DOR MO706 estate tax returns?

Absolutely! airSlate SignNow supports integration with various applications commonly used for estate management, enhancing your experience while preparing the DOR MO706 estate tax return. Whether you need to connect with accounting software or other document management systems, our platform adapts to your needs.

-

How does airSlate SignNow ensure the security of my DOR MO706 estate tax return documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and safety protocols to protect your sensitive documents, including the DOR MO706 estate tax return. Our platform ensures that your data remains confidential and is only accessible by authorized users.

-

Will I receive support when preparing my DOR MO706 estate tax return using airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist you with any questions regarding the DOR MO706 estate tax return. Our support team is available to help you navigate the platform and resolve any issues that may arise during the document preparation process. We strive to ensure your experience is smooth and efficient.

Get more for MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE

Find out other MISSOURI DEPARTMENT OF REVENUE MO 706 MISSOURI ESTATE

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free