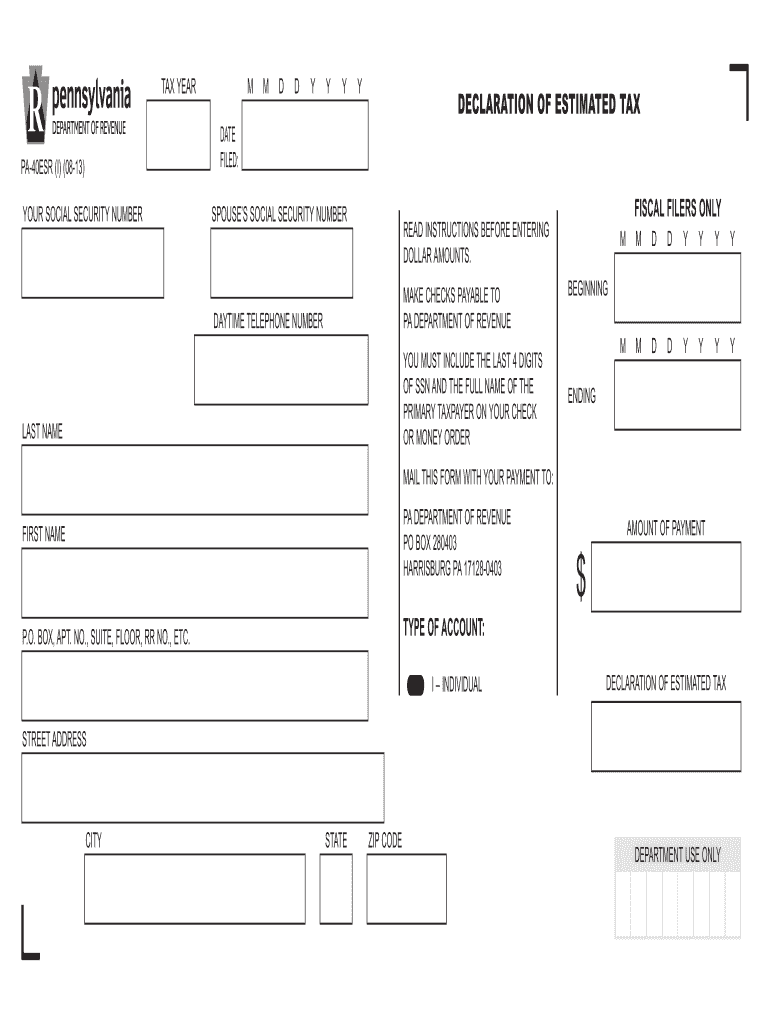

TAX YEAR M M D D Y Y Y Y DECLARATION of ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL Form

Key elements of the 2013 Pennsylvania DOR PA 40ESR estimated tax form

The 2013 Pennsylvania DOR PA 40ESR estimated tax form is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. This form helps individuals and businesses report their estimated tax liability for the year. Key elements include:

- Tax Year: Indicate the year for which you are filing.

- Social Security Number: Provide your SSN to identify your tax records.

- Estimated Tax Amount: Calculate and report your expected tax liability.

- Payment Schedule: Specify when you plan to make your estimated payments.

Steps to complete the 2013 Pennsylvania DOR PA 40ESR estimated tax form

Completing the 2013 Pennsylvania DOR PA 40ESR estimated tax form involves several steps to ensure accuracy and compliance:

- Gather necessary financial documents, including previous tax returns and income statements.

- Calculate your expected income and deductions for the tax year.

- Determine your estimated tax liability using the appropriate tax rates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for errors before submission.

Filing deadlines for the 2013 Pennsylvania DOR PA 40ESR estimated tax form

Understanding the filing deadlines is crucial for avoiding penalties. For the 2013 tax year, estimated tax payments are typically due on:

- April 15, 2013

- June 15, 2013

- September 15, 2013

- January 15, 2014

Ensure payments are made by these dates to avoid interest and penalties.

Legal use of the 2013 Pennsylvania DOR PA 40ESR estimated tax form

The 2013 Pennsylvania DOR PA 40ESR estimated tax form is legally binding when completed correctly. To ensure its validity:

- Follow all instructions provided on the form.

- Use a reliable method for submission, whether online or by mail.

- Retain copies of submitted forms and payment confirmations for your records.

Compliance with state tax laws is essential to avoid potential legal issues.

Required documents for the 2013 Pennsylvania DOR PA 40ESR estimated tax form

Before filling out the 2013 Pennsylvania DOR PA 40ESR estimated tax form, gather the following documents:

- Previous year's tax return for reference.

- W-2 forms or 1099s for income verification.

- Documentation for any deductions or credits you plan to claim.

Having these documents on hand will streamline the completion process.

Digital vs. paper version of the 2013 Pennsylvania DOR PA 40ESR estimated tax form

Choosing between the digital and paper versions of the 2013 Pennsylvania DOR PA 40ESR estimated tax form can impact convenience and efficiency:

- Digital Version: Allows for easier editing, e-signature capabilities, and quicker submission.

- Paper Version: May be preferred by those who are less comfortable with technology or require physical copies for their records.

Consider your comfort level and the resources available to you when deciding which version to use.

Quick guide on how to complete tax year m m d d y y y y declaration of estimated tax date filed pa 40esr i 08 13 your social

Effortlessly prepare TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It presents a superb eco-friendly alternative to conventional printed and signed documents, as you can easily access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without hindrances. Manage TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to edit and eSign TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL effortlessly

- Find TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL and click on Get Form to begin.

- Use the available tools to complete your form.

- Mark important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to keep your changes.

- Decide how you want to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, lengthy form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax year m m d d y y y y declaration of estimated tax date filed pa 40esr i 08 13 your social

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2013 Pennsylvania DOR PA 40ESR estimated fill process?

The 2013 Pennsylvania DOR PA 40ESR estimated fill process involves completing and submitting the estimated tax form to ensure compliance with state tax regulations. This process is crucial for individuals who expect to owe taxes and want to estimate their payments accurately. Using airSlate SignNow can simplify this by allowing you to prepare and sign documents online seamlessly.

-

How can airSlate SignNow help with the 2013 Pennsylvania DOR PA 40ESR estimated fill?

airSlate SignNow streamlines the 2013 Pennsylvania DOR PA 40ESR estimated fill by providing an intuitive platform for document preparation and electronic signatures. Users can create, manage, and send tax documents securely, ensuring that everything is completed correctly and on time. This saves time and reduces the stress of tax season.

-

What are the costs associated with using airSlate SignNow for the 2013 Pennsylvania DOR PA 40ESR estimated fill?

The pricing for airSlate SignNow is competitive and offers various plans to meet different needs while helping with the 2013 Pennsylvania DOR PA 40ESR estimated fill. You can choose from monthly subscriptions or annual plans, both of which include features like unlimited signing and document storage. This cost-effective solution ensures that you get the best value for your needs.

-

Are there any features specifically beneficial for handling the 2013 Pennsylvania DOR PA 40ESR estimated fill?

Yes, airSlate SignNow offers features like customizable templates and automated reminders that are particularly helpful when handling the 2013 Pennsylvania DOR PA 40ESR estimated fill. These features help streamline your document workflow, ensuring that important deadlines are met and that the filling process is as efficient as possible.

-

Can airSlate SignNow integrate with other software to assist with the 2013 Pennsylvania DOR PA 40ESR estimated fill?

Absolutely! airSlate SignNow integrates with several software applications, enhancing your workflow for the 2013 Pennsylvania DOR PA 40ESR estimated fill. Whether you use accounting software or business management tools, these integrations ensure that you can manage your tax documents seamlessly across platforms.

-

What are the benefits of using airSlate SignNow over traditional methods for the 2013 Pennsylvania DOR PA 40ESR estimated fill?

Using airSlate SignNow offers numerous benefits over traditional methods for the 2013 Pennsylvania DOR PA 40ESR estimated fill, such as increased speed, security, and convenience. You can easily access and sign documents from anywhere, reducing the time spent on paperwork. Additionally, electronic records minimize the risk of lost documents.

-

Is it secure to use airSlate SignNow for the 2013 Pennsylvania DOR PA 40ESR estimated fill?

Yes, airSlate SignNow prioritizes the security of your documents, making it a safe option for the 2013 Pennsylvania DOR PA 40ESR estimated fill. The platform employs advanced encryption and follows industry standards to protect sensitive information, ensuring that your data remains confidential throughout the process.

Get more for TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL

- Yahtzee score card form

- Application form for mobile banking service dfafon als

- Nr5 form

- Mock recall template excel form

- Model release form

- Printable insurance slip template form

- Calfresh informing notice of sending intercounty transfer cdss ca

- Misdemeanor diversion program contract state attorney office sa14 fl form

Find out other TAX YEAR M M D D Y Y Y Y DECLARATION OF ESTIMATED TAX DATE FILED PA 40ESR I 08 13 YOUR SOCIAL

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe