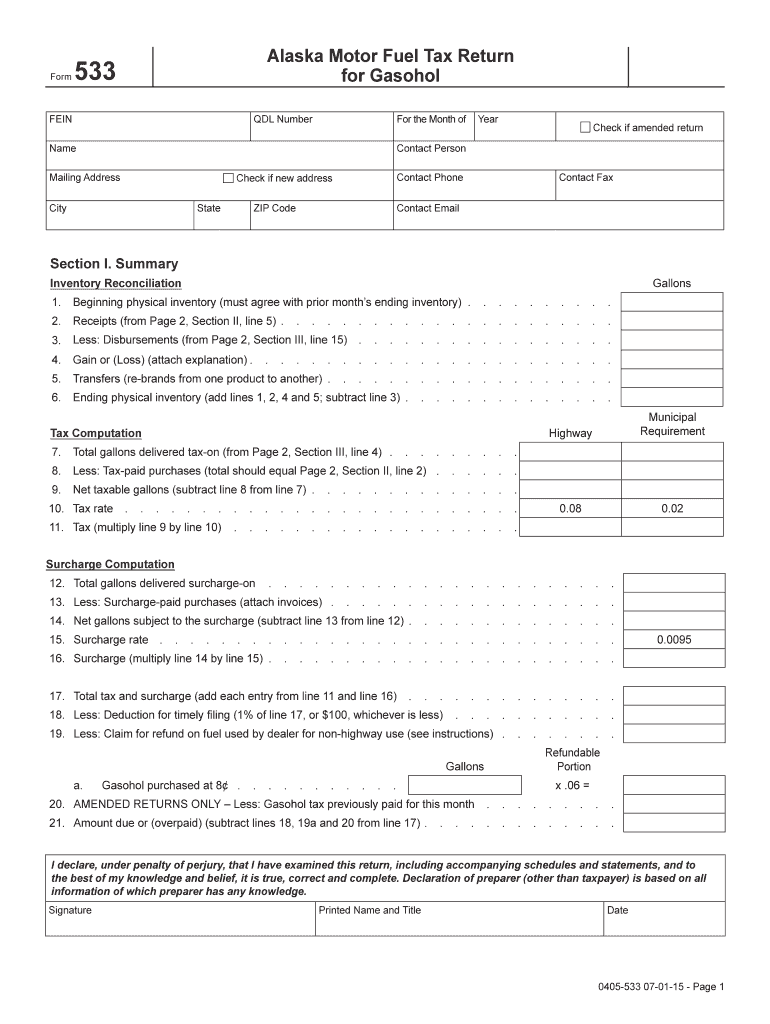

Tax Alaska Form

What is the Tax Alaska

The Tax Alaska form is a specific document used for reporting and filing taxes within the state of Alaska. It is essential for individuals and businesses to accurately disclose their income, deductions, and credits to ensure compliance with state tax laws. This form is tailored to meet the unique tax regulations and requirements that apply to Alaskan residents and entities, reflecting the state's distinctive economic landscape.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form accurately, ensuring all information is current and complete. Once completed, review the form for any errors before submitting it to the appropriate state tax authority. Utilizing a digital solution can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach:

- Collect all necessary financial documents, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, ensuring all sources are included.

- Detail any deductions or credits you are eligible for, following state guidelines.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or manually, as required.

- Submit the form by the designated deadline, either online or by mail.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws, which dictate how the form must be filled out and submitted. Compliance with these laws ensures that the form is considered valid and binding. It is important to use a reliable digital platform that adheres to legal standards for electronic signatures, such as the ESIGN Act and UETA, to maintain the integrity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are critical to avoid penalties. Typically, the deadline for submitting the form is April 15 of each year, aligning with federal tax deadlines. However, specific dates may vary based on individual circumstances, such as extensions or special provisions for certain taxpayers. It is advisable to check the Alaska Department of Revenue's official announcements for any updates or changes to these deadlines.

Required Documents

To successfully complete the Tax Alaska form, several documents are typically required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or business expenses.

- Previous year’s tax return for reference.

- Any relevant documentation for tax credits claimed.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission via the Alaska Department of Revenue's website, which is often the quickest method.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices, if preferred.

Quick guide on how to complete tax alaska 6967284

Effortlessly Prepare Tax Alaska on Any Device

Digital document management has gained traction among enterprises and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Tax Alaska on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Tax Alaska Without Difficulty

- Locate Tax Alaska and click Get Form to initiate the process.

- Utilize the features we provide to fill out your document.

- Emphasize essential portions of the documents or redact sensitive details with the tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select how you wish to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Alaska to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967284

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is an eSignature solution that allows businesses to send and sign documents quickly and securely. Many companies dealing with Tax Alaska documents can benefit from this solution, ensuring compliance and efficiency when managing tax-related paperwork.

-

How can airSlate SignNow help with filing Tax Alaska documents?

With airSlate SignNow, you can easily create, send, and sign Tax Alaska documents online, streamlining the filing process. The platform offers templates specifically designed for tax documents, minimizing errors and ensuring timely submissions.

-

Is airSlate SignNow cost-effective for managing Tax Alaska documents?

Yes, airSlate SignNow is a cost-effective solution for managing Tax Alaska documents. Our pricing plans are designed to fit various business sizes, enabling everyone to take advantage of the benefits of eSigning without overspending.

-

What features does airSlate SignNow offer for Tax Alaska compliance?

airSlate SignNow provides a host of features to ensure Tax Alaska compliance, including secure document storage, audit trails, and templates for tax-specific documents. These features ensure your business remains compliant while saving time on administrative tasks.

-

Can I integrate airSlate SignNow with my existing software for Tax Alaska?

Absolutely! airSlate SignNow seamlessly integrates with popular software solutions that businesses use to manage their Tax Alaska obligations. This includes accounting software and CRMs, making it easier to incorporate eSigning into your existing workflow.

-

What are the benefits of choosing airSlate SignNow for Tax Alaska eSigning?

Choosing airSlate SignNow for Tax Alaska eSigning offers numerous benefits including quicker turnaround times, improved accuracy, and enhanced security. Our platform helps businesses reduce paperwork and streamline their tax processes, allowing them to focus on their core operations.

-

How secure is airSlate SignNow for handling Tax Alaska documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods and complies with top industry standards to ensure that your Tax Alaska documents are securely handled throughout the eSigning process.

Get more for Tax Alaska

Find out other Tax Alaska

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure