Privilege Form

What is the Privilege Form

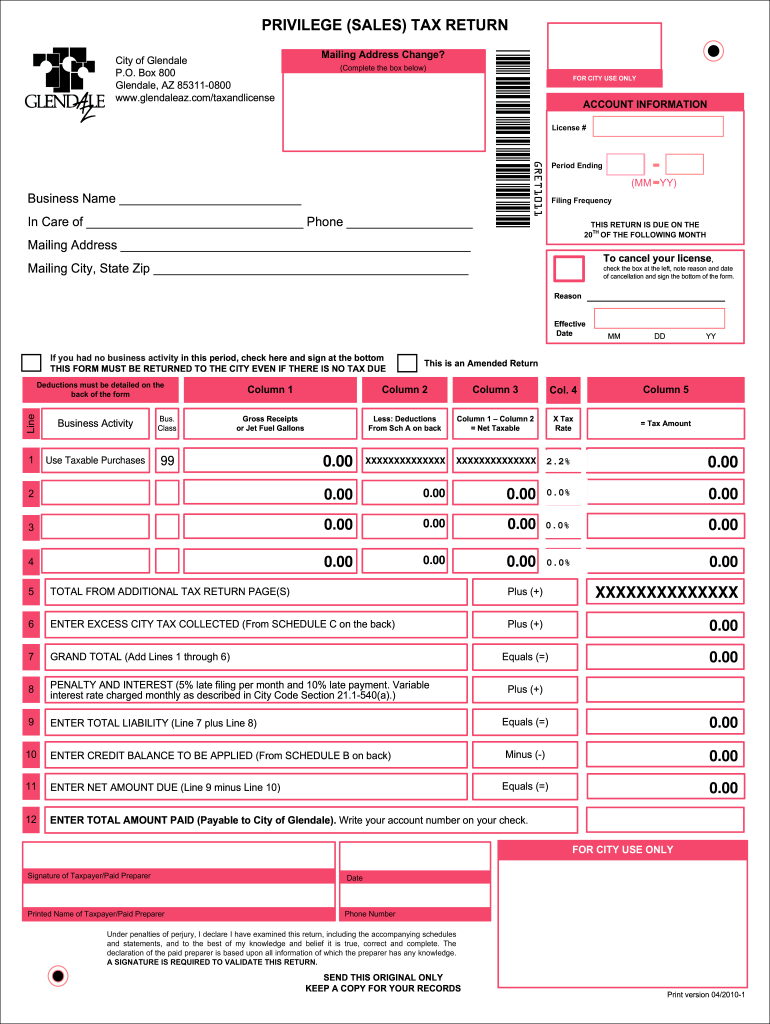

The Privilege Form is a crucial document used in the context of sales tax in Glendale, Arizona. It serves to report and pay sales tax obligations for businesses operating within the city. This form is essential for ensuring compliance with local tax laws and regulations, as it helps to accurately calculate the amount of sales tax owed based on the business's sales activities. Understanding the purpose and function of the Privilege Form is vital for any business owner looking to maintain good standing with the state and local tax authorities.

Steps to complete the Privilege Form

Completing the Privilege Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, total sales, and applicable deductions. Next, fill out the form by entering your sales figures and calculating the sales tax owed. It is important to double-check all entries for accuracy. Once completed, review the form to ensure it meets all requirements set forth by the Colorado Revised Statutes. Finally, submit the form by the designated deadline to avoid penalties.

Legal use of the Privilege Form

The legal use of the Privilege Form is governed by state and local tax laws. This form must be filled out correctly and submitted on time to comply with the regulations established by the Arizona Department of Revenue. Failure to use the form as required can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their obligations regarding the Privilege Form to avoid legal complications and ensure proper tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Privilege Form are critical for businesses to adhere to in order to avoid late fees and penalties. Typically, the form is due on a monthly or quarterly basis, depending on the volume of sales. It is advisable to check the specific deadlines set by the Glendale tax authorities to ensure timely submission. Marking these dates on a calendar can help business owners stay organized and compliant with their tax obligations.

Required Documents

To complete the Privilege Form accurately, certain documents are required. Businesses should have their sales records, invoices, and any relevant receipts on hand. These documents provide the necessary information to report total sales and calculate the sales tax owed. Additionally, having previous tax filings may be helpful for reference. Ensuring that all required documents are organized and accessible can streamline the process of completing the Privilege Form.

Form Submission Methods (Online / Mail / In-Person)

The Privilege Form can be submitted through various methods, providing flexibility for businesses. Online submission is often the most efficient option, allowing for quick processing and confirmation. Alternatively, businesses can choose to mail the completed form to the appropriate tax authority or submit it in person at designated offices. Each submission method has its own timeline for processing, so it is important to consider which option best fits the business's needs and urgency.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the Privilege Form can lead to significant penalties for businesses. These penalties may include fines based on the amount of tax owed, interest on late payments, and potential legal action for continued non-compliance. Understanding these consequences emphasizes the importance of timely and accurate submission of the Privilege Form, helping businesses avoid unnecessary financial burdens and legal issues.

Quick guide on how to complete privilege form

Complete Privilege Form effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents promptly without delays. Manage Privilege Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based operation today.

How to alter and eSign Privilege Form without any hassle

- Obtain Privilege Form and select Get Form to begin.

- Employ the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Edit and eSign Privilege Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the privilege form

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is tax file use and how does airSlate SignNow support it?

Tax file use refers to the management and signing of documents related to tax submissions. airSlate SignNow simplifies tax file use by allowing users to securely eSign and send tax-related documents electronically, ensuring compliance and reducing processing time.

-

How does airSlate SignNow ensure the security of tax file use?

airSlate SignNow employs advanced encryption and secure cloud storage to protect your documents, enhancing the security of tax file use. This ensures that sensitive information is only accessible by authorized individuals, safeguarding your tax documents.

-

What features does airSlate SignNow offer for efficient tax file use?

airSlate SignNow offers features such as customizable templates, bulk send options, and real-time tracking, which signNowly enhance tax file use. These tools streamline the document workflow, making it easier for businesses to manage tax forms and signatures.

-

Is there a free trial available for airSlate SignNow for tax file use?

Yes, airSlate SignNow offers a free trial that allows users to explore all features related to tax file use. This is a great opportunity to test the platform's capabilities before committing to a subscription plan.

-

How can airSlate SignNow integrate with my existing tax software?

airSlate SignNow offers seamless integrations with various tax software, enhancing its capability for tax file use. By linking your existing applications, you can easily import and manage documents in one place, improving efficiency.

-

What is the pricing structure for airSlate SignNow as it relates to tax file use?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes focusing on tax file use. These plans are designed to be affordable while offering features that help streamline the signing and management of tax documents.

-

Can I use airSlate SignNow for multiple users handling tax file use?

Absolutely! airSlate SignNow supports team collaboration, allowing multiple users to engage in tax file use seamlessly. This feature is especially beneficial for organizations that require input from various departments on tax-related documents.

Get more for Privilege Form

- California 1099 form pdf

- Novena for deliverance form

- Lions club hearing aid application form

- Pita pit menu pdf form

- Barber written exam practice test form

- Cross curricular reading comprehension worksheets e 36 of 36 answer key form

- Wohnungsgeberbescheinigung zentraler th ringer formularservice

- Application to open a personal account cdr form

Find out other Privilege Form

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now