Deductions from Wages California Department of Form

What is the Deductions From Wages California Department Of

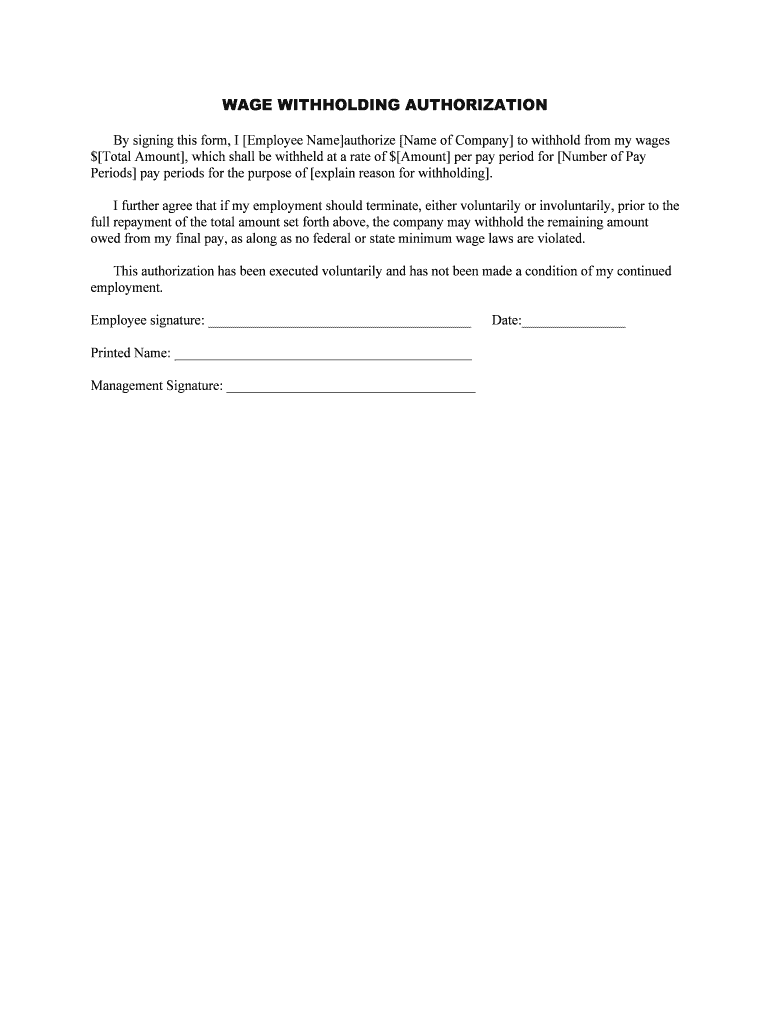

The Deductions From Wages California Department Of form is a crucial document used to outline the specific deductions that can be taken from an employee's wages. This form serves as a formal request and authorization for employers to deduct certain amounts from an employee's paycheck. These deductions may include taxes, benefits contributions, and other legally permissible amounts. Understanding this form is essential for both employers and employees to ensure compliance with state regulations and to protect the rights of workers.

How to use the Deductions From Wages California Department Of

Using the Deductions From Wages California Department Of form involves several key steps. First, the employee must complete the form accurately, providing all necessary information regarding their wages and the specific deductions requested. Employers should then review the completed form to ensure it complies with state regulations. Once approved, the employer can implement the deductions as authorized. It is important to keep a copy of the signed form for record-keeping and compliance purposes.

Steps to complete the Deductions From Wages California Department Of

Completing the Deductions From Wages California Department Of form requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including employee details and wage amounts.

- Identify the specific deductions to be made, such as taxes or benefits.

- Fill out the form clearly, ensuring all fields are completed.

- Review the form for accuracy before submission.

- Sign and date the form to authorize the deductions.

Legal use of the Deductions From Wages California Department Of

The legal use of the Deductions From Wages California Department Of form is governed by state labor laws. Employers must ensure that all deductions are lawful and that employees are fully informed of the deductions being made. This form acts as a protective measure for both parties, ensuring that deductions are authorized and documented. Compliance with legal standards is crucial to avoid potential disputes or penalties related to wage deductions.

State-specific rules for the Deductions From Wages California Department Of

California has specific rules regarding wage deductions that employers must follow. These rules dictate what types of deductions are permissible, such as taxes, retirement contributions, and health insurance premiums. Employers must also adhere to regulations regarding the timing and frequency of deductions. Familiarity with these state-specific rules helps ensure compliance and protects employee rights.

Required Documents

To successfully complete the Deductions From Wages California Department Of form, certain documents may be required. These documents typically include:

- Employee identification information, such as Social Security number.

- Details of the wage agreement between employer and employee.

- Any relevant agreements or contracts outlining the deductions.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Deductions From Wages California Department Of form can result in significant penalties for employers. These penalties may include fines, back payment of wages, and potential legal action from employees. It is essential for employers to understand their obligations and ensure that all deductions are legally justified and properly documented to avoid these consequences.

Quick guide on how to complete deductions from wages california department of

Effortlessly prepare Deductions From Wages California Department Of on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Deductions From Wages California Department Of on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Deductions From Wages California Department Of with ease

- Locate Deductions From Wages California Department Of and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Alter and eSign Deductions From Wages California Department Of and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the primary deductions from wages enforced by the California Department of?

Deductions from wages in California include mandatory withholdings such as federal income tax, Social Security, and Medicare taxes. Other deductions may involve state income tax and contributions to unemployment insurance. Understanding these deductions is crucial for employees and employers in California.

-

How can airSlate SignNow help with managing deductions from wages?

airSlate SignNow streamlines the process of documenting and managing deductions from wages by offering an eSigning feature. This allows businesses to efficiently collect employee signatures on important documents related to wage deductions. With clear documentation, employers can ensure compliance with the California Department of regulations.

-

What are the benefits of using airSlate SignNow for wage deduction documentation?

Using airSlate SignNow for wage deduction documentation ensures that all forms are properly signed and archived. This not only provides legal security but also enhances organizational efficiency. Having a secure solution in place for managing deductions from wages aligns with compliance habits needed by the California Department of.

-

Is airSlate SignNow compliant with California Department of regulations regarding wage deductions?

Yes, airSlate SignNow is designed to comply with all applicable laws, including those governing deductions from wages per the California Department of. This ensures that all documentation and processes adhere to state regulations, minimizing the risk of compliance issues for businesses.

-

What pricing plans does airSlate SignNow offer for managing wage deductions?

airSlate SignNow offers several pricing plans tailored to different business needs, making it a cost-effective solution for managing wage deductions. Each plan includes features designed to facilitate eSigning and document management processes. You can choose a plan that best fits your organizational size and operational requirements.

-

Can airSlate SignNow integrate with other payroll systems to manage deductions effectively?

Absolutely! airSlate SignNow offers integrations with popular payroll systems. This allows businesses to seamlessly manage deductions from wages while ensuring all data is consistent and securely shared across platforms, in line with the practices set by the California Department of.

-

How does airSlate SignNow ensure the security of documents related to wage deductions?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect documents related to deductions from wages. This ensures that sensitive information is safeguarded, allowing businesses peace of mind in compliance with the California Department of security standards.

Get more for Deductions From Wages California Department Of

- Adlro amended form

- Affidavit in support of motion for leave to proceed on appeal in forma pauperis courts state hi

- State of hawai i courts state hi form

- Administrative driver s license revocation office adlro courts state hi form

- Set order courts form

- Hawaii form reconsider license

- Edp ss form

- Application for amended ignition interlock permit courts state hi form

Find out other Deductions From Wages California Department Of

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast