Getting Started a Guide to Filing and Paying Florida FormuPack

What is the Getting Started A Guide To Filing And Paying Florida FormuPack

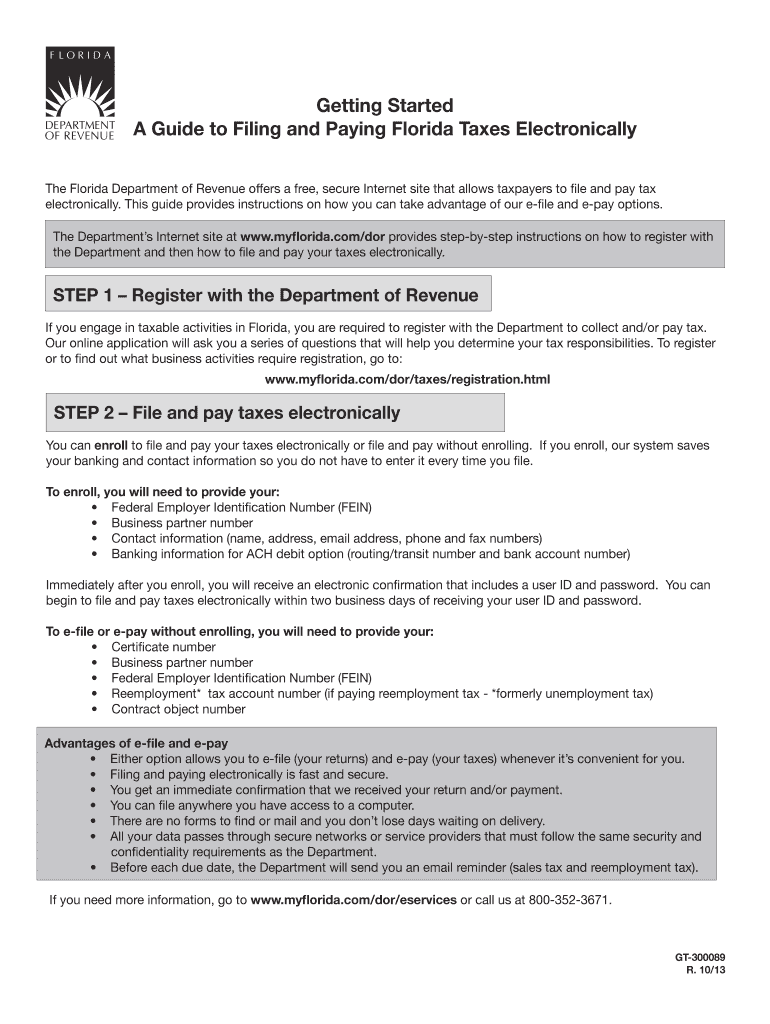

The Getting Started A Guide To Filing And Paying Florida FormuPack is a comprehensive resource designed to assist individuals and businesses in understanding the process of filing and paying their taxes in Florida. This guide outlines the necessary steps, key information, and important deadlines associated with the filing process. It serves as an essential tool for ensuring compliance with state tax regulations and helps users navigate the complexities of tax obligations effectively.

Steps to complete the Getting Started A Guide To Filing And Paying Florida FormuPack

Completing the Getting Started A Guide To Filing And Paying Florida FormuPack involves several key steps:

- Gather necessary documents, including income statements, previous tax returns, and identification.

- Review the guide for specific instructions related to your tax situation.

- Fill out the required forms accurately, ensuring all information is complete.

- Double-check calculations and details to avoid errors.

- Submit the completed forms through the preferred method: online, by mail, or in person.

Legal use of the Getting Started A Guide To Filing And Paying Florida FormuPack

The legal use of the Getting Started A Guide To Filing And Paying Florida FormuPack is crucial for ensuring that all tax filings are compliant with state laws. This guide provides information on the legal requirements for filing, including necessary signatures and the importance of using a reliable platform for electronic submissions. Utilizing this guide helps to maintain compliance with Florida tax regulations and protects against potential legal issues.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential for timely compliance. The Getting Started A Guide To Filing And Paying Florida FormuPack outlines critical dates, such as:

- Annual tax return due dates

- Estimated tax payment deadlines

- Extension request deadlines

Staying informed about these dates helps avoid penalties and ensures that all tax obligations are met on time.

Required Documents

To successfully complete the Getting Started A Guide To Filing And Paying Florida FormuPack, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Proof of identity, such as a driver's license or Social Security number

Having these documents ready simplifies the filing process and ensures accuracy in reporting income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The Getting Started A Guide To Filing And Paying Florida FormuPack can be submitted through various methods, providing flexibility for users. The available submission options include:

- Online submission through the Florida Department of Revenue's website

- Mailing completed forms to the appropriate state office

- In-person submission at designated tax offices

Each method has its own advantages, and users should choose the one that best suits their needs and preferences.

Quick guide on how to complete getting started a guide to filing and paying florida formupack

Effortlessly Prepare Getting Started A Guide To Filing And Paying Florida FormuPack on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without hassle. Manage Getting Started A Guide To Filing And Paying Florida FormuPack on any device using airSlate SignNow applications for Android or iOS, and streamline any document-related task today.

How to Edit and eSign Getting Started A Guide To Filing And Paying Florida FormuPack with Ease

- Find Getting Started A Guide To Filing And Paying Florida FormuPack and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Select pertinent sections of your documents or obscure sensitive information using tools specifically designed for this by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal standing as a traditional ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or sharing a link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign Getting Started A Guide To Filing And Paying Florida FormuPack and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the getting started a guide to filing and paying florida formupack

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 'Getting Started A Guide To Filing And Paying Florida FormuPack'?

airSlate SignNow is an intuitive eSignature and document management platform that simplifies the process of sending and signing documents. 'Getting Started A Guide To Filing And Paying Florida FormuPack' focuses on ensuring that users have a clear roadmap for handling Florida FormuPack filings efficiently, leveraging airSlate SignNow's capabilities.

-

How can airSlate SignNow help me with Florida FormuPack filings?

With airSlate SignNow, you can streamline the process of filing and paying your Florida FormuPack by digitizing your documents. The platform offers templates and customizable workflows that make it easier to manage documentation needs related to 'Getting Started A Guide To Filing And Paying Florida FormuPack'.

-

Is there a cost associated with using airSlate SignNow for FormuPack filing?

Yes, there are various pricing plans available for airSlate SignNow, accommodating different user needs and budgets. The pricing is designed to offer value for efficiency in 'Getting Started A Guide To Filing And Paying Florida FormuPack', ensuring you can file with ease without overspending.

-

What features does airSlate SignNow offer for handling FormuPack documents?

airSlate SignNow provides features such as electronic signatures, document templates, and secure cloud storage to facilitate easy handling of FormuPack documents. These features are essential for 'Getting Started A Guide To Filing And Paying Florida FormuPack', ensuring compliance and efficiency.

-

Can I integrate airSlate SignNow with other tools for my FormuPack filings?

Absolutely! airSlate SignNow integrates with numerous applications to help you manage your FormuPack filings seamlessly. By integrating these tools, 'Getting Started A Guide To Filing And Paying Florida FormuPack' becomes a smooth experience, minimizing workflow interruptions.

-

What are the benefits of using airSlate SignNow for my Florida FormuPack process?

Using airSlate SignNow can signNowly reduce the time and effort needed for the Florida FormuPack filing process. By following 'Getting Started A Guide To Filing And Paying Florida FormuPack', you can ensure accurate filings while enjoying the benefits of increased productivity and streamlined operations.

-

Is customer support available for issues related to Florida FormuPack on airSlate SignNow?

Yes, airSlate SignNow provides robust customer support to assist users with any issues regarding FormuPack filings. Whether you need help with 'Getting Started A Guide To Filing And Paying Florida FormuPack' or have specific questions, their support team is ready to assist you.

Get more for Getting Started A Guide To Filing And Paying Florida FormuPack

- Tenant insurance addendum form

- New mexico odometer statement form

- Western national life insurance company amarillo texas form

- Umac toronto form

- 32bj life insurance form

- Form it 203 tm att a schedule a group return for nonresident athletic team members tax year

- Power of attorney app25065 13 form

- Covid 19 screening questionnaire form

Find out other Getting Started A Guide To Filing And Paying Florida FormuPack

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template